Key Moments:

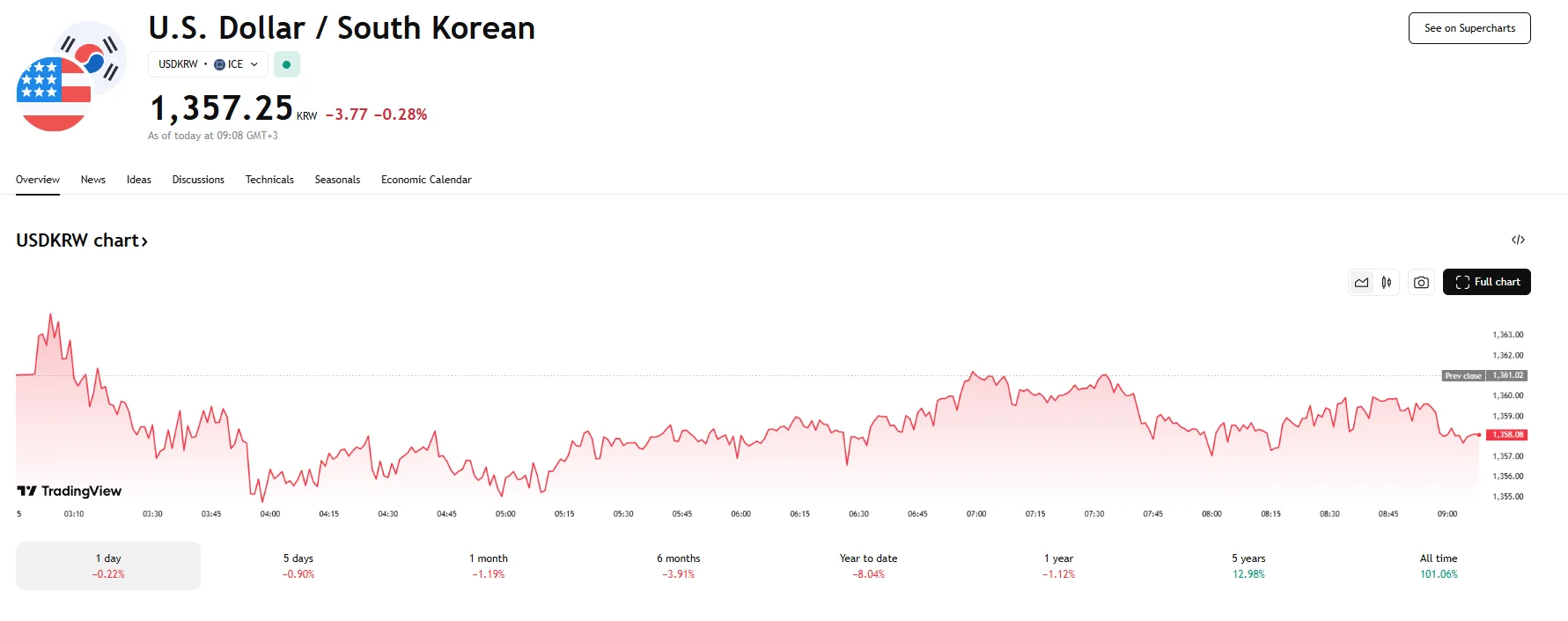

- USD/KRW sank to a 7-month low below 1,360 today.

- Investor confidence in the South Korean won improved after President Lee Jae-myung assumed office

- The US Dollar Index failed to reach 99.00.

KRW Strengthens Amid Political Transition

Thursday saw the South Korean won appreciate significantly against the US dollar. The USD/KRW pair is trading near 1,360 at press time, and earlier in the session, it managed to drop to 1,354.75, marking the won’s best performance against the dollar in seven months. The KRW gained investors’ favor after President Lee Jae-myung began his term.

Markets welcomed the return of political stability following former President Yoon Suk Yeol’s ousting, a development that followed his Martial Law declaration. The new administration has placed priority on revitalizing the economy and managing diplomatic ties with both the United States and China. The two countries represent over 35% of South Korea’s export market.

Meanwhile, the US Dollar Index has been trading below the 99.00 mark on Thursday, but it generally stayed in the green. Caution persisted ahead of the publication of the weekly jobless claims report, scheduled for later today.

Challenges Persist Despite Market Upside

Despite the won’s recent strength, concerns over South Korea’s economic trajectory remain, particularly given how the first quarter of 2025 saw the nation’s Gross Domestic Product suffer a 0.2% decline. Economists attributed this contraction to subdued domestic demand along with declining export activity.

Further highlighting the pressure on South Korea’s economy, foreign exchange reserves fell to $404.6 billion last month. The fall appears linked to previous government actions centered around market stabilization.