Key Moments:

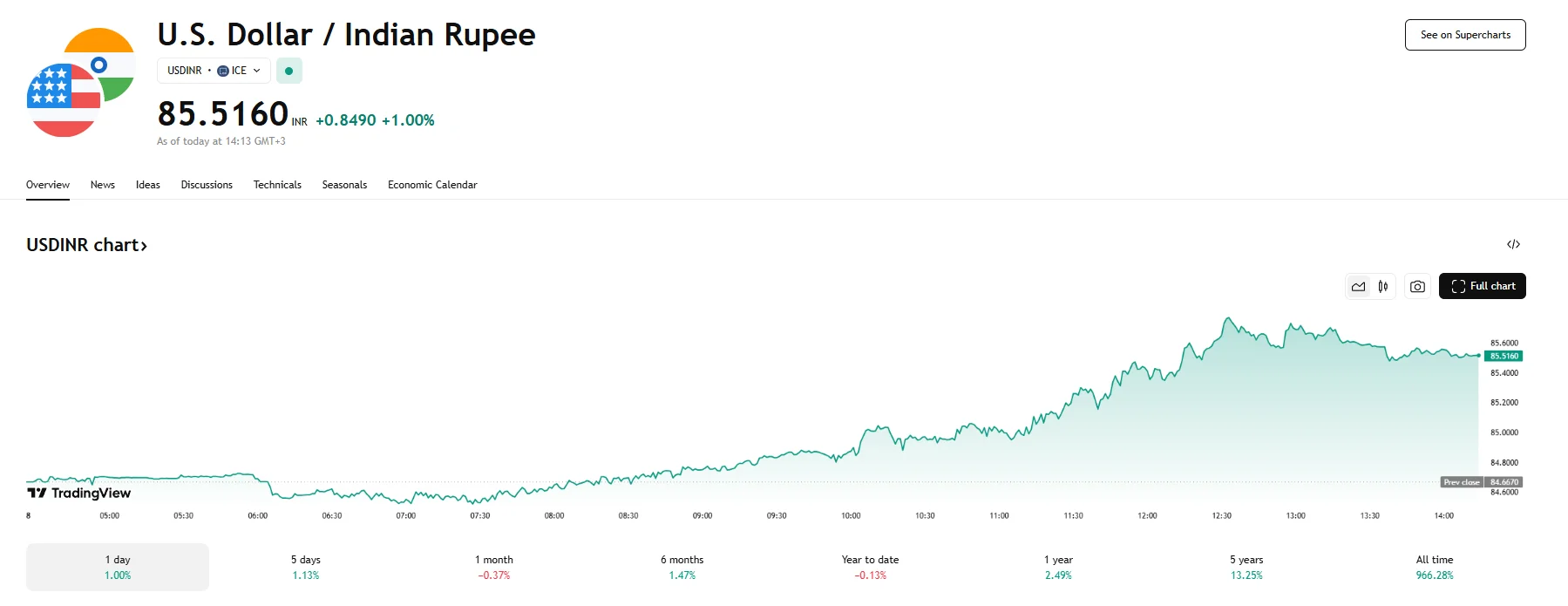

- The Indian rupee dropped by 1% against the US dollar on Thursday. An earlier USD/INR surge saw the rate climb past 85.7900, marking the rupee’s steepest drop in years.

- Military escalations between India and Pakistan, including drone strikes and retaliatory artillery exchanges, triggered a flight from Indian assets.

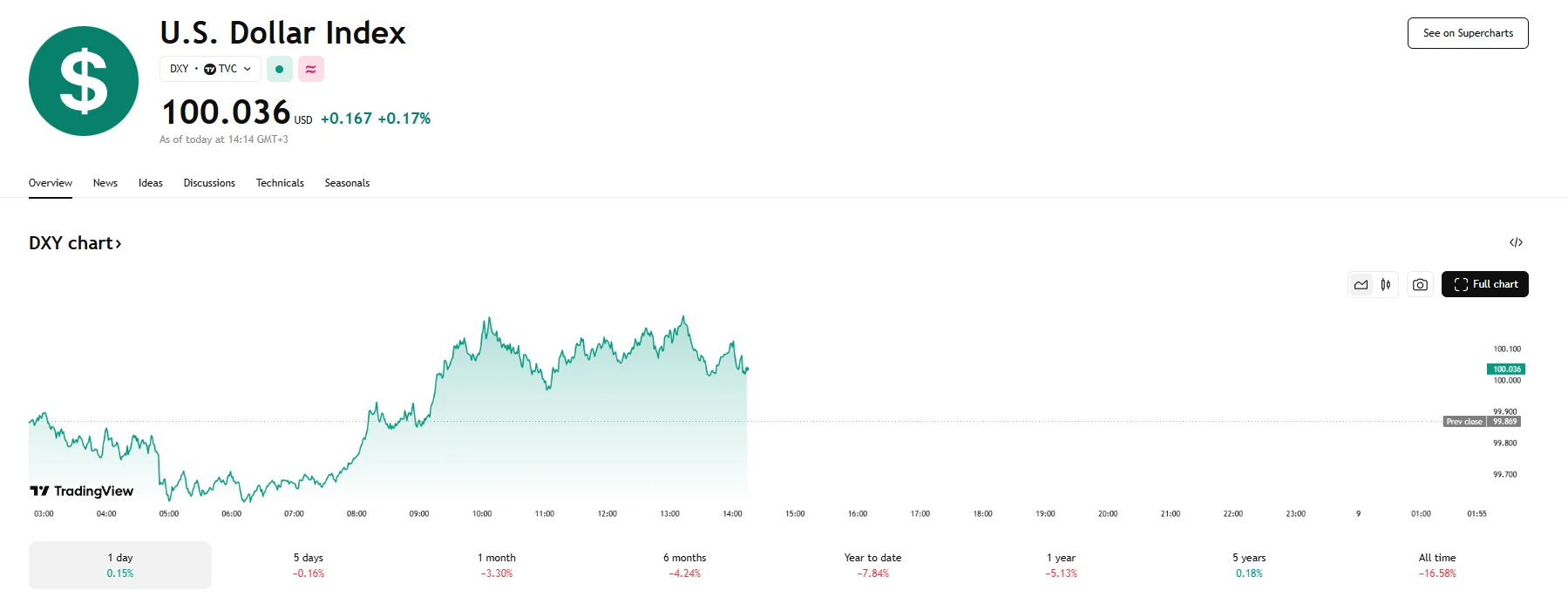

- The US Dollar Index has stayed above 100.

Currency Weakens Amid Geopolitical Tensions

The Indian rupee experienced a sharp decline on May 8th, propelling the USD/INR exchange rate by around 1%. Earlier movement saw the currency trade at around 85.79 INR per USD, a steep depreciation from its recent peak of 85.2 INR.

The decline came as rising military tensions with Pakistan spurred investor aversion to Indian markets in favor of perceived safer assets, fueling the rupee’s continued losing streak. Cross-border risks intensified after Indian forces conducted strikes within Pakistani territory in response to terror incidents in Indian-administered Kashmir from the previous month. Pakistan later reported that it had downed Indian drones, while India claimed to have dismantled Pakistani air defenses.

Fed Signals Dampen Risk Sentiment

Market sentiment was further pressured by the Federal Reserve’s recent announcement. Although the Fed chose to hold its benchmark interest rates steady at the 4.25-4.50% range, it acknowledged rising concerns about inflation and employment, which clouded the policy outlook. The central bank’s reserved tone contributed to a global risk-off environment, amplifying weaknesses in currencies like the rupee. The US Dollar Index (DXY), in contrast, advanced for a second consecutive session, managing to both reach and maintain a position around the 100 mark.

Indian Bond Yields Decline

Despite the heightened geopolitical strain, Indian bond yields moved lower on improving sentiment and strong market liquidity. The 10-year Indian government bond yield hovered at just over 6.30%. Market participants viewed the recent volatility as a buying opportunity and assumed the conflict would not intensify. According to current forecasts, the yields are projected to remain between 6.30% and 6.40% in the near term.