Key Moments:

- The Reserve Bank of Australia (RBA) implemented a 25-basis-point rate cut amid mounting downside risks to the economy.

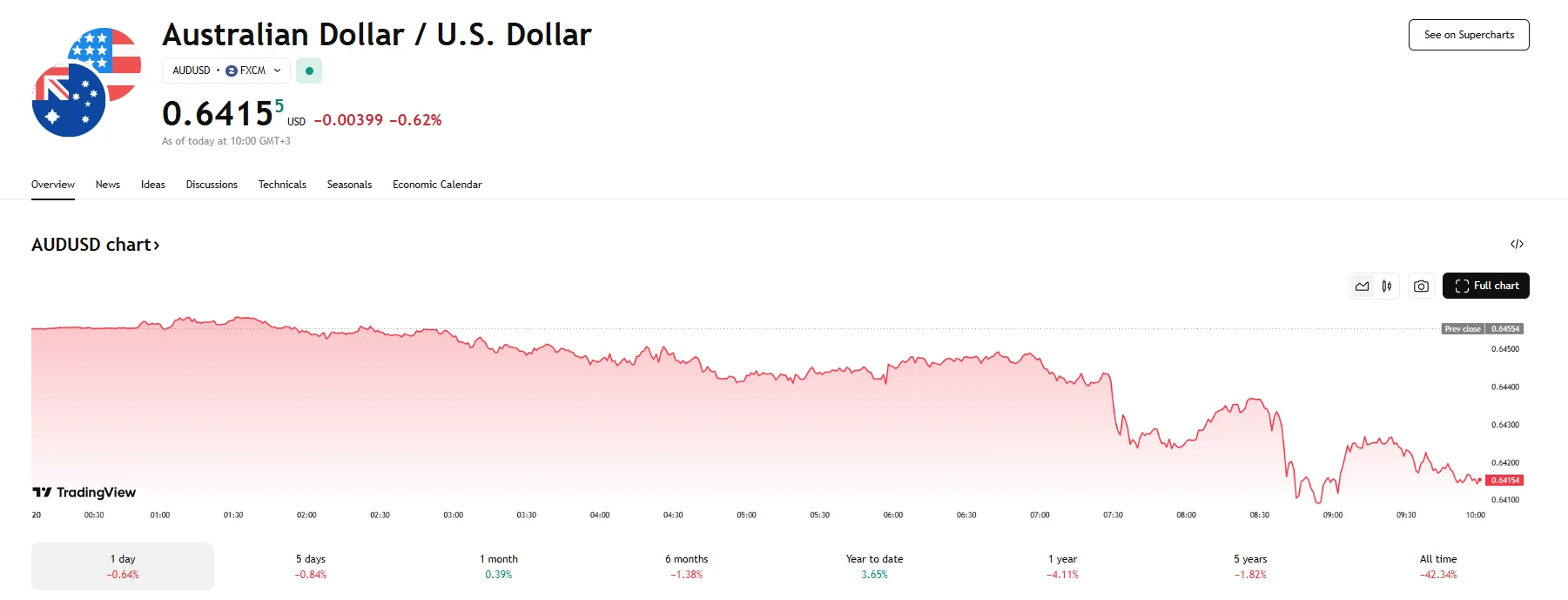

- The Australian dollar dropped to 0.6415 following the central bank’s policy decision.

- Growing political uncertainty and recent global economic developments have contributed to the AUD/USD pair’s decline.

AUD/USD Slips to 0.6415

Tuesday saw the Australian dollar depreciate by 0.62% against the greenback. The AUD/USD pair hit 0.6415 after a widely anticipated 25-basis-point rate cut was imposed by the Reserve Bank of Australia (RBA). The move was accompanied by concerns over domestic and global headwinds that could dampen the country’s economic outlook.

RBA Delivers Expected Rate Cut, Flags Economic Concerns

According to the central bank, quarterly data revealed that inflationary pressures had softened further. Policymakers also observed a trend toward reduced upside risks of inflation. The RBA’s updated projections now point to headline inflation hovering near the 2 to 3% target range.

In its statement, the bank highlighted international trade tensions as a potential threat to domestic growth. This sentiment added to growing expectations that the rate-cutting cycle may not be over. Weakness in the Australian dollar reflected these shifting expectations, particularly against the backdrop of sustained uncertainty in the global economy.

The central bank has also expressed confidence that lower interest rates, along with climbing wages, could support household consumption. However, officials acknowledged that consumer spending had not risen as much as anticipated.

Political Instability and Global Moves Add Pressure

The Australian dollar also faced pressure from political developments at home, following a fracture in the nation’s opposition coalition. The National Party’s withdrawal of support introduced a fresh layer of political uncertainty, further influencing market sentiment.

Adding to the cautious tone, a recent interest rate cut by the People’s Bank of China (PBoC) weighed on the Australian currency. Given its traditional role as a liquid proxy for the Chinese yuan, the AUD has been particularly sensitive to developments involving China’s monetary policy as well as trade tensions involving major global economies.