Key Moments:

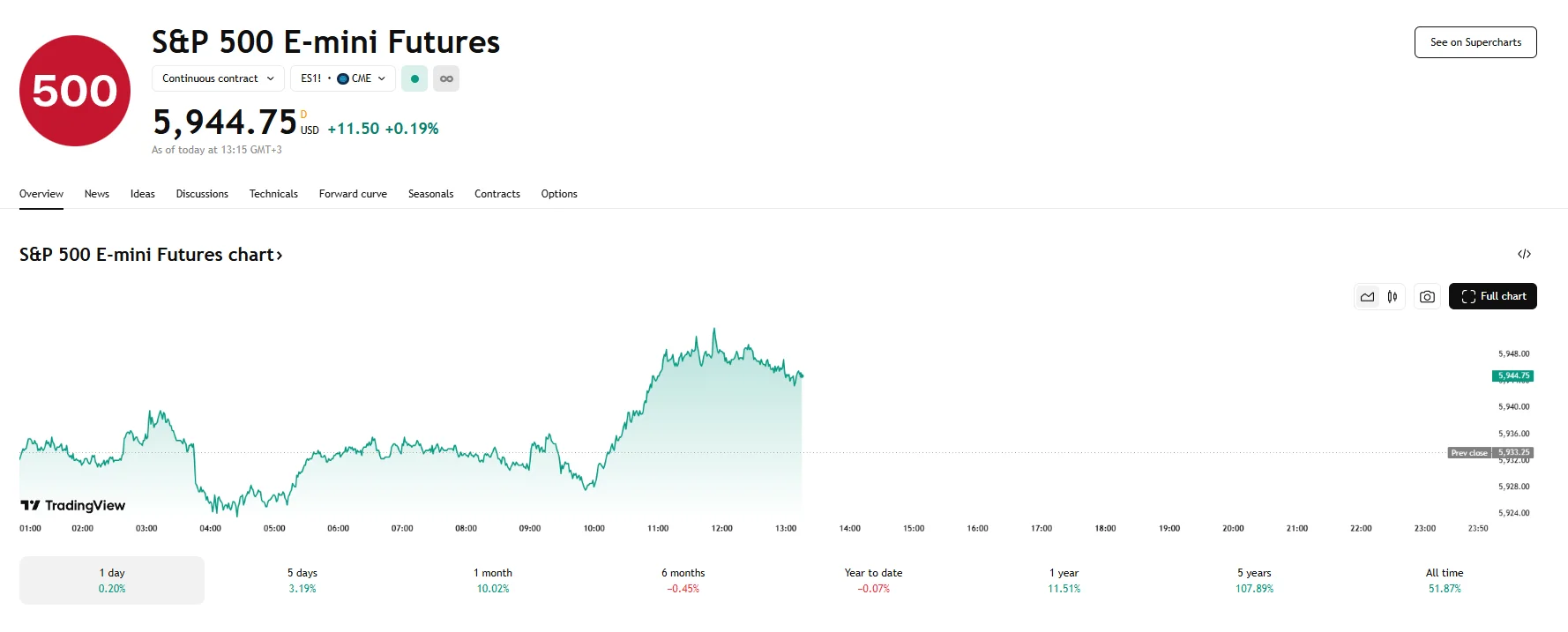

- Wall Street stock futures ticked higher on Friday following the S&P 500’s fourth day of gains.

- This week’s US-China trade announcement continues to lift market sentiment.

- Wholesale prices declined 0.5% in April, supporting optimism around easing inflation.

Futures Maintain Upward Momentum

US stock futures advanced on Friday, building on the momentum of a four-session rally in the S&P 500. The temporary tariff relief between the United States and China has maintained its positive influence on investor enthusiasm. The pause, which came into effect on Wednesday and will last 90 days in total, resulted in both countries’ respective tariffs being slashed by a notable 115%. The truce has helped to ease investor concerns around trade disruptions and the broader economic implications of escalating tariffs.

S&P 500 futures edged 0.2% higher, while the tech-heavy Nasdaq 100 witnessed its futures contracts rise by 0.16%. Dow Jones Industrial Average futures jumped the highest, with a boost of 144 basis points pushing the contract near the 42,530 mark.

Inflation Data Bolsters Optimism

Signs of cooling inflation also served to further aid markets, as April’s wholesale price index showed a 0.5% month-over-month drop. This report followed earlier data this week showing consumer price growth has decelerated substantially, rising by just 2.3% in April.

So far this week, the S&P 500 has advanced by over 4%, the Dow has climbed more than 2%, and the Nasdaq Composite has achieved a surge exceeding 6%. On Thursday, both the S&P 500 and Dow closed with gains. The Nasdaq 100 stayed relatively flat, with a rise of just 0.08%, while the broader Nasdaq Composite shed 34.49 basis points.

Despite the upbeat market tone, cautionary signals are emerging from corporate America, as Thursday saw Walmart indicate that tariffs may force the retailer to raise prices on select items by the end of May.

Chief market strategist at Ritholtz Wealth Management, Callie Cox, commented that Thursday’s market was a continuation of the relief after US tariff cuts on China, noting current moves lack economic data drivers. Regarding price hikes, she observed no market reaction yet but sensed underlying anxiety and emerging signs of tariffs’ impact that could signal future problems.