Key Moments:

- The UK’s GDP expanded 0.7% quarter-over-quarter in the first three months of 2025, beating market expectations.

- March monthly GDP increased 0.2% even though analysts had expected no growth.

- The GBP/USD pair rose above the 1.3200 mark.

Solid Start to 2025 for the UK Economy

The UK posted stronger-than-expected economic growth in the first quarter of 2025, rising 0.7% during 2025’s first quarter compared to analysts’ forecasts of 0.6%. This followed a 0.1% expansion in Q4 2024.

On an annual basis, GDP climbed 1.3% in the first three months of 2025, edging past the 1.2% projection. It did fall below the 1.5% increase seen in the previous quarter. In addition, March’s monthly GDP percentage hit 0.2% even though economists had expected the rate to stay at 0%. However, it slowed from February’s 0.5%.

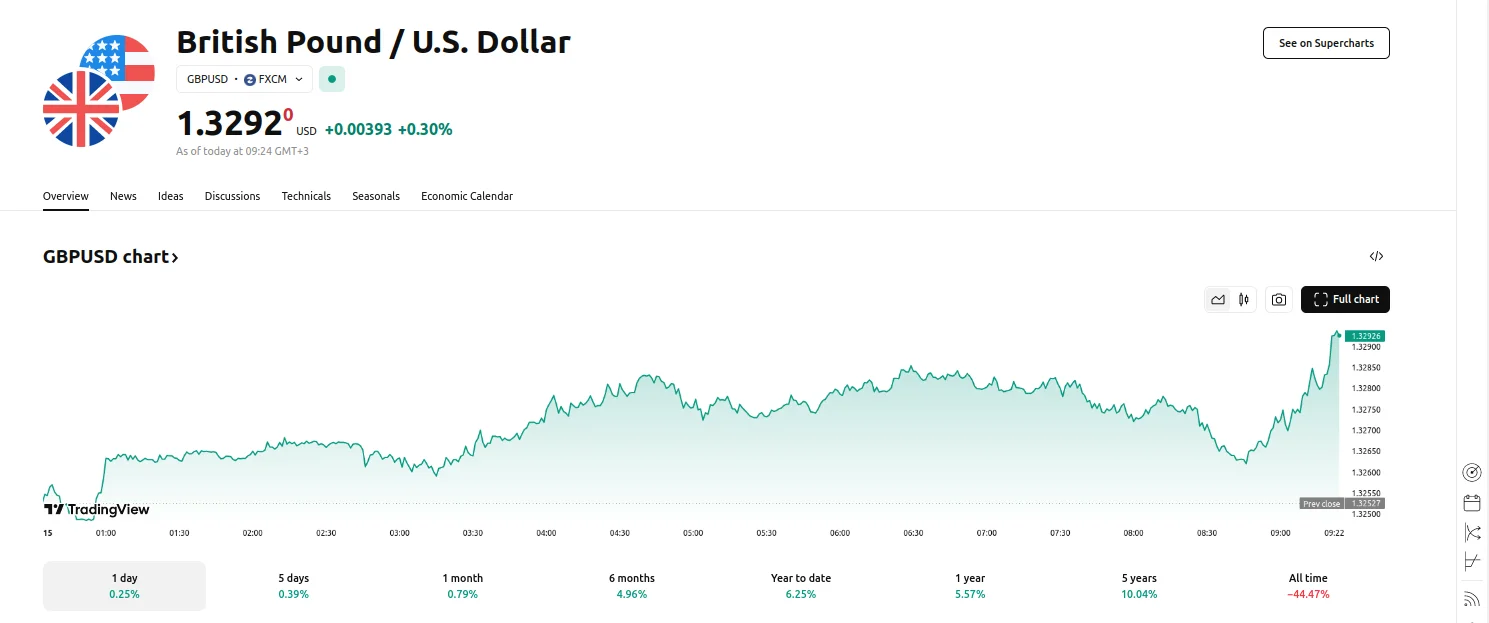

GBP/USD Gains

Following the release of UK economic data, the sterling appreciated against the US dollar, with the GBP/USD rising 0.3% to 1.3292. A softer dollar also served to support the sterling, as the greenback faced pressure due to lingering uncertainty around the US tariff policies.

Ongoing discussions about US currency policy have added to volatility, with market participants speculating that the Trump administration could favor a weaker dollar. A stronger dollar, US officials contend, puts US exporters at a disadvantage relative to peers in nations with softer currencies, while a weakened greenback may improve competitiveness in international trade. Nevertheless, anticipation of major interest rate cuts by the Federal Reserve has cooled.

Sector Performance: Services Up, Manufacturing Down

When examining the data on a sector-by-sector basis, the Index of Services for March posted a 0.7% gain in the 3-month-over-3-month comparison, up by 0.1%. However, this strength was not mirrored across the board, as key industrial components suffered declines. In March, Industrial Production fell 0.7%, while Manufacturing Production slipped 0.8% on a monthly basis. Both figures came in below analyst forecasts, reflecting weakness in the UK’s industrial base.

Preliminary data on Total Business Investment showed a robust increase of 5.9% in Q1. This statistic suggests that UK companies may be showing renewed confidence despite ongoing economic and global uncertainties.