Key Moments:

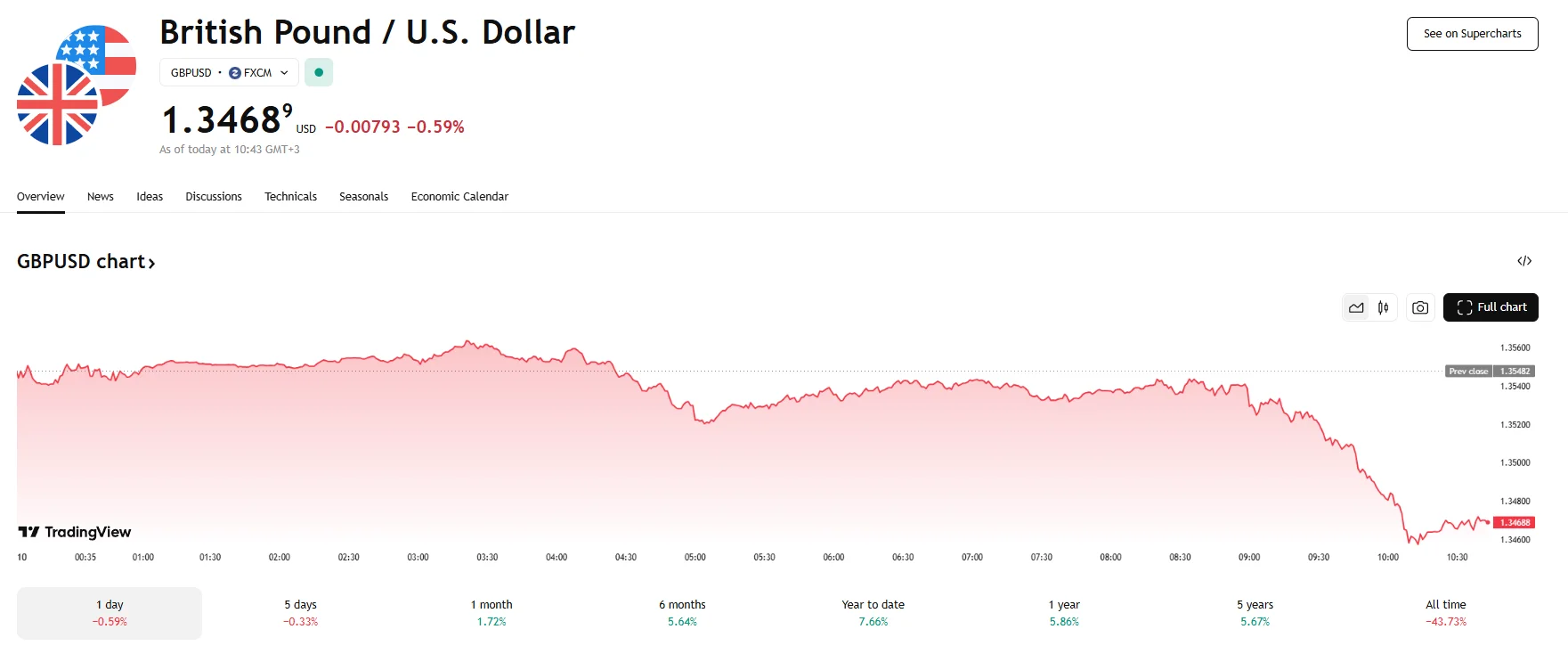

- GPD/USD dipped 0.6% to 1.3468 on Tuesday.

- UK average weekly earnings (excluding bonuses) increased 5.2% year-over-year in the three months to April, easing from 5.5% in the previous period.

- Unemployment rose to 4.6%, the highest in years.

Pound Slips Against Dollar

GBP/USD gave back some recent gains on Tuesday. The pair slid 0.6% to 1.3468, showing short-term weakness after falling below its ascending trendline and the 50-EMA. This decline followed the release of the UK’s latest wage growth data.

According to a publication by the Office for National Statistics on Tuesday, the United Kingdom’s labor market showed signs of cooling in the three months ending in April, offering some comfort to officials at the Bank of England. However, the pace of wage growth remains too brisk to allow inflation to ease back to its 2% target in the near term.

Wages and Jobless Rate Align with Forecasts

Average weekly earnings, excluding bonuses, rose by 5.2% between February and April compared to the same period last year. This marked a slowdown from the 5.5% increase reported in the three months to March and fell just slightly below the 5.3% projected by economists who participated in a poll of the Wall Street Journal.

Meanwhile, the UK unemployment rate hit 4.6%, which is the highest level recorded since 2021’s May through July period. The figure also matched the poll’s expected rate.

Wages Still Too Strong for Inflation Target

While earnings softened, the current pace of pay increases remains too high to support a return to the Bank of England’s inflation goal. One factor behind the wage pressure was a 6.7% increase in the minimum wage that took effect at the beginning of April.

Even so, this development is not expected to deter plans for a potential interest rate cut in the summer. The Bank of England projects that wage growth will decline to about 3.75% by the end of 2025.