Key Moments:

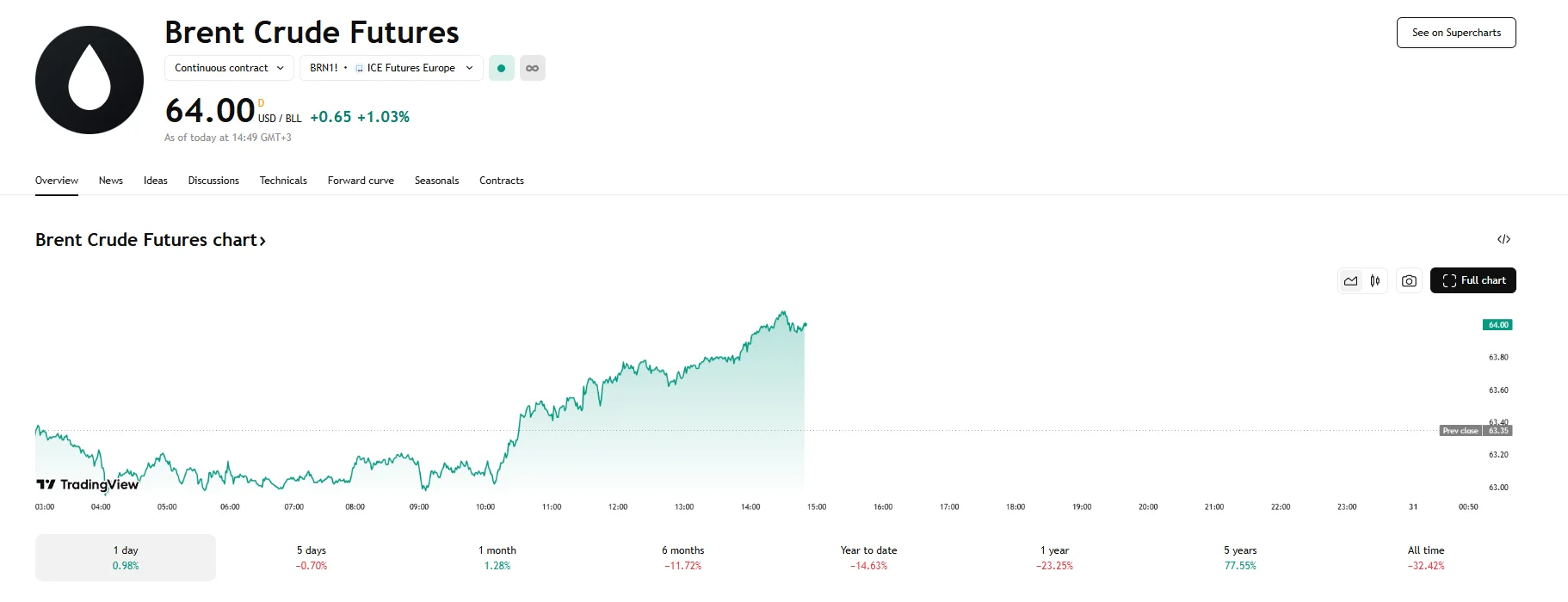

- WTI futures rose 1.12% on Friday, while Brent contracts hit $64.

- Ongoing OPEC+ production increases and trade uncertainty continue to pressure market outlook, and Brent crude’s forecast for 2025 now stands at $66.98 per barrel.

- WTI is expected to trade $1.73 lower than previous estimates and hit $63.35 per barrel.

Global crude oil markets experienced an uptick on Friday, with prices for both major benchmarks seeing gains. Brent crude futures advanced to $64 a barrel, up by about 1% from yesterday. Concurrently, West Texas Intermediate (WTI), the primary US oil indicator, advanced approximately 1%, reaching $61.62 per barrel.

This positive movement was primarily fueled by new figures from the US Energy Information Administration (EIA) revealing an unexpected reduction in US crude inventories. Their report indicated a notable draw in American commercial crude oil stockpiles, which diminished by roughly 2.8 million barrels to a total of 440.4 million barrels for the week ending May 23. However, gains were limited by anticipated OPEC+ supply hikes and uncertainty from a court ruling that reinstated Trump-era tariffs.

Outlook Weakens for 2025 Oil Prices

Despite the supportive inventory data, the market remains cautious. Crude price projections have fallen for the third straight month, as analysts polled by Reuters expect expanded output from OPEC+ and nagging uncertainty about how global trade frictions to affect fuel consumption.

According to their estimates, Brent prices are likely to reach $66.98 per barrel in 2025. That marks a retreat from the $68.98 average prediction reported in April. Meanwhile, US West Texas Intermediate (WTI) is now estimated at $63.35 per barrel, down from the previous month’s outlook of $65.08. Both figures would represent a decline from the average prices recorded in 2025 thus far, as data from LSEG shows that Brent and WTI were trading at approximately $71.08 and $67.56 per barrel, respectively.

Production Moves

Concerns linger that unresolved conflicts could suppress global energy demand. UniCredit’s Tobias Keller commented that the production decisions of OPEC+ would heavily influence oil prices on the supply side, adding that geopolitical tensions continued to pose risks of disruption and price volatility.

Output has already been ramped up by 411,000 barrels per day across May and June. According to anonymous sources who spoke with Reuters on the matter, Saturday’s upcoming meeting could result in a similar increase for July.

While the surveyed analysts foresee a 775,000 bpd rise in global oil demand in 2025 (exceeding the IEA’s 740,000 bpd estimate), trade uncertainties and recession fears cast doubt on the strength of this recovery. Julius Baer’s Norbert Ruecker highlighted that global oil demand growth is now primarily driven by resource-rich nations themselves. He noted that US and Chinese consumption has been limited by factors like greater fuel efficiency, economic difficulties, and rising electric vehicle adoption.