Key Moments:

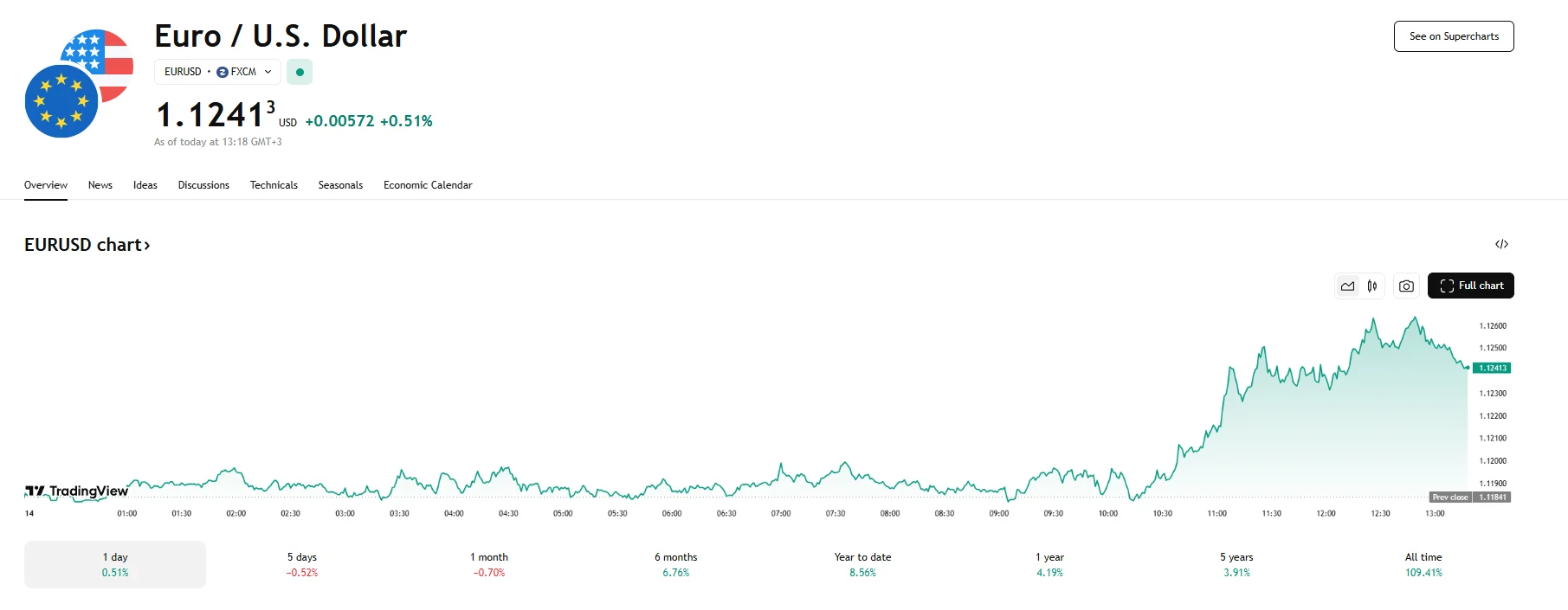

- The EUR/USD advanced by 0.51% on Wednesday.

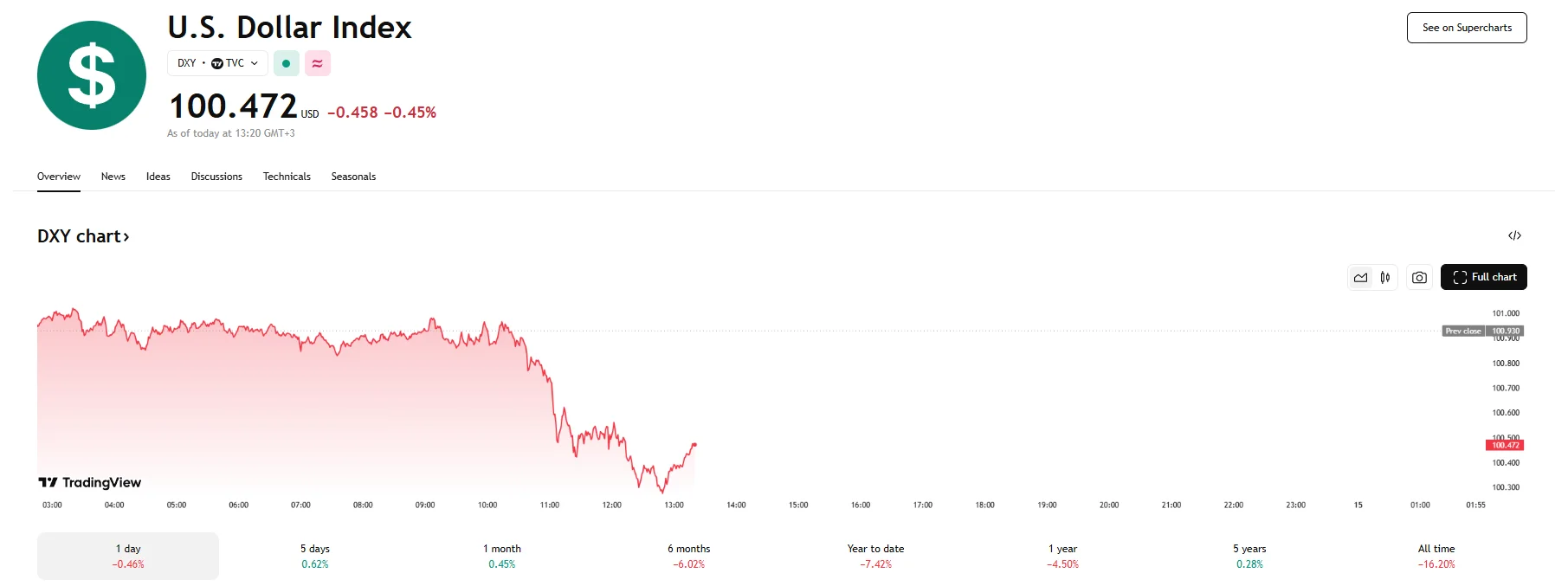

- Meanwhile, the US Dollar Index dipped 0.42% as April’s headline CPI rose just 2.3%

- Commentary by Francois Villeroy de Galhau indicated optimism about a potential ECB rate cut before the end of summer.

Euro Extends Gains as Dollar Slides

The EUR/USD currency pair managed to climb further on Wednesday, rising 0.51% in an effort to reach the 1.1250 level. This move built upon the previous session’s gains and reflected growing demand for the euro, which has strengthened against the US dollar.

The euro outperformed even as European Central Bank officials continued expressing their willingness to implement additional rate cuts, since, according to the Governor of the Bank of France, Francois Villeroy de Galhau, the ECB “does not see inflation picking up.”

Pressure Mounts on the Fed Amid Weak US Inflation

The US dollar faced added pressure after the release of softer-than-expected inflation data for April. Headline CPI climbed by a mere 2.3%, and in response, US President Donald Trump renewed criticism of Federal Reserve Chair Jerome Powell for resisting calls to lower interest rates.

The decline in the greenback pushed the US Dollar Index (DXY) below the 101.00 mark. This marked a significant drop from its recent peak of around 102.00.

Despite calls from Trump for rate reductions and evidence pointing to waning inflationary pressures, investor expectations for a near-term shift in the Fed’s monetary policy remain largely unchanged. As shown by CME FedWatch data, current forecasts point to the Fed maintaining interest rates in July, and the probability stands at 63.3%. Moreover, concerns over a long-term slowing of inflation have been offset by optimism stemming from Washington and Beijing’s recent decision to temporarily cut tariffs by 115%.

Market participants also watched closely for developments in the trade negotiations between the US and the European Union. The lack of communication from the White House regarding talks with the EU has heightened investor uncertainty, with many interpreting the silence as a sign of limited progress.