Key Moments:

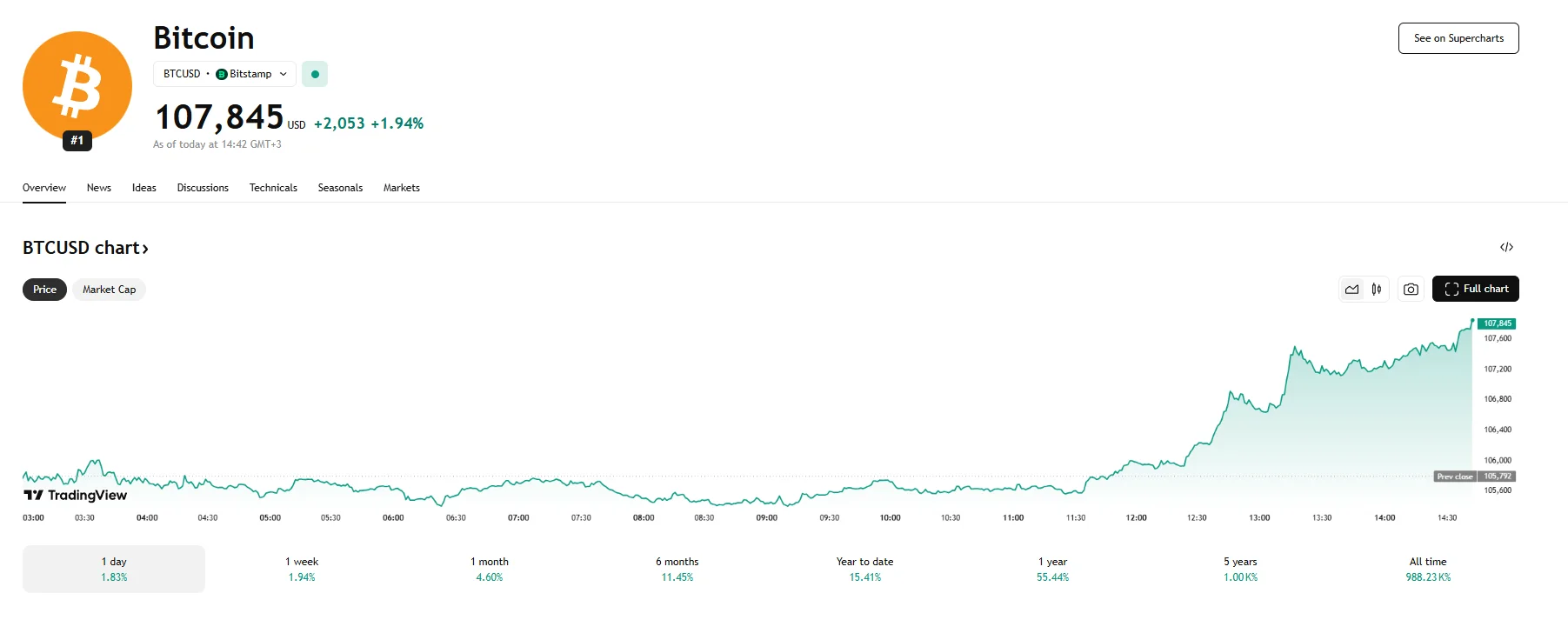

- Bitcoin surged 1.94% to $107,845 on Monday.

- The price rose more than $1,000 in under one hour

- Market sentiment turned bullish as upside momentum strengthened ahead of today’s US-China trade meeting.

Bitcoin Accelerates Past $107,000 in Sudden Upswing

Crypto markets on Monday witnessed Bitcoin surge 1.94% to $107,845 level. Earlier in the session, the token managed to advance by $1,000 within just 60 minutes, catching many traders by surprise and generating significant interest.

The rapid price action, one of Bitcoin’s most major in recent weeks, hinted at intense buying activity, which may be attributed to institutional interest or rising appeal of digital assets amid hopes surrounding the latest round of talks between US and Chinese officials. According to market analyzers, a notable rise in trading volume was observed across major exchanges today.

Although Bitcoin has yet to reclaim the all-time peak it achieved in May, today’s rally nonetheless managed to steer the market’s tone toward optimism. Crypto communities on social media platforms have been actively discussing fresh price targets, and the $110,00 figure as the next potential milestone has been of particular interest.

Positive Sentiment Builds

From a technical perspective, Bitcoin has cleared crucial resistance, which may now serve as a support level. Maintaining prices above the $107,000 threshold in the short term could spark a sustained upward trajectory. Some observers are attributing this momentum to factors such as fresh inflows into spot ETFs, along with institutions becoming increasingly interested in Bitcoin.

Investors are also closely monitoring macroeconomic developments and upcoming announcements from central banks that may affect risk sentiment across markets. As US and Chinese officials are expected to meet sometime today to discuss their trade relations, the results of these talks could influence expectations regarding the US Federal Reserve’s future monetary policy decisions.