Key Moments:

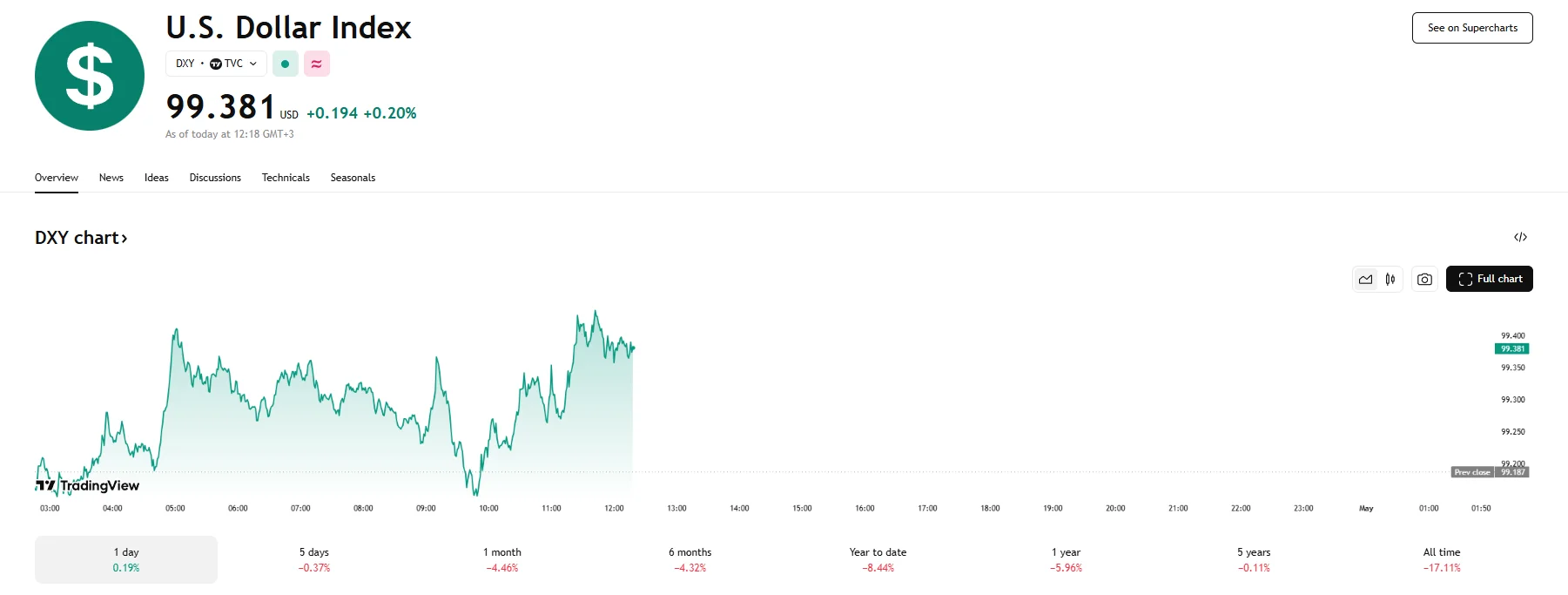

- The US Dollar Index advanced for a second straight session, hovering around the 99.40 threshold.

- Two-year yields rose 3.66%, while ten-year yields experienced a climb of 4.16%.

- March job openings sank, dropping to 7.19 million. Q1 GDP growth is expected to slow significantly to 0.4% YoY.

Greenback Extends Strength as Bond Yields Stabilize

The US Dollar Index (DXY) extended yesterday’s momentum, moving near 99.40 on Wednesday. This upward move coincides with a recovery in Treasury yields, as both the 2-year and 10-year US government bond yields reversed recent declines. Yields hovered around 3.66% and 4.16%, respectively.

Labour Market Concerns and Potential for Slowing Growth Raises Economic Worries

All eyes are now on upcoming US economic reports, with market participants awaiting the March Core Personal Consumption Expenditures (PCE) Price Index and first-quarter GDP figures, due for release later today.

Analysts expect the Trump administration’s tariff policies to have significantly affected the US economy, as the Bureau of Economic Analysis is projected to report a GDP growth of a mere 0.4%. This would mark a steep drop from the 2.4% rate recorded in the prior quarter.

In the labor market, the Job Openings and Labor Turnover Survey (JOLTS) recently revealed that US job openings mirrored September’s 2024 lows, as they declined to 7.19 million in March.

Consumer Confidence Sinks Amid Tariff Concerns

Another figure that further emphasized the strained economic sentiment had to do with US consumers’ outlook on the economy. The Conference Board’s Consumer Confidence Index dropped sharply to 86.0 in April, a low unseen since 2020.