Key Moments:

- Crude oil futures climbed after a US court ruling challenged most of President Trump’s tariff policies.

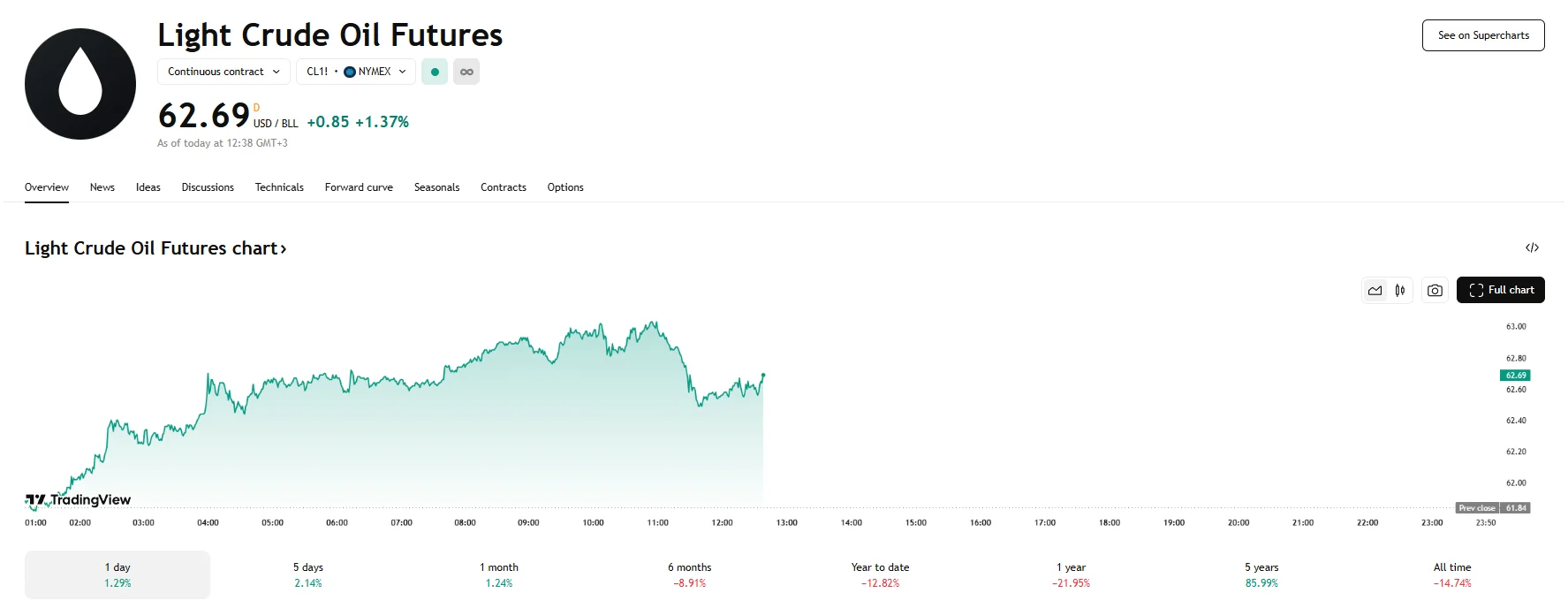

- Brent contracts rose 1.24%, and WTI futures rallied by 1.37%.

- US crude inventories dropped by 4.236 million barrels last week, according to API data.

Oil Advances on Legal Setback for US Tariffs

Crude oil futures rose sharply on Thursday, driven by optimism following a US court’s decision to block a large portion of tariffs imposed by the Trump administration. Investors interpreted the move as a signal of easing trade tensions, which could stimulate global economic activity and in turn support broader crude demand. As a result, WTI futures reached $62.69 by climbing 1.37%, while Brent saw its contracts rise 1.24% to $65.12.

The US Court for International Trade ruled on Wednesday that the administration’s duties, announced this April, exceeded executive authority and encroached on the powers of Congress. While the ruling affected broad measures, separate tariffs on the automotive industry were not addressed. Duties affecting metals like aluminum and steel were also excluded.

A degree of uncertainty was injected back into the market following the White House’s appeal of the decision. Analysts have cautioned that the optimism seen in markets might fade depending on the outcome or delay of the appeal proceedings.

Inventory Decline Adds to Bullish Sentiment, Supply Concerns Persist

Further underpinning oil’s gains was a report from the American Petroleum Institute (API) that indicated a drawdown of 4,236 million barrels in US crude stockpiles last week, reversing an earlier build of 2,499 million barrels.

Oil traders also eyed possible disruptions in future supply levels. Sources and analysts suggested OPEC+ may reach an agreement on May 31st to step up oil production starting July. Such a move may lead to oversupply, which could weigh on prices. According to IGN analysts, the supply increase is expected to reach 411,000 barrels per day, and similar hikes may follow by the end of Q3.

Geopolitical and Weather Risks Add Complexity

Expectations for additional sanctions on Russian oil provided further market tension, compounding geopolitical uncertainty. In Latin America, energy major Chevron wound down activities in Venezuela after the Trump administration revoked a key operational license earlier this year. Chevron had accounted for 290,000 barrels per day of Venezuelan crude exports, approximately one-third of the nation’s total.

North American supplies are also under pressure due to a wildfire in Alberta, Canada. The situation led to the evacuation of a town and curtailed some oil and gas operations in the region.