Key Moments:

- Best Buy reduced its FY 2026 comparable sales guidance, while the adjusted EPS forecast was cut to $6.15-$6.30.

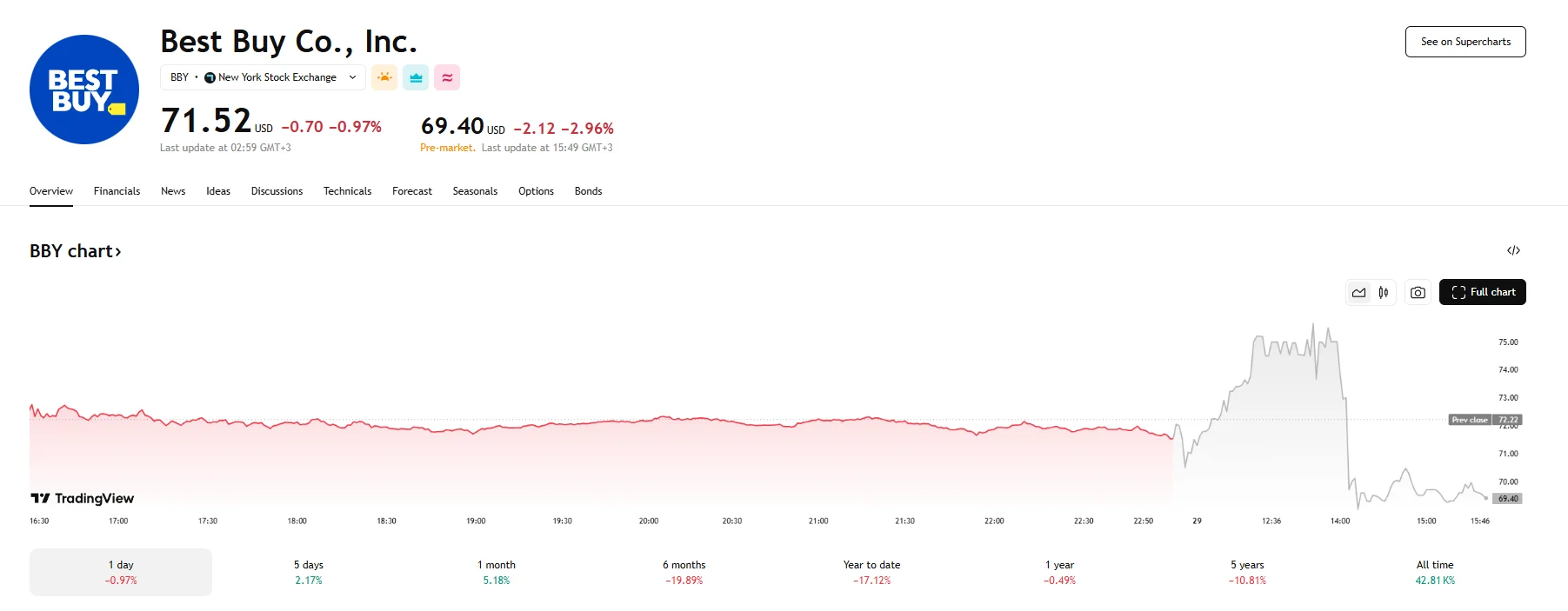

- The company’s share price sank by around 3% during pre-market hours.

- Q1 same-store sales fell 0.7%, worse than the 0.6% decline analysts were expecting.

Sales Outlook Lowered Amid Tariff Pressures

Best Buy revised its full-year sales and earnings guidance lower Thursday, as mounting pressure from US tariffs dampened expectations for demand on big-ticket electronics and appliances. The company now anticipates comparable sales for fiscal 2026 to decline by 1% or rise by 1%. The forecast scales back from an earlier projection of the figures remaining flat or increasing by 2%.

Pre-market trading reflected investor concern, with shares of the electronics retailer dropping around 3% to $69.40 after it reported a sharper-than-anticipated decline in same-store sales.

Consumer Spending Under Strain

Elevated borrowing costs and the added strain of tariffs have affected consumer spending, with households scaling down purchases of grocery items, consumer electronics, and other goods. These headwinds are now influencing Best Buy’s business outlook.

According to Matt Bilunas, Best Boy’s Chief Financial Officer, the updated forecast factors in the current tariff environment provided there are no policy changes or major shifts in consumer behavior relative to recent quarters.

Supply Chain Exposed to Import Risks as Q1 Performance Falls Short

Best Buy’s heavy dependency on imports, particularly from China, is amplifying its exposure to the tariff policies of the Trump administration. Telsey Advisory Group’s Joe Feldman noted that the company sources a significant portion of its merchandise from the United States’ second-largest trade partner. Previously, Best Buy executives disclosed that approximately 60% of the cost of goods that the company sells is attributable to China. Mexico, another country hit with hefty tariffs, contributes around 20%.

For the quarter that ended in early May, Best Buy reported that same-store sales had declined by 0.7%. According to LSEG data, the drop was sharper than the 0.6% market participants had anticipated.