Key Moments:

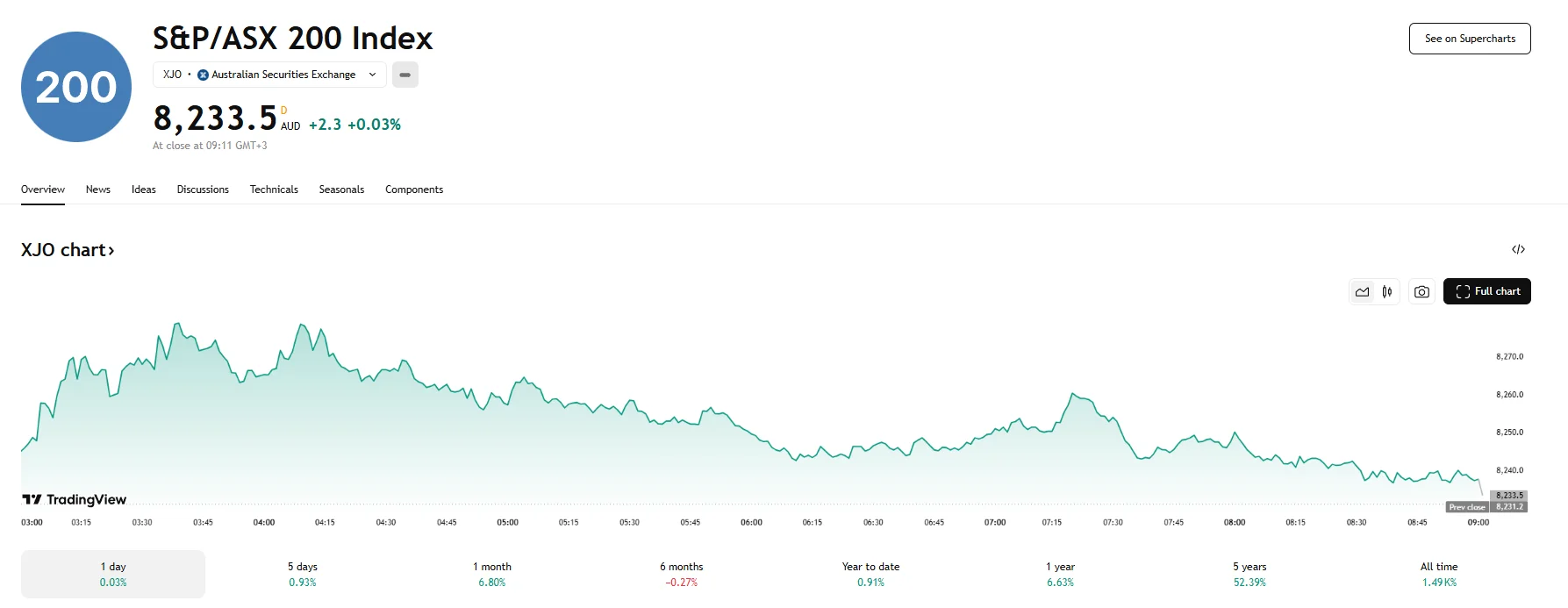

- The S&P/ASX 200 closed practically flat on Monday, inching up 0.03% to finish at 8,233.5.

- Healthcare stocks dropped to a level not seen since April.

- Mining equities advanced 0.9%, supported by stronger iron ore prices. Optimism over trade discussions between the US and China further bolstered market confidence.

Uneven Sector Performance Keeps Index Steady

Strength in Australia’s mining sector served as a counterbalance to a steep decline in healthcare equities on Monday. The S&P/ASX 200 closed nearly unchanged as a result. Stocks tied to pharmaceutics came under pressure, falling 1.4% to April lows following statements from US President Donald Trump about upcoming drug price reforms. Namely, he is planning on lowering prescription drug prices by 30% to 80%, which would bring them into line with costs in other high-income nations.

Neuren Pharmaceuticals stood at the bottom of the index with its shares plummeting by 9.56%, while companies such as CSL Ltd and Mayne Pharma Group were among the hardest hit as their significant exposure to US markets made them vulnerable to American policy shifts. CSL Ltd’s shares sank 1.74%, and Mayne Pharma closed the session by dropping by 3.1%. The sector has suffered a year-do-date decline of almost 10%.

Meanwhile, mining stocks rallied 0.9% as hopes of warming US-China relations lifted commodity sentiment and boosted iron ore prices. Secretary of the Treasury Scott Bessent said that the nations had made “substantial progress” and that the discussions were productive. China’s Vice premier, He Lifeng added to these claims, stating that the nations had “come to an agreement.”

BHP, the largest listed mining company globally, added 2.3%, while Rio Tinto rose 2.1%. Mineral Resources Limited saw the highest gains, having jumped 8.21% to A$22.81 by the time markets closed. Gold-related stocks, on the other hand, retreated amid reduced demand for safe haven assets. The gold sub-index dropped by 3.2%, and Evolution Mining led the declines with a 3.7% slide.

Monday’s market movements left the S&P/ASX 200 with a closing figure of 8,233.5, a mere 2.3-basis-point increase from the previous session. It should also be noted that this followed earlier highs of over 8,278.