Key Moments:

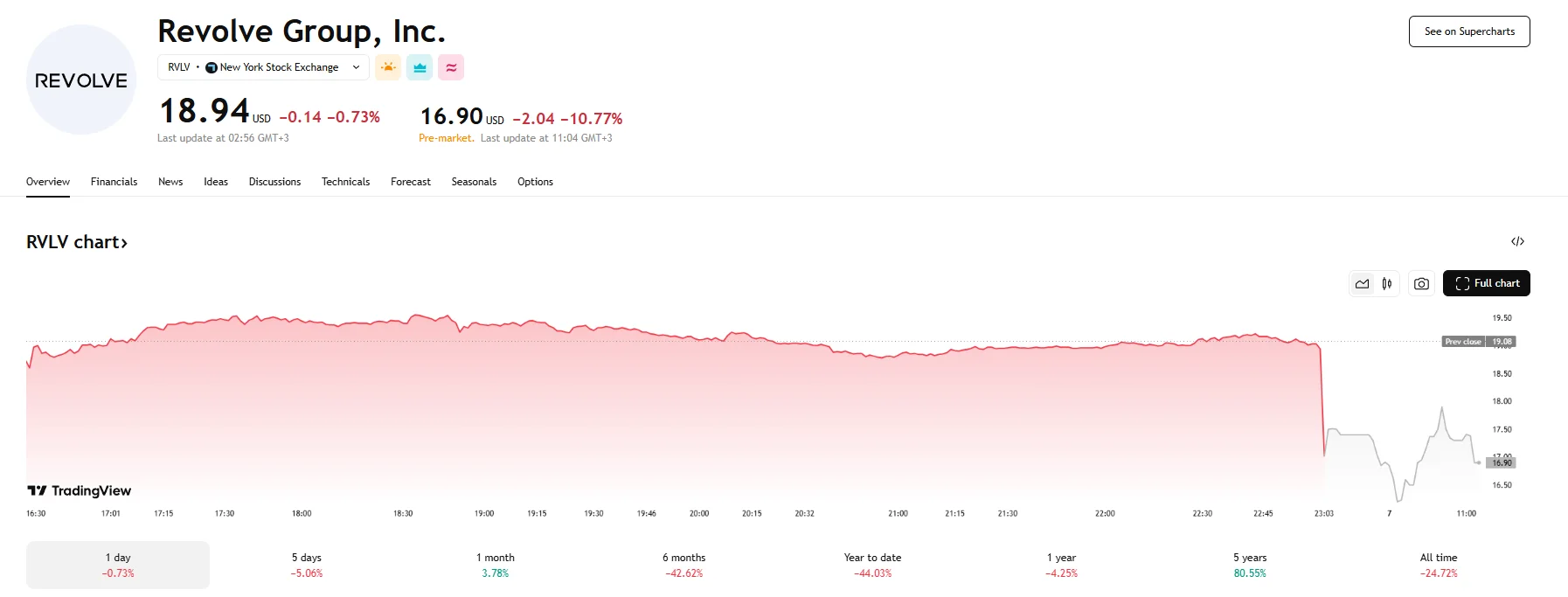

- Revolve Group’s shares fell 10.77% in after-hours trading following a revenue miss.

- Revenue hit $296.71 million, below the analyst consensus of $297.56 million. Q1 adjusted earnings per share came in at $0.16.

- Full-year 2025 gross margin guidance now stands at 50.0-52.0%, down from prior estimates of 52.4-52.9%.

Revenue Disappointment Weighs on Investor Sentiment

Shares of Revolve Group Inc. cratered over 10% to $16.90 during Wednesday’s pre-market trading session after the fashion e-commerce company published its financial report for 2025’s first quarter. The results exceeded earnings projections but missed on revenue.

Revolve posted adjusted earnings per share of $0.16 for the quarter, $0.1 higher than analyst predictions. In contrast, the company’s revenue fell to $296.71 million, a 10% year-over-year (YoY) increase that nonetheless marked a $0.85 million decline from analyst forecasts.

Operational Gains and Customer Metrics

According to co-founder and co-CEO Mike Karanikolas, their robust execution amidst a fluctuating macro environment had produced outstanding first-quarter figures. Notably, top-line growth was in the double digits, and operating income grew by 57% YoY. He also highlighted the $45 million in operating cash flow that further reinforced their balance sheet. The company also saw its active customer base expand 6% YoY to 2.7 million. Total orders placed jumped to 2.31 million, a 4% increase, but average order value dipped 1% to $295.

Segment and Geographic Performance

Revolve’s core segment delivered solid growth, with net sales climbing 11% to reach $254.4 million. FWRD, the company’s high-end fashion segment, also posted a more modest 3% rise to $42.3 million. In geographical terms, domestic sales were up 9% at $239.2 million. International markets enjoyed even greater growth, with sales reaching $57.5 million, translating to an impressive increase of 12%.

Updated Guidance for 2025

Looking ahead, Revolve Group revised its full-year 2025. The company cited a gross margin forecast of 50% to 52%, down from the previous guidance of 52.4% to 52.9%. Marketing expenses are expected to remain steady at 14.9% to 15.1% of net sales. As for the second quarter, current estimates point to a gross margin of 52% to 53%. Marketing expenses, on the other hand, are projected to make up 15% of net sales.