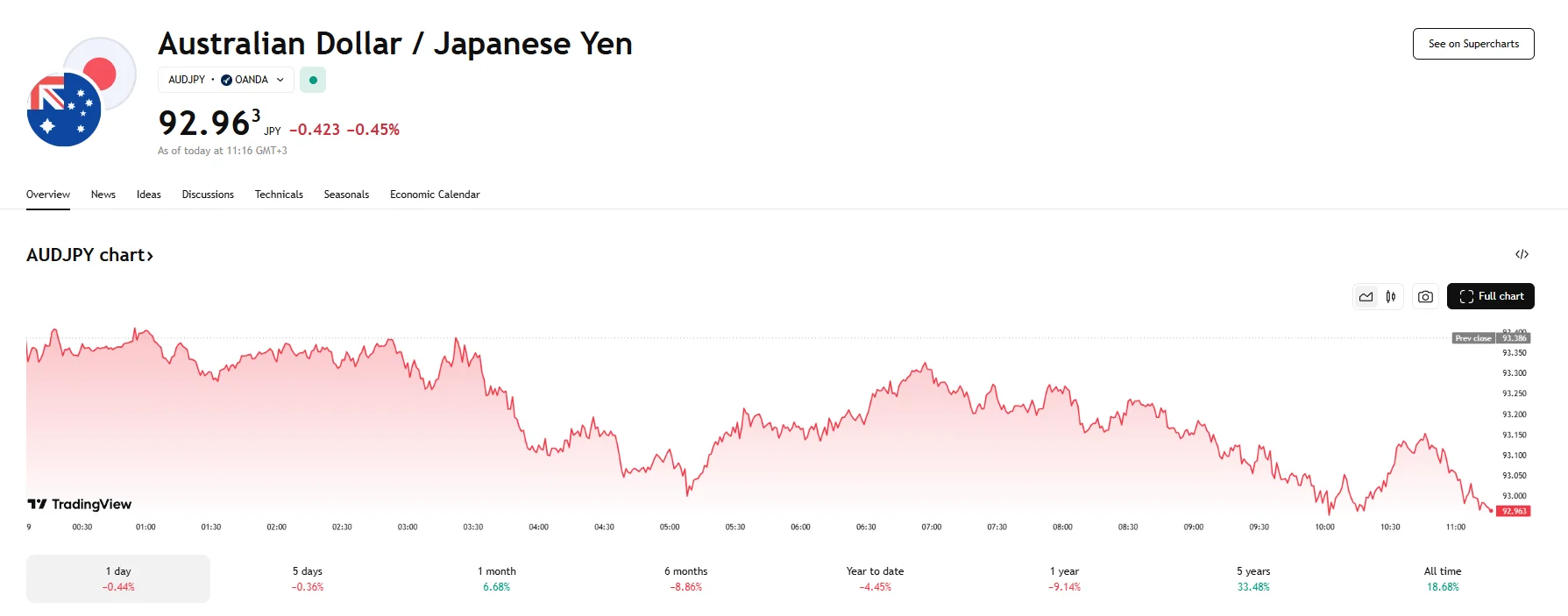

Key Moments:

- AUD/JPY pulled back below 93.00 on Friday.

- March saw household spending climb 2.1% year-over-year, aiding the yen.

- The pair’s downward momentum was mitigated by robust Chinese trade data.

Yen Strengthens as Household Spending Jumps

The Japanese yen appreciated against the Australian dollar on Friday, pushing the AUD/JPY pair down to 92.96. The move followed the release of encouraging Japanese economic data, which signaled strengthening consumer activity in March. While this uptick in spending offers a positive signal for domestic demand, real wages continue to suffer persistent declines.

Consumer Spending in Japan Jumps More than Expected

In March, household outlays in Japan climbed by 2.1% on a year-over-year basis. The figure exceeded analyst expectations that had projected spending would climb by a mere 0.2%, and it marked a significant turnaround from February’s 0.5% drop. The surge was attributed to higher utility expenses amid an unexpected cold spell.

While nominal earnings showed some growth, Japanese workers continued to be impacted by falling real wages. March’s labor cash earnings were up 2.1% YoY, lower than the 2.7% reported in February. The data also failed to reach analysts’ 2.3% forecast. When adjusted for inflation, real wages declined for a third consecutive month, dropping by 2.1%,

Australian Dollar Buoyed by China’s Trade Data

Although the Yen’s strength applied pressure on the AUD/JPY pair, positive Chinese trade figures served to soften the decline due to the strong economic relations between China and Australia. China’s trade surplus in April reached $96.18 billion, exceeding projections of $89 billion. Exports also managed to climb above expected figures thanks to an 8.1% YoY surge.

While the data fell short of the increases witnessed in the prior month, it nonetheless bolstered market sentiment. We should also note that imports slipped just 0.2%, a notably milder decline compared to the 4.3% drop observed in March.