Key Moments:

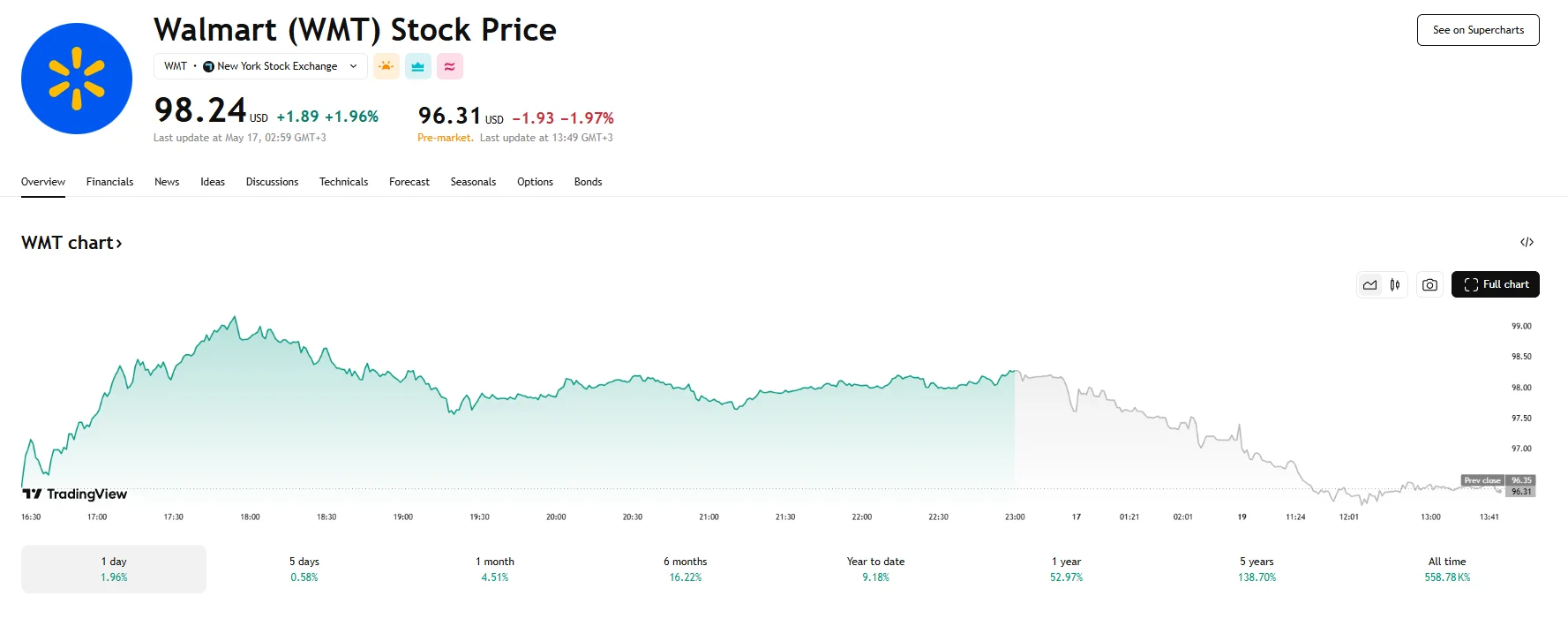

- Walmart’s shares dropped around 2% in pre-market trading after President Trump criticized its pricing strategy on social media.

- A Walmart representative reaffirmed the company’s dedication to maintaining competitive pricing for its customers.

- Treasury Secretary Scott Bessent claimed Walmart will pass along some tariff-related costs to consumers.

Presidential Pressure Weighs on Walmart

Walmart’s share price came under scrutiny on Monday after US President Donald Trump publicly admonished the retail giant for raising prices in response to tariffs on Chinese goods. Walmart has long depended on Chinese imports for a wide array of merchandise, and this long-standing supply chain dynamic is now under pressure.

The President’s remarks, posted on Truth Social over the weekend, sent Walmart stock down around 2% during Monday’s pre-trading hours. The share price decline erased the gains of 1.96% achieved on Friday, when Walmart closed at $98.24. At press time, the stock is trading near $96.

Trump’s post on Truth Social read:

“Walmart should STOP trying to blame Tariffs as the reason for raising prices throughout the chain. Walmart made BILLIONS OF DOLLARS last year, far more than expected. Between Walmart and China they should, as is said, ‘EAT THE TARIFFS,’ and not charge valued customers ANYTHING. I’ll be watching, and so will your customers!!!”

Walmart Responds to Pricing Criticism

Responding to Trump’s recent assertion, a Walmart spokesperson reiterated the company’s long-standing pricing strategy, stating that they had consistently strived to maintain the lowest possible prices and would continue to do so. They added that the retailer would keep prices as low as feasible for as long as possible, considering the narrow profit margins typical in small retail.

Treasury Secretary Scott Bessent also weighed in. Bessent, speaking on Sunday, stated that he had spoken with Walmart CEO Doug McMillon on May 17th and acknowledged that Walmart would be absorbing a portion of the tariffs, while some might be passed on to their customers. He pointed out that a recent decline in gasoline prices might cushion the impact of retail inflation for households, though he also suggested that Walmart’s scenario could represent a worst-case projection.

It also bears noting that John David Rainey, CFO of Walmart, spoke on the Yahoo Finance Catalysts programme last week, asserting the company was still committed to keeping prices low. However, he conceded that price increases on some products were “unavoidable” due to significant rises in the costs associated with imports.