Key Moments:

- Dow and S&P 500 futures fell 0.1% and 0.14%, respectively, before rebounding slightly near flat levels.

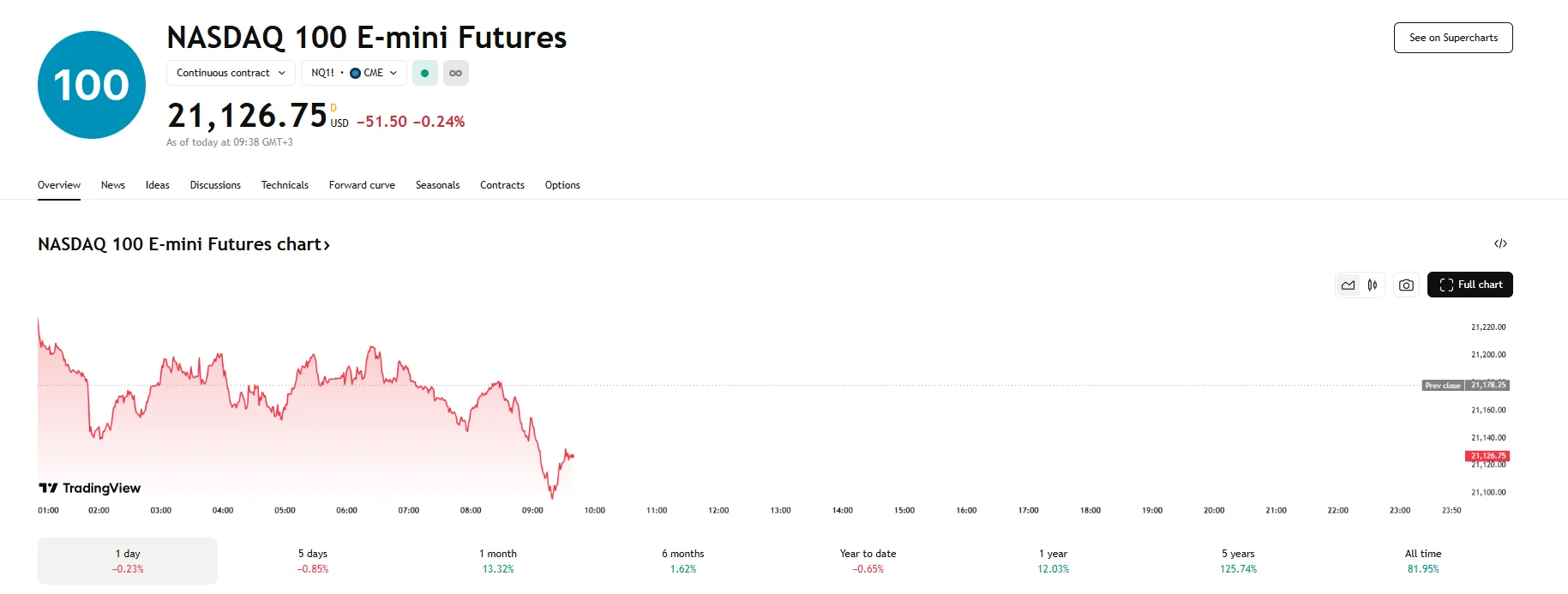

- E-mini contracts in the Nasdaq 100 fell 0.24%

- Investor concern surrounding last week’s US credit downgrade by Moody’s persisted.

PMI Data Suggests Growth but Futures Dip on Buildup of Economic Doubts

US equity futures declined as the trading week came to a close, reflecting investor unease about the nation’s economic trajectory amid President Trump’s tax and trade initiatives. Dow Jones e-minis fell around 0.1% to 41.886, while contracts tied to the S&P 500 edged 0.14% lower. Both would later reverse these losses. Nasdaq 100 futures fell the sharpest, dropping 0.24% to 21,126.75, and are still struggling to exit contraction territory.

Bearish sentiments persisted despite the latest preliminary PMI data suggesting a robust acceleration in US private sector business activity through May. The S&P Global Composite Purchasing Managers’ Index (PMI) registered a reading of 52.1 in its flash estimate for the month. This represents a noticeable increase from April’s 50.6. Individual segments also jumped, with both the Manufacturing PMI and the Services PMI experiencing a solid uptick to 52.3.

Moody’s Downgrade Shadows Wall Street, Trump’s Fiscal Strategy Fuels Debt Fears

Since the start of the week, investor attention has been locked onto Moody’s decision to lower the US credit rating. Despite initial resilience in markets, optimism eventually waned, and markets have been sliding downward. Investor sentiment soured further after President Trump’s proposed tax legislation, dubbed “One Big Beautiful Bill,” was passed by the US House.

The bill, while intended to encourage spending according to supporters, has the potential to dramatically increase national debt. This raised red flags with both investors and credit agencies, and these risks were highlighted by Moody’s as one of the factors behind its downgrade of the US credit rating to Aa1 from Aaa.