Key Moments:

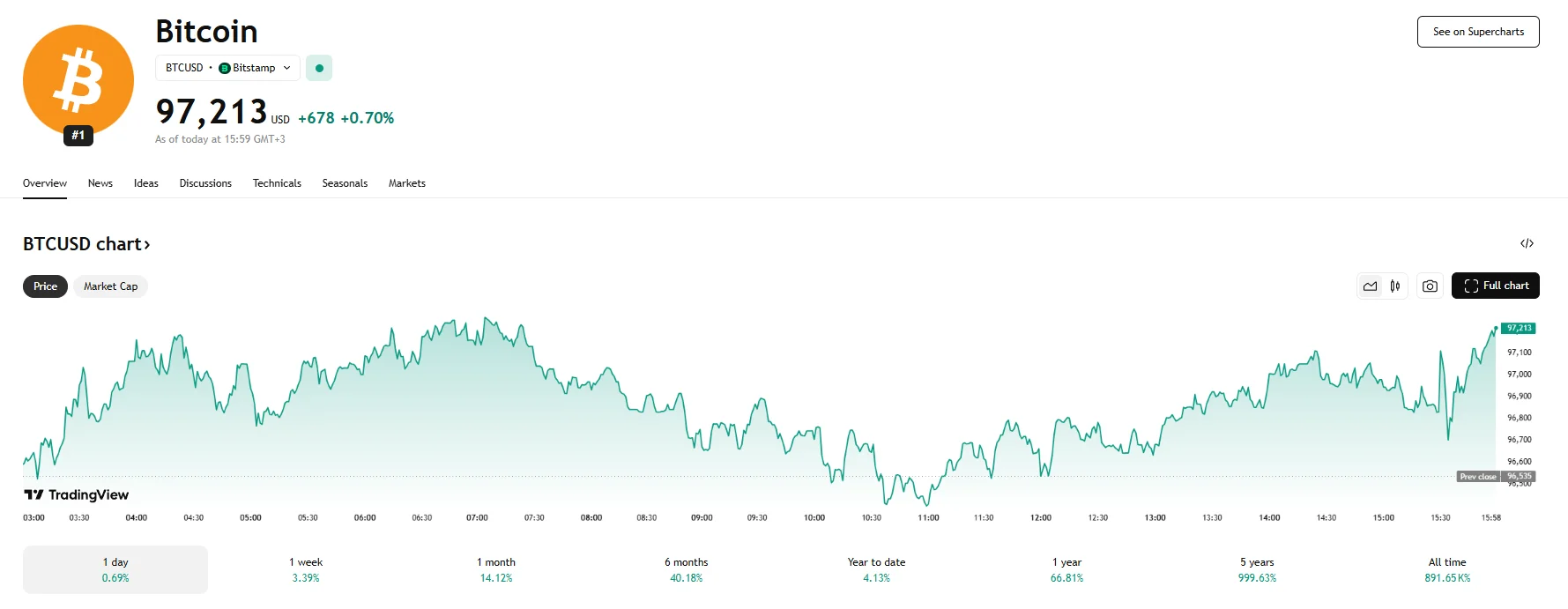

- Bitcoin reached the $97,213 mark on Friday, climbing by 0.7%.

- The cryptocurrency’s market dominance has risen to 64.89%.

- On Thursday, Bitcoin ETF inflows exceeded $422 million.

Bitcoin Extends Its Lead in Crypto Markets

Bitcoin enjoyed a notable rally on Friday, as the cryptocurrency hit $97,213 amid a 0.7% climb. Moreover, Bitcoin’s share of the overall crypto market surged to reach 64.89%, marking the cryptocurrency’s highest dominance level in around four years.

According to data from TradingView, Bitcoin’s dominance has climbed steadily from early 2025’s 57.90%. However, it had previously dipped to 55% in early December as altcoins soared on positive sentiment after Donald Trump won the 2024 presidential election. The said momentum in alternative cryptocurrencies was later reversed, as the Trump administration’s tariff policies in recent months served to curb enthusiasts for highly speculative assets like altcoins, while Bitcoin remained relatively unscathed in comparison.

Market Strategists Point to Bitcoin’s Structural Edge

Senior Market Analyst at Trade Nation David Morrison attributes Bitcoin’s outperformance in part to its pioneering status in the crypto space. When speaking with the team of media company Decrypt, he stated that the cryptocurrency’s superior acceptance, when contrasted with its counterparts and riskier digital coins, stemmed from its comparatively accommodating regulatory framework. He also anticipates the regulatory landscape surrounding Bitcoin under the Trump administration.

Morrison further noted that Bitcoin continues to attract attention from both retail and institutional investors despite periodic downturns. Its capped supply and history of rebounding from pullbacks contribute to its perceived stability.

The appeal of Bitcoin ETFs, in particular, has grown significantly among institutional entities. Thursday witnessed over $422 million in net inflows be registered when it came to Bitcoin ETFs, continuing the surge observed this week. Over the past five trading days, Bitcoin ETF inflows have reached $3 billion.

According to Morrison, institutional demand has the potential to bolster Bitcoin’s market dominance, especially if it continues its upward trend and surpasses the 70% mark. He added that Bitcoin commanded significantly more confidence than the majority of alternative cryptocurrencies, although he acknowledged that a select few altcoins could see gains due to their unique applications.

Morrison also commented on the potential of tariff-related conflicts as a factor that could aid altcoins. He pointed out that a sustained increase in risk appetite typically encouraged investors and traders to explore opportunities beyond Bitcoin.