Key Moments:

- Baidu reported Q1 revenue of $4.47 billion, a 3% improvement from 2024’s figures. The news caused the stock to jump by over 5% before it retreated.

- Adjusted earnings per ADS came in at $2.55, surpassing the $1.96 analyst consensus

- AI Cloud revenue increased 42% year-over-year, helping boost non-online marketing revenue to $1.30 billion

Strong Top-Line Performance and EPS Beat Expectations

Baidu’s US-listed shares fluctuated on Wednesday following the release of its fiscal first-quarter results. The company posted $4.47 billion in revenue for the quarter, marking a 3% year-over-year increase and exceeding the $4.30 billion forecasted by market participants. The company’s adjusted earnings per American Depository Share comfortably exceeded the forecasted $1.96 by reaching $2.55.

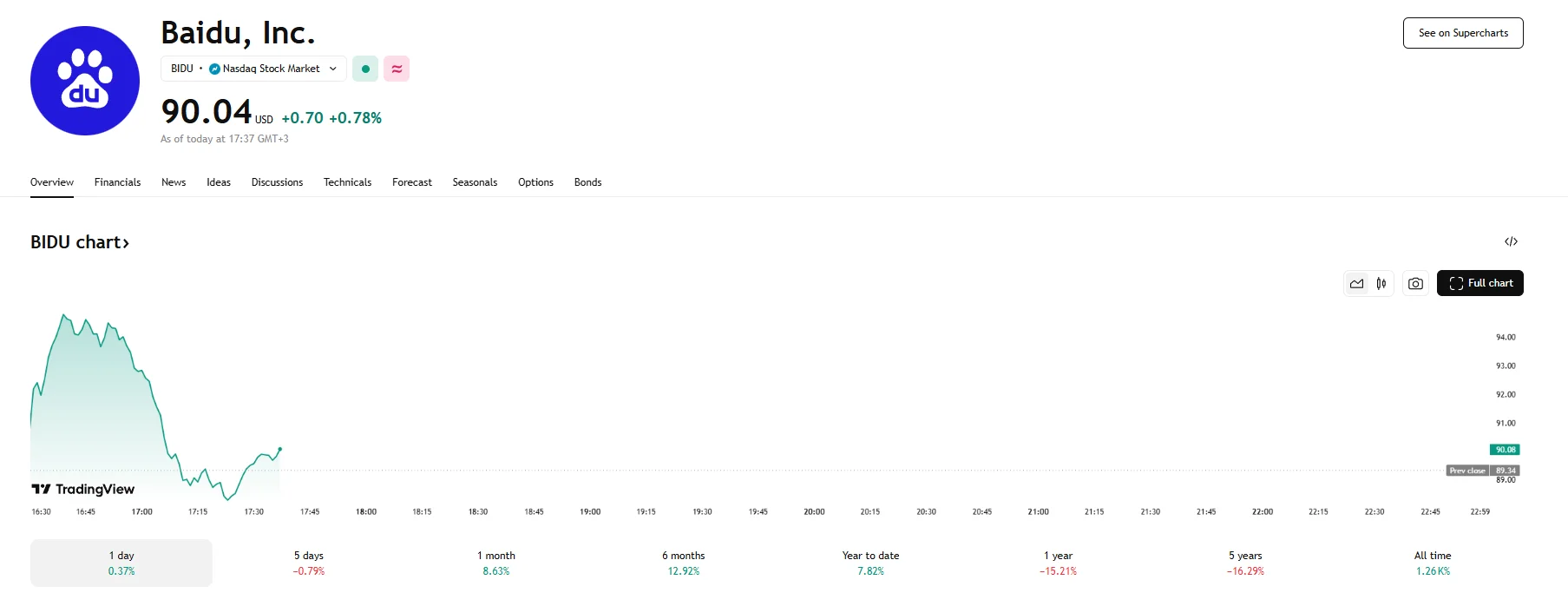

The company’s stock initially experienced a notable surge of 5.5% to around $94, but the momentum did not last long. At press time, the share price is hovering around the $90 mark.

AI Cloud Helps Offset Online Marketing Weakness

Baidu disclosed that its core revenue hit $3.51 billion, marking a 7% year-over-year jump. In contrast, online marketing revenue suffered a contraction of 6% compared to last year’s figures, dropping to $2.21 billion. The said decline was offset by continued strength in the company’s non-online marketing initiatives, which surged to $1.30 billion, a notable 40% increase from the same period last year. This jump was driven primarily by Baidu’s AI cloud division, which posted a 42% increase year-over-year.

CEO Robin Li highlighted the rising recognition of Baidu’s AI Cloud offerings and pointed to a major milestone in the company’s autonomous driving operations, with Apollo Go making its international debut in Dubai and Abu Dhabi.

Baidu’s Interim CFO, Junjie He, commented that the tech giant’s AI Cloud sustained its strong growth in the first quarter. This, he explained, offered substantial backing to their overall revenue as they expedited the AI transformation throughout their mobile ecosystem. He continued, saying that the company has a strong commitment to injecting capital into AI in order to transform the company’s technological prowess into consistent, extended growth.

iQIYI Revenue Beats Estimates Despite Yearly Dip

Baidu’s affiliated company IQIYI reported revenue of $990.3 million. Though this signified a 9.97% decline compared to $1.10 billion in the prior-year quarter, it still surpassed analysts’ expectations of $973.7 million.

Sales, General, and Administrative (SG&A) expenses climbed by 10% to $815 million, an increase attributed to expanded channel investments and heightened promotional activities. Meanwhile, research and development (R&D) costs declined to $626 million, down 15%.

Meanwhile, the adjusted EBITDA margin contracted by 400 basis points to 22%. Baidu’s Core adjusted EBITDA margin also slipped by 400 basis points, ending at 26% for the quarter.