Key Moments:

- India’s foreign exchange reserves dropped by $4.9 billion to $685.73 billion last week.

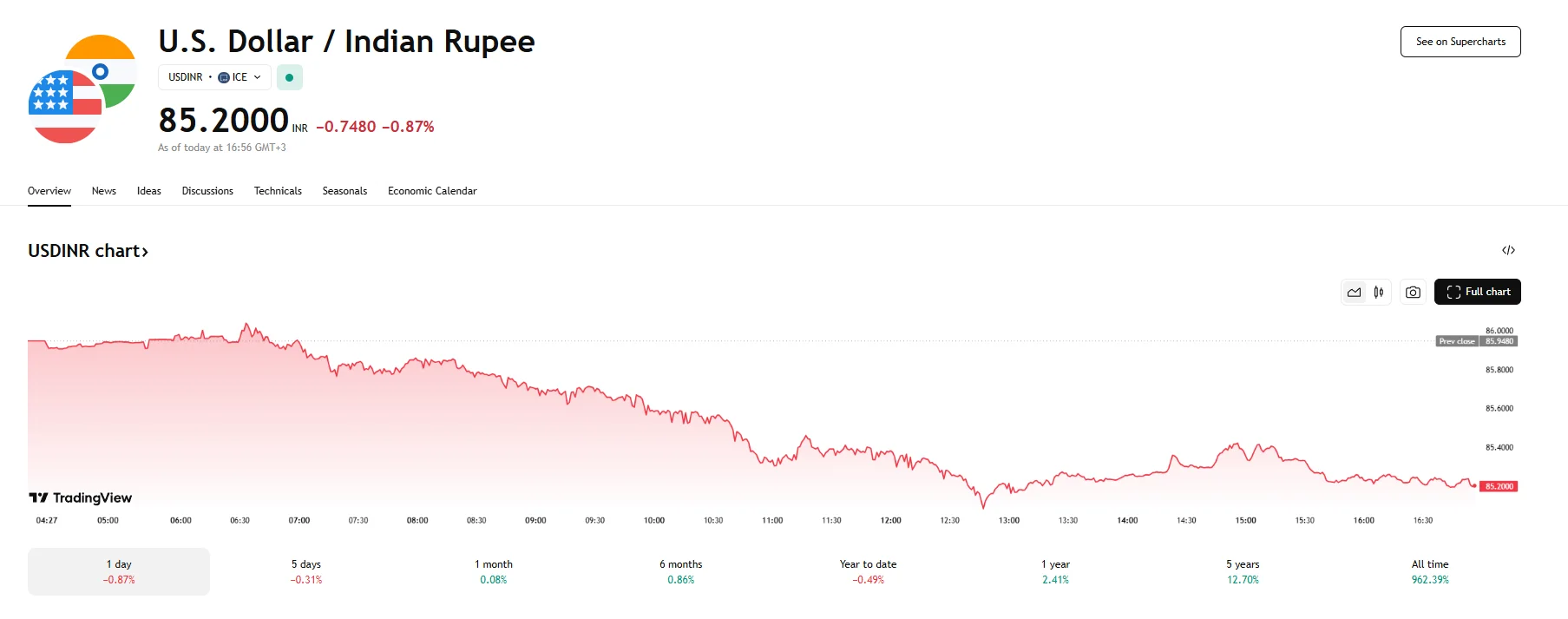

- The Indian rupee advanced 0.87% against the greenback.

- India’s 10-year government bond saw its yield decrease by 2 basis points.

FX Reserves Decline Sharply

Figures published by the Reserve Bank of India on Friday showed that during the week ending May 16, India’s foreign exchange reserves declined by $4.9 billion to $685.73 billion. This marks their lowest level in five weeks and sharply contrasts the previous week’s increase of $4.5 billion.

India’s foreign exchange reserves consist of several components, including foreign currency assets, gold holdings, Special Drawing Rights (SDRs), and the Reserve Tranche Position in the International Monetary Fund.

| Component | May 16, 2025 (in million USD) | May 09, 2025 (in million USD) |

|---|---|---|

| Foreign Currency Assets | 581,652 | 581,373 |

| Gold | 81,217 | 86,337 |

| SDRs | 18,490 | 18,532 |

| Reserve Tranche Position | 4,371 | 4,374 |

| Total | 685,729 | 690,617 |

Rupee Rebounds Sharply

The data was revealed as the rupee enjoyed one of its most successful days against the US dollar in years, which saw the USD/INR exchange rate decline by 0.86% to 85.2000. During the week, the USD/INR currency pair fluctuated, with movements resulting in the pair briefly climbing to 86.0400 as the pair continued being influenced by market reactions surrounding a ceasefire announcement between India and Pakistan. However, the rupee staged a strong comeback on Friday, and today’s trading session even saw the USD/INR pair drop to 85.0810.

Debt Market Developments and Other Data

India’s 10-year government bond closed at 100.87 rupees. Its yield fell by 2 basis points to hit 6.2107% as concerns regarding the US’s own yields were offset by market anticipation regarding rate cuts and the Central Bank of India making a surplus transfer of 2.69 trillion INR ($31.55 billion). Meanwhile, the one-year overnight index swap (OIS) rates fell to 5.53%. The five-year swap rate also eased, reaching 5.63% after shedding 4 basis points.