Key Moments:

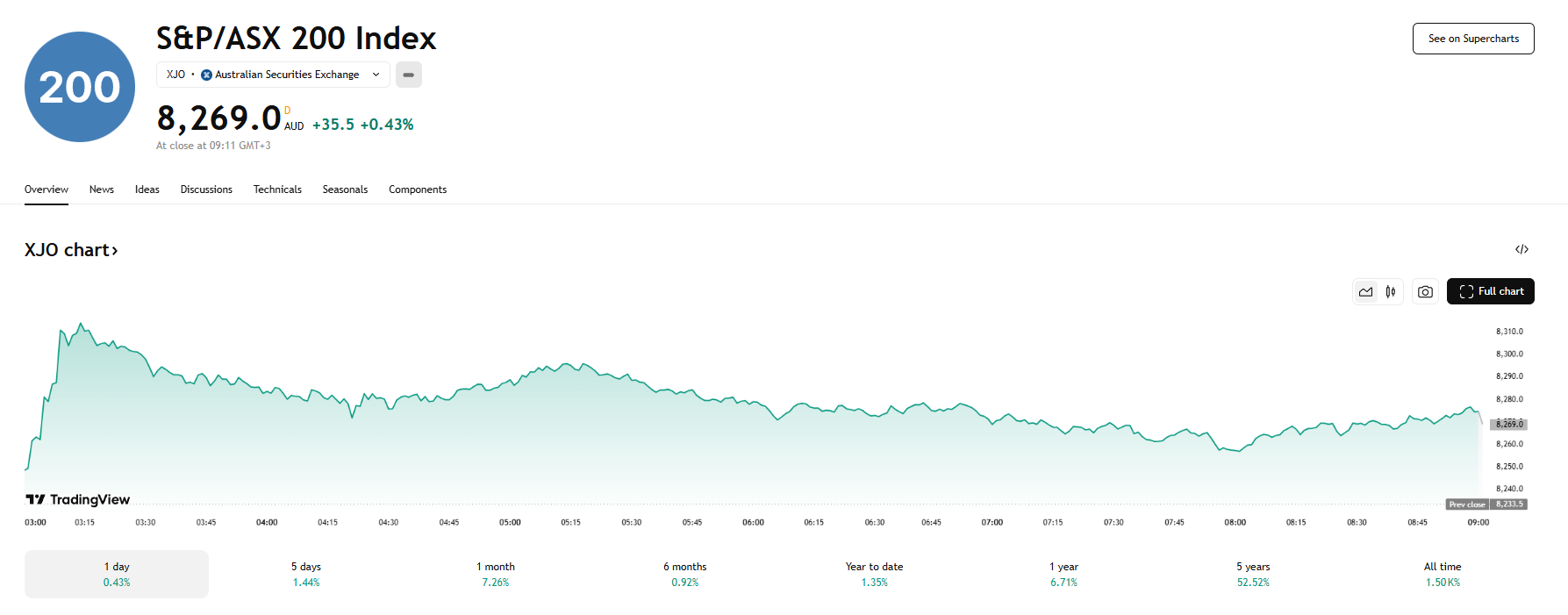

- The S&P/ASX 200 Index rose 0.43% to 8,269 at Tuesday’s close.

- US and China agreed to reduce tariffs, boosting optimism in Australian equities.

- Life360 surged 14% after posting a profit for the first quarter

Australian Equities Gain

Australian stocks ended higher on Tuesday, bucking broader weakness across other Asian markets. Investor sentiment was lifted by easing trade tensions between the United States and China, which provided a boost to local equities. The S&P/ASX 200 Index rose 0.43%, with its closing value reaching 8,269.

The United States plans to reduce tariffs on Chinese imports from 145% to 30% for a 90-day period. In return, China is set to slash the duties imposed on US goods from 125% to 10%. In total, both trade partners have implemented a tariff cut of 115%.

Company Highlights

Life360 was the top performer of the ASX 200, jumping 13.96% after its latest financial report showed that Q1 net income grew to A$0.05% per share. This marks a notable recovery from last year’s A$1.47 loss. Corporate Travel Management and Mineral Resources were also bolstered by investor confidence, with the former’s shares climbing almost 10%, while the latter advanced by over 9.7%.

In addition, Abacus Storage King’s shares closed with a 1.67% gain after news broke out that the company had turned down an acquisition proposal from Ki and Public Storage. Had an agreement been reached, Ki and Public Storage would have purchased all outstanding stapled securities for A$1.47 per unit.

Local Sentiment and Business Conditions

Domestically, consumer sentiment showed signs of recovery, as ANZ Research and Roy Morgan Research reported an uptick in consumer confidence last week. Furthermore, the Westpac–Melbourne Institute has revealed that its consumer sentiment index climbed 2.2% in May, reaching 92.1. This contrasts a major 6% decline observed in April. Meanwhile, a survey by the National Australia Bank indicated that April saw business conditions soften, and while confidence showed a modest improvement, it remained in negative territory.