Key Moments:

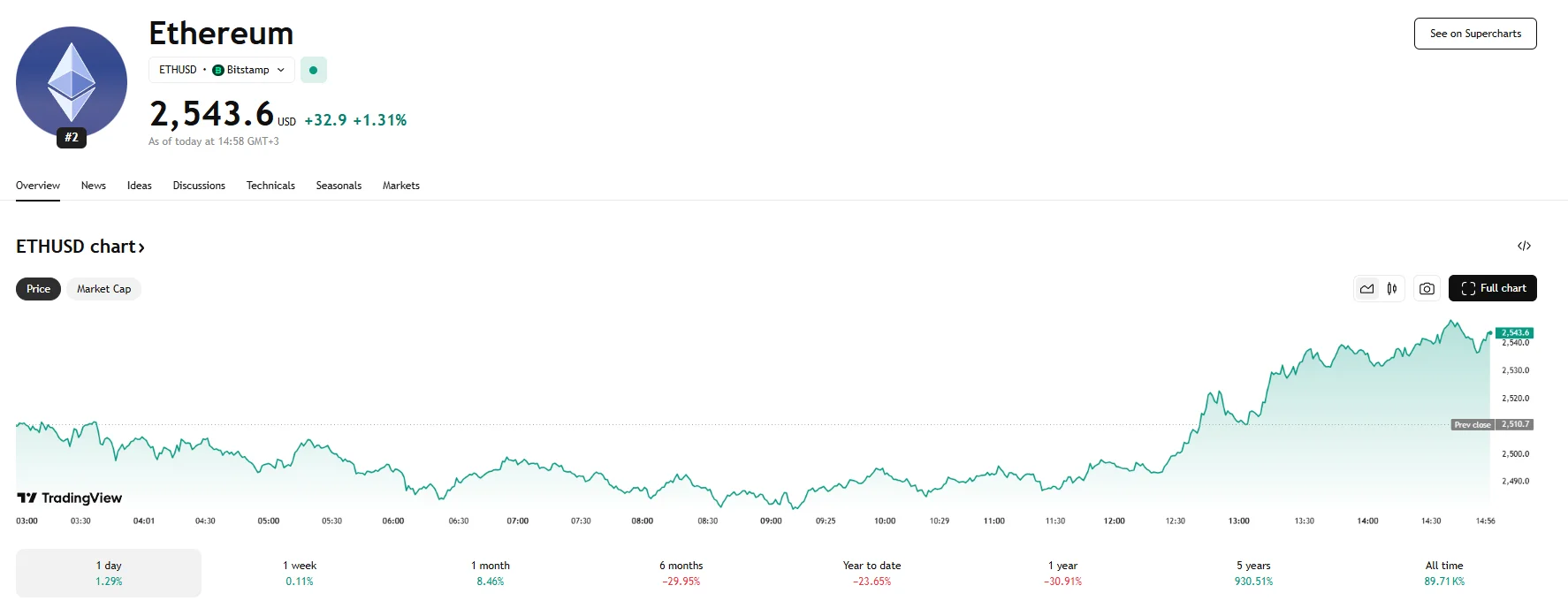

- Ethereum’s price staged a recovery on Monday and advanced 1.31% to $2,543.6.

- Ether ETPs attracted $296 million in inflows last week, their strongest performance since the 2024 US election.

- Crypto venture capital activity dropped to 62 deals in May, raising a mere $909 million.

Ether ETPs Lead the Pack Amid Market Uncertainty

Ethereum’s price advanced significantly during Monday trading following news of the exchange-traded-product (ETP) volumes registered last week. According to the data provided by CoinShares, investment products tied to Ethereum bucked a broader slowdown in the crypto markets and recorded 296 million in inflows. This marked their strongest weekly gain since Donald Trump was elected president in 2024. At press time, ETH is trading above the $2,500 threshold.

As per CoinShares’ report, Ether products now represent more than 10.5% of the assets under management (AUM) across all ETPs in the crypto sphere. The latest figures also extend the inflow streak to seven weeks in a row.

Outlook for Ether Prices Remains Cautiously Optimistic

Bitget Research’s chief analyst, Ryan Lee, told media company Cointelegraph that Ether’s price is likely to stay within the $2,400–$2,800 range in the near term. He noted that deflationary pressures, along with trade tensions, will cap gains. Lee continued, stating that network upgrades and ETF inflows had the potential to drive the price towards $2,700, but he cautioned that a wider market sell-off could challenge the $2,300 support level.

Crypto Venture Capital Slows Sharply

In contrast to Ether’s performance, Bitcoin investment products recorded $56 million in weekly outflows. Moreover, the broad digital asset landscape registered a notable deceleration in its risk-taking endeavors.

Specifically, May witnessed a major cooling in venture capital participation within the crypto sector, culminating in merely 62 funding rounds. This figure marked the lowest count observed thus far in 2025. The capital secured through these more modest investments amounted to a total of $909 million.