Key Moments:

- Quantum Computing reported Q1 earnings of $0.11 per share.

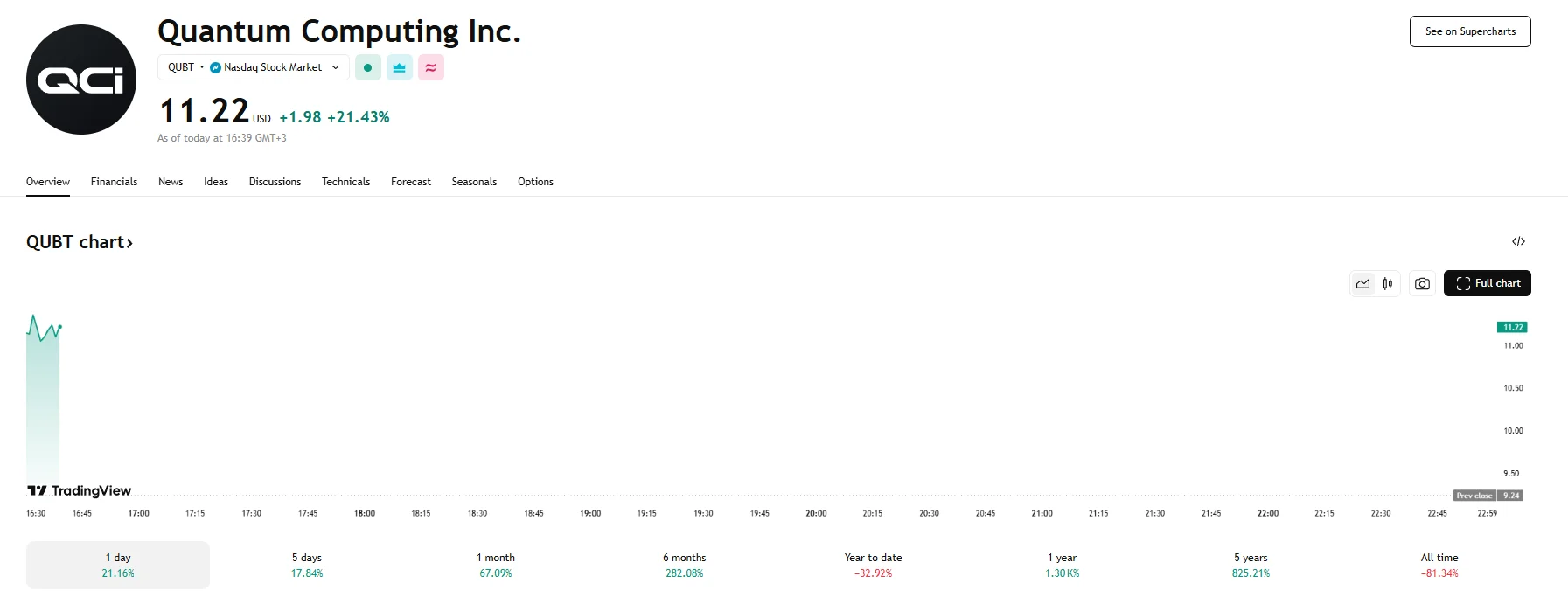

- The company’s stock jumped 21.43% after the opening bell.

- Investor sentiment was also bolstered by the recent finalization of the Quantum Photonic Chip Foundry in Arizona.

Strong Quarterly Turnaround

Friday witnessed the stock price of Quantum Computing (NASDAQ:QUBT) climbing by more than 21% to $11.22 following a significant turnaround in quarterly results. This placed Quantum Computing among the top performers on the Nasdaq Composite.

The photonic and quantum optics technology firm reported a shift to profitability in the first quarter, citing benefits from a prior acquisition and increasing demand for its thin film lithium niobate (TFLN) photonic semiconductors.

The company posted net income of $17 million ($0.11 per share), marking a significant improvement from last year’s net loss of $6.4 million ($0.08 per share). Revenue figures were promising as well, reaching $39,000, an achievement that reflects an increase of $12,000.

Merger With QPhoton and New Foundry Boost Results

Quantum Computing highlighted that the earnings improvement was mainly driven by a $23.6 million non-cash gain. This gain, they explained, resulted from the mark-to-market valuation of their warrant liability following their merger with QPhoton in June 2022.

As noted by interim CEO Dr. Yuping Huang, the company recently completed the construction of its Quantum Photonic Chip Foundry located in Tempe, Arizona. According to Huang, the board felt encouraged by the early success, which they believe represents the initial phase of a significant, multi-year prospect to serve the expanding datacom, telecom, and quantum-enabled application markets. He also highlighted the company’s successful efforts to strengthen its connection with public and private sector partners alike.