Key Moments:

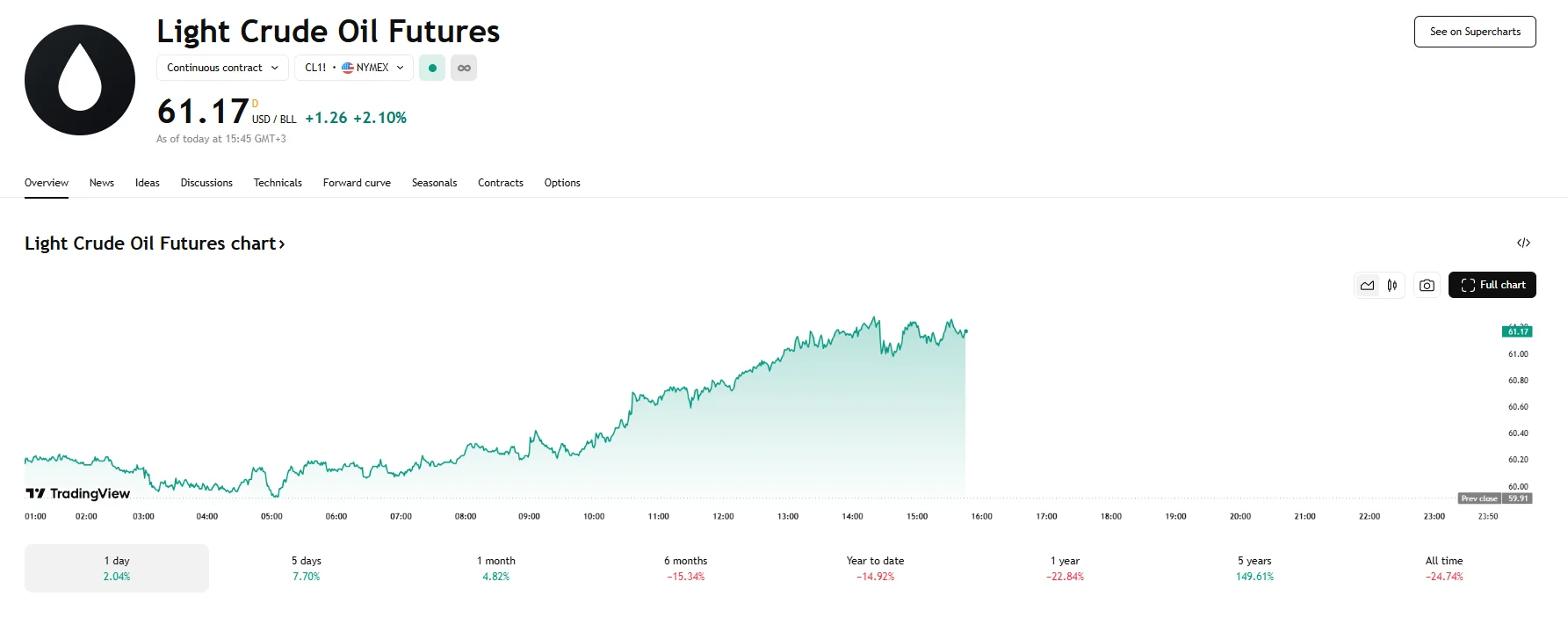

- WTI futures jumped 2.1% on Friday, while the Brent benchmark rose 1.93%.

- China’s April crude imports were 7.5% higher YoY despite a monthly dip.

- OPEC+ output dropped last month.

Trade Optimism Fuels Market Momentum

Crude oil prices are finding support as the potential for positive developments in US-China trade relations provides a fresh tailwind. Brent crude oil futures surged by as much as 3% on Thursday and advanced a further 1.93% on Friday. WTI futures also climbed, surging by 2.1% to $61.17. The rally follows news that US Treasury Secretary Scott Bessent will discuss trade relations with Chinese Vice Premier He Lifeng on Saturday.

With the trade meeting on the horizon, momentum could build even further if the talks lead to a tangible reduction in trade friction, and analysts speculated that the possibility of a pause in tariffs could lift oil prices by an additional $2-3 per barrel.

China Demand Offers Additional Support

Further buoying sentiment, China’s latest trade figures for April showed stronger-than-expected exports and a milder decline in imports. Crude purchases achieved a 7.5% YoY increase despite the figures suffering a decline compared to what was reported in March. This sustained demand, attributed in part to restocks by state-owned refiners, is seen as a sign of continued consumption strength.

Conflicting OPEC+ Signals Keep Supply Outlook Uncertain

While the OPEC+ alliance has communicated plans to raise production, actual output fell in April according to a survey conducted by Reuters. The data revealed that declines in Libya, Venezuela, and Iraq outpaced increases in other member states, which in turn aided oil prices that were struggling amid oversupply fears.