Key Moments:

- US nonfarm payrolls rose by 177,000 in April, following a revised 185,000 gain in March.

- The unemployment rate remained unchanged at 4.2%, with labor market momentum intact.

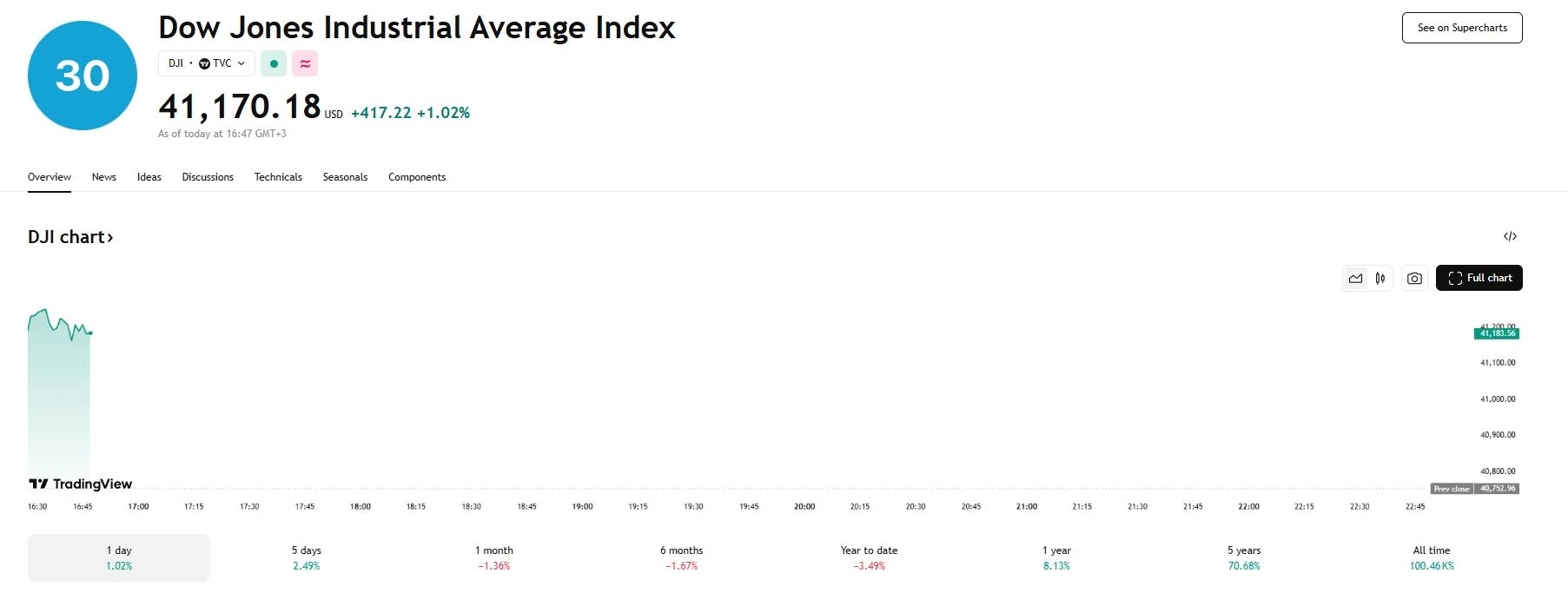

- US stocks started out Friday by rising around 1%, with the Dow Jones Industrial Average surging by more than 400 basis points.

Investors Respond Positively to Labor Market Data

April brought a modest slowdown in job creation, with the US economy adding 177,000 new nonfarm positions, according to the latest report from the Labor Department. This figure represents a decline from March’s 185,000 growth, but despite the deceleration, the data surpassed economists’ expectations of 130,000 new jobs.

The unemployment rate stood firm at 4.2%, showing no immediate signs of deterioration due to Washington’s shifting trade stance. Moreover, analysts predict that the Federal Reserve will maintain interest rates at their current range of 4.25% to 4.50% in light of the tariff-driven economic uncertainty that continues to roil global markets.

Following the release of the aforementioned jobs data, US equities rose. The Dow gained 417.22 basis points amid a 1.02% surge and managed to reach the 41,170 mark. The S&P 500 gained as well, climbing almost 1% to 5,658.67. The Nasdaq 100 and the broader tech-heavy Nasdaq Composite also jumped by over 1%.

Economists Highlight Risks and Resilience

Sameer Samana of Wells Fargo Investment Institute described the labor market as entering a “steady state,” noting that job and wage growth are aligning with forecasts. He warned, however, that US-China trade tensions remain a significant downside risk.

Northlight Asset Management’s Chris Zaccarelli echoed the cautious optimism, stating that markets experienced a sense of relief today due to the jobs data exceeding expectations. He added that while concerns about a recession were still present, the “buy-the-dip” trend could persist, at least until the tariff pause concluded. He also noted that the market’s reaction to the administration’s initial tariff plan was already evident, suggesting that unless a different approach was taken in July when the 90-day pause ended, similar market behavior to the first week of April could be anticipated.

He also suggested that if adjustments led to a more nuanced approach with reasonable tariffs and exemptions for activities aligning with the administration’s goals, the economy could adapt, and markets would absorb it.