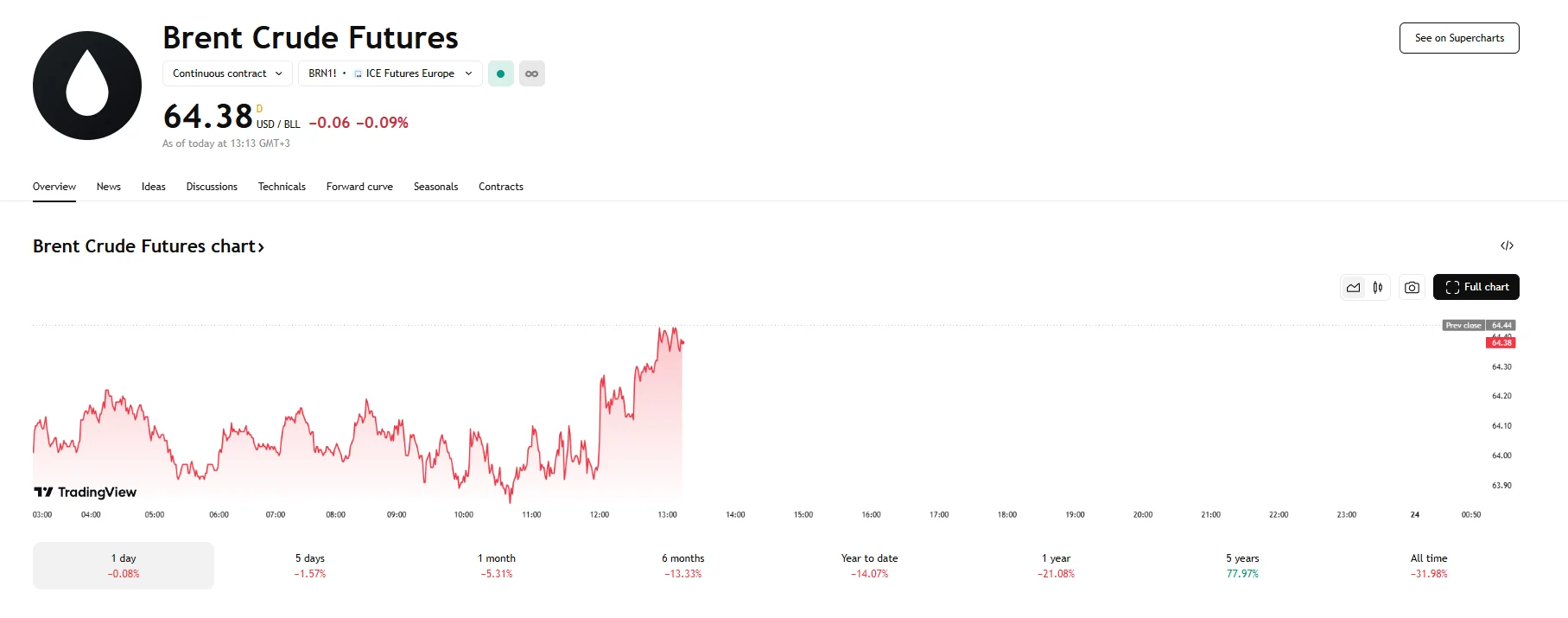

Key Moments:

- Brent crude and WTI each dropped 0.1% on Friday, putting both on track for their first weekly loss this month.

- OPEC+ is weighing a July production hike of 411,000 barrels per day.

- US crude inventories increased and storage demand surged, pressuring oil prices

Crude Steps Back as Supply Concerns Build

Oil prices fell for a fourth consecutive session on Friday, with mounting concerns of higher future supply dragging on the market. Brent crude futures declined 0.1% on Friday and reached $64.38. US West Texas Intermediate (WTI) contracts mirrored this decline, dropping to $61.14. Both benchmarks are poised to register their first weekly loss in May, as they are down more than 1% over the five-day span.

OPEC+ Hints at Further Output Hike

The market has been unsettled by reports that OPEC+ may implement another sizable production hike at its meeting on June 1st. According to delegates cited by Bloomberg News, the group is considering adding 411,000 barrels per day (bpd) to output in July. No final decision has been announced, however.

ING analysts commented that the petroleum market faced increased strain as uncertainty mounted concerning OPEC+’s plans for July production. At present, they see OPEC+ following through with the proposed increase. As a result, they continued, Brent crude could hover around the $59 bpd mark in Q4 2025.

US Inventory Surge Exerts Pressure on Prices

In addition to OPEC+ uncertainty, crude markets are also facing pressure from a substantial rise in US inventories. This inventory build, recently reported by the US Energy Information Administration, has heightened concerns about near-term oversupply. Reflecting that pressure, Brent and WTI both reached their lowest levels in over a week on Thursday and have struggled to stage a decisive rebound. Moreover, as revealed by brokerage The Tank Tiger, May witnessed US storage capacity demand climb markedly, approaching levels not seen since the COVID-19 pandemic.

Looking ahead, traders will be monitoring two key developments: the Baker Hughes oil and gas rig count due Friday and the upcoming talks between the US and Iran regarding their ongoing nuclear negotiations, the conclusion of which could impact Iranian oil flows.