Key Moments:

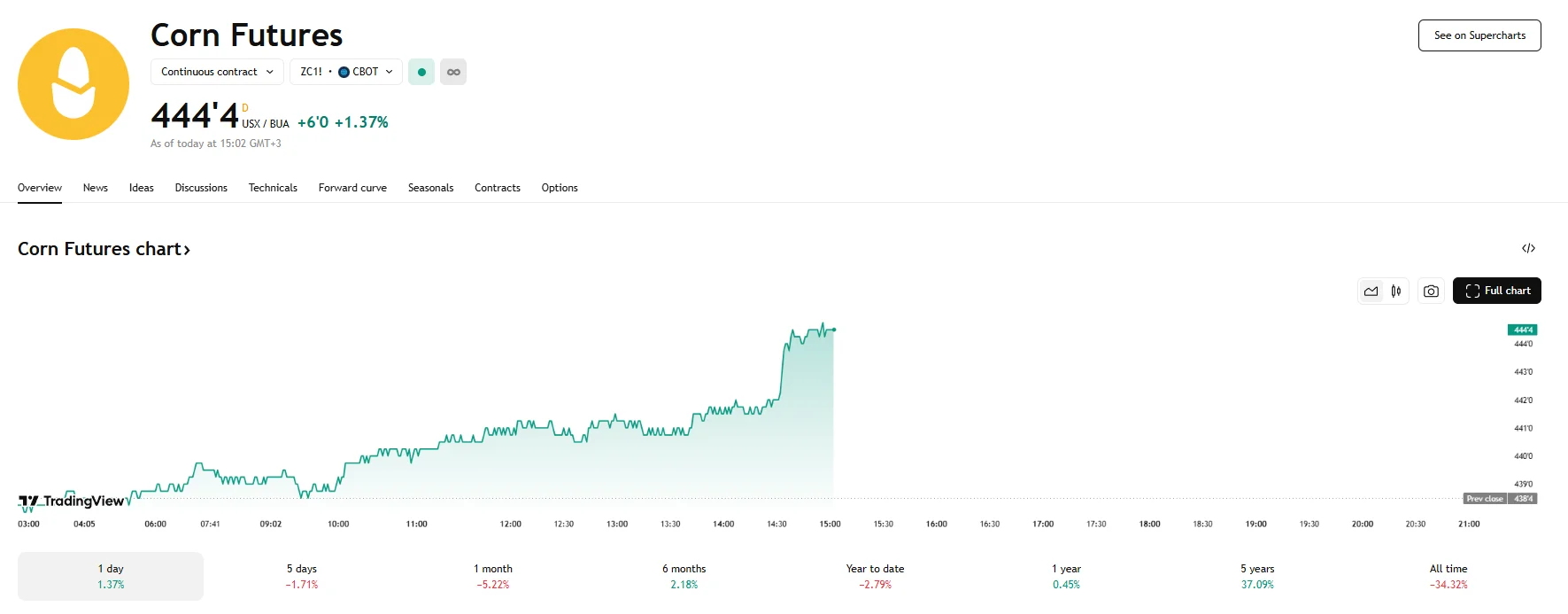

- Chicago Board of Trade (CBOT) agriculture futures rose on Wednesday, with the corn benchmark in particular jumping by almost 1.4%.

- Market sentiment was affected by increased tensions between Ukraine and Russia, along with expectations of improved export opportunities.

- Favorable weather conditions in the US continued to exert pressure on grain price movements.

Markets React to Geopolitical and Trade Developments

Grain prices on the Chicago Board of Trade (CBOT) advanced on Wednesday as concerns about intensifying conflict in the Black Sea region and renewed chatter around US trade negotiations bolstered confidence among traders of wheat, corn, and soybeans.

The CBOT wheat contract advanced nearly 1% and managed to reach 541’0. Soybean futures, meanwhile, advanced by a more modest 0.62% to 1047’2. CBOT corn futures saw the highest gains as they rose by 1.37%.

The uptick came amid signs of escalating military activity by Ukraine targeting sites in Russia, which reignited concerns over the security of Black Sea grain flows. Simultaneously, the latest report of the US Department of Agriculture indicated improving conditions across key American growing regions, which served to temper gains.

Crop Conditions, Trade Prospects, and Global Demand Balance Market Sentiment

Forecasts of healthy crop development in the United States continued to exert pressure on prices after corn declined to a six-month low yesterday and soybeans dipped to a seven-week low on June 2nd. Stronger-than-expected ratings for winter and spring wheat were of particular note when it came to how the assets have been affected, according to analysts at Argus.

Traders also maintained a watchful eye on the potential for drought-induced losses when it came to China’s wheat crop. However, the implications for import demand remained uncertain due to Beijing’s ample domestic reserves.

On the trade front, optimism emerged amid rising expectations that US President Donald Trump and Chinese President Xi Jinping will engage in dialogue sometime this week. The anticipated discussions boosted hopes for improved US agricultural exports to the world’s top soybean importer. In addition, Vietnamese companies signed memorandums of understanding to purchase $2 billion worth of US agricultural products in a move aimed at advancing bilateral trade relations.