Key Moments:

- France’s economy posted 0.1% growth in Q1.

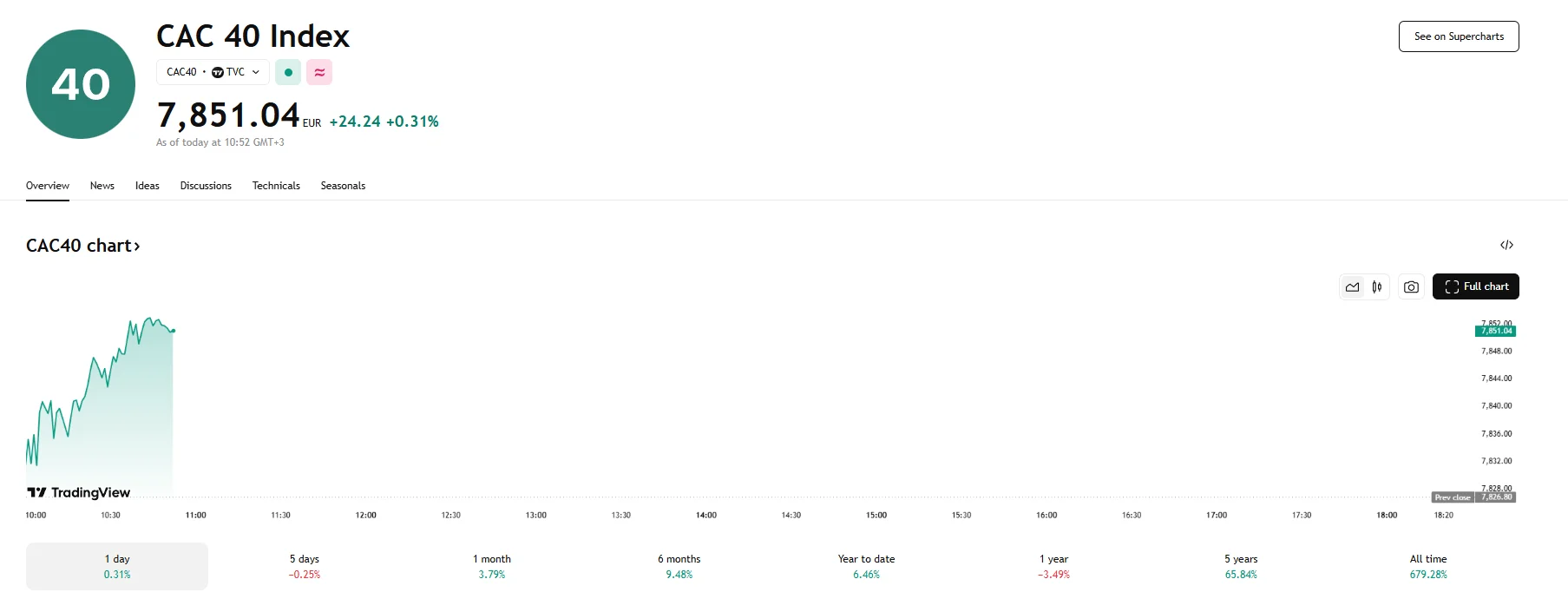

- The CAC 40 index rose by 0.31% to 7,841.04 on Wednesday.

- The German DAX rose 0.35% after data revealed a surprise 0.4% annual drop in April’s import prices, while the STOXX 600 index hit 553.24.

French Economy Edges 0.1% Higher

France recorded a modest quarterly economic expansion in the first quarter, with final figures from statistics agency INSEE reporting a 0.1% increase. The report reaffirmed initial estimates. The modest growth stemmed primarily from a buildup in corporate inventories, which helped offset weaker performance in domestic consumption and exports.

Meanwhile, household purchasing power in France rose by 0.3% in Q1, mirroring the previous quarter’s gain. The data also showed an increase in the household savings rate, now at 18.8%, which marks an increase from the prior quarter’s 18.5%. On the business side, corporate profit margins declined slightly from the 32% posted in Q4 2024 and now stand at 31.8%.

European Rise as Trade Talks Loom

European stock markets opened with muted gains on Wednesday, a slowdown from a recent rally that was propelled by signs of easing tensions between the US and the EU. As the EU prepares for upcoming trade discussions with the United States, European officials have requested that major corporations outline their investment plans regarding US operations, according to anonymous sources cited by Reuters.

The pan-European STOXX 600 rose by 0.16% on Wednesday. The domestic CAC 40 jumped by 0.31% to 7,851.04, buoyed by the release of the GDP data that confirmed the country’s slight first-quarter economic growth. Germany’s benchmark DAX 40 index also gained in early trading hours, rising 0.35% to 24,310.29 after yesterday’s major surge. Today’s rise followed news of Germany’s import prices delivering an unexpected decline of 0.4% in April compared to the same period last year.