Key Moments:

- US stock futures advanced on Monday, buoyed by optimism around US-China trade discussions.

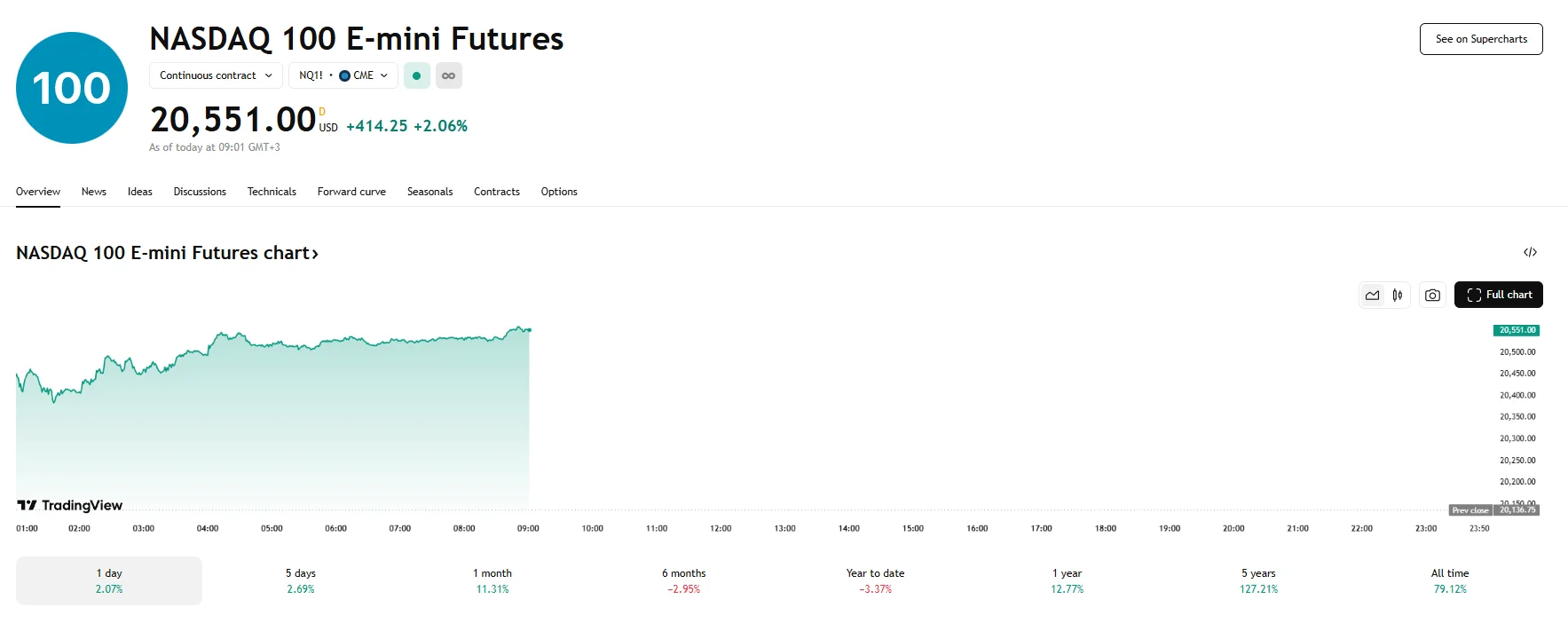

- Nasdaq 100 futures jumped 2.06%, while Dow along with S&P 500 e-minis rose over 1%.

- Fed rate cut expectations for June declined to 17%.

Markets Propelled by Trade Talk Optimism

US equity futures moved higher on Monday, fueled by signs of progress in trade negotiations between Washington and Beijing. The dollar also found firmer footing against traditional safe-haven currencies, as investor sentiment improved on hopes that a global economic slump may be avoided.

While critical details from the discussions remain unclear, US Treasury Secretary Scott Bessent reported that the ongoing trade talks were “productive and constructive.” According to Chinese Vice Premier He Lifeng, the two sides had reached an agreement to establish a consultation mechanism for trade and economic issues, identify the lead representatives on each side, and are set to continue further discussions regarding trade and economic issues. China and the US are expected to issue further details later today.

Tensions on the geopolitical front also appeared to ease as a ceasefire between India and Pakistan continued to hold. Additionally, President Volodymyr Zelenskyy of Ukraine has conveyed that he is open to engaging in talks with Russian President Putin. The meeting is scheduled for Thursday and will be held in Turkey.

Outlook Uncertain Despite Constructive Signs, Fed Caution Tempers Rate Cut Expectations

Monday saw risk appetite rise on Monday, leading to gains across key indices. S&P 500 futures rose 1.5%, and Dow e-minis rose by just over 1%. Nasdaq 100 futures performed the strongest and bounced 2.06% higher.

Investors remain hopeful that upcoming policy changes may reduce the 145% tariff on Chinese imports, potentially bringing it back to the 60% level previously floated by President Donald Trump. However, persistent support from the White House for sweeping tariffs continues to stoke concerns over inflationary pressures and slowing economic growth.

While the dollar had recently come under pressure due to erratic trade policy shifts, it found support last week after the Federal Reserve signaled little urgency to implement further rate cuts. On Monday, traders adjusted their expectations for monetary easing, with Fed fund futures dropping 3 to 7 ticks. Market sentiment indicated just a 17% probability of a rate cut in June, marking a sharp contrast from last month’s 60% forecast.