Key Moments:

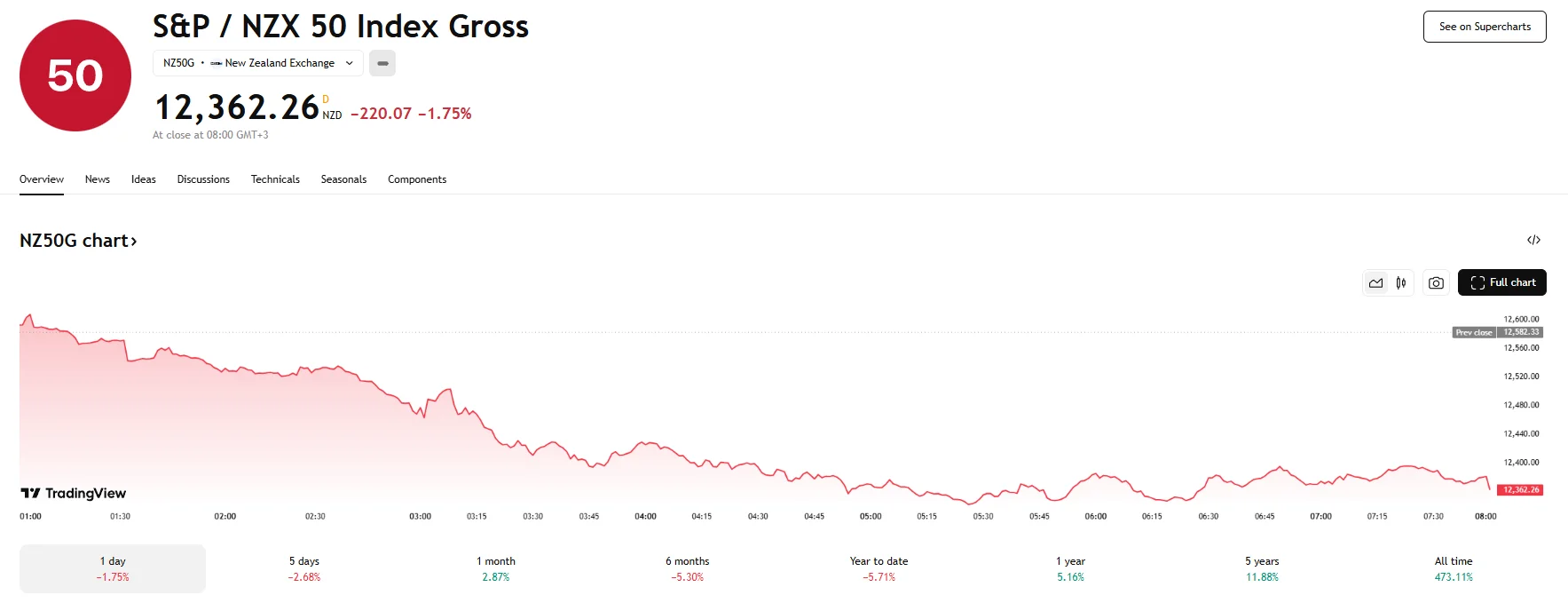

- The S&P/NZX 50 Index declined 1.75%, closing at 12,362.26 on Wednesday.

- The Reserve Bank of New Zealand cut its official cash rate to 3.25%.

- Infratil Limited was at the bottom of the index as it dropped by 5.94%.

Rate Cut Weighs on New Zealand Equities

Equity markets in New Zealand finished lower on Wednesday following a monetary policy shift from the country’s central bank. The Reserve Bank of New Zealand (RBNZ) implemented a 25-basis-point cut to its official cash rate, bringing it to 3.25%. This adjustment came with signals that a more extensive easing cycle may unfold, prompting investors to exercise caution.

The RBNZ monetary policy committee cited elevated commodity prices and easing interest rates as supportive forces for New Zealand’s economic momentum. Despite this, the central bank flagged risks ahead that could hamper recovery.

RBNZ Governor Christian Hawkesby stated that both tariffs and heightened policy uncertainty abroad were anticipated to temper New Zealand’s economic recovery and diminish medium-term inflationary pressures. He cautioned, however, that considerable uncertainty persisted regarding these assessments.

NZX 50 Down 1.75%

New Zealand’s benchmark index, the S&P/NZX 50, slipped 1.75% following the rate cut’s announcement and ended the trading session with a closing value of 12,362.26. The company that suffered the sharpest decline was Infratil Limited, whose share price fell 5.94%.

The Warehouse Group was also one of the worst performers of the index, with its stock dropping 4.40% after it was announced that starting August 1st, Group Chief Financial Officer Mark Stirton will serve as the company’s Group Chief Executive Officer. Oceania Healthcare, along with Fisher & Paykel Healthcare, witnessed their shares decline by over 4% as well.

On the other end of the spectrum, KMD Brands LTD rose by 5% by the time markets closed, while Hallenstein Glasson and Kiwi Property Group Limited both advanced by over 3%.

Stats NZ released new data on employment and business activity on Wednesday, which may have also affected local equities. The seasonally adjusted number of filled jobs across industries dipped 0.1% in April to 2.35 million, marking a decline from March’s 0.1% increase. In contrast, the total business count rose, reaching 596,721 in April compared to 593,937 in the previous month.