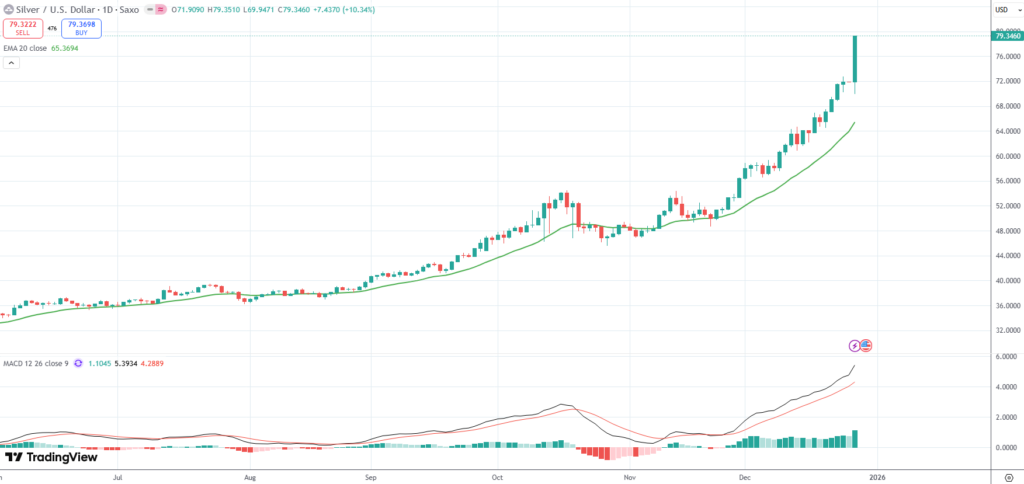

Spot Silver settled near a fresh all-time high of $79.35/oz. on Friday, underpinned by expectations of further policy easing by the Federal Reserve and amid ongoing supply deficit, rising industrial demand as well as robust investment demand.

Moderating inflation and a cooling labor market in the US have given the Fed more scope to lower interest rates.

FOMC policy makers signaled just one 25 bps rate cut for next year, while investors continue to expect two rate cuts of 25 basis points each.

The safe-haven allure of the metal has also been heightened by mounting tensions between the US and Venezuela.

The US has deployed numbers of special-operations aircraft, troops as well as equipment to the Caribbean area this week, giving Washington additional options for potential military action in Venezuela, according to a report by the WSJ.

Robust industrial demand also continued to support Silver prices. The white metal plays a key role in solar energy, electronics and broader electrification efforts.

Year-to-date, the metal has surged 158%, while outperforming Gold. Its weekly gain was 18.17%.