Key Moments:

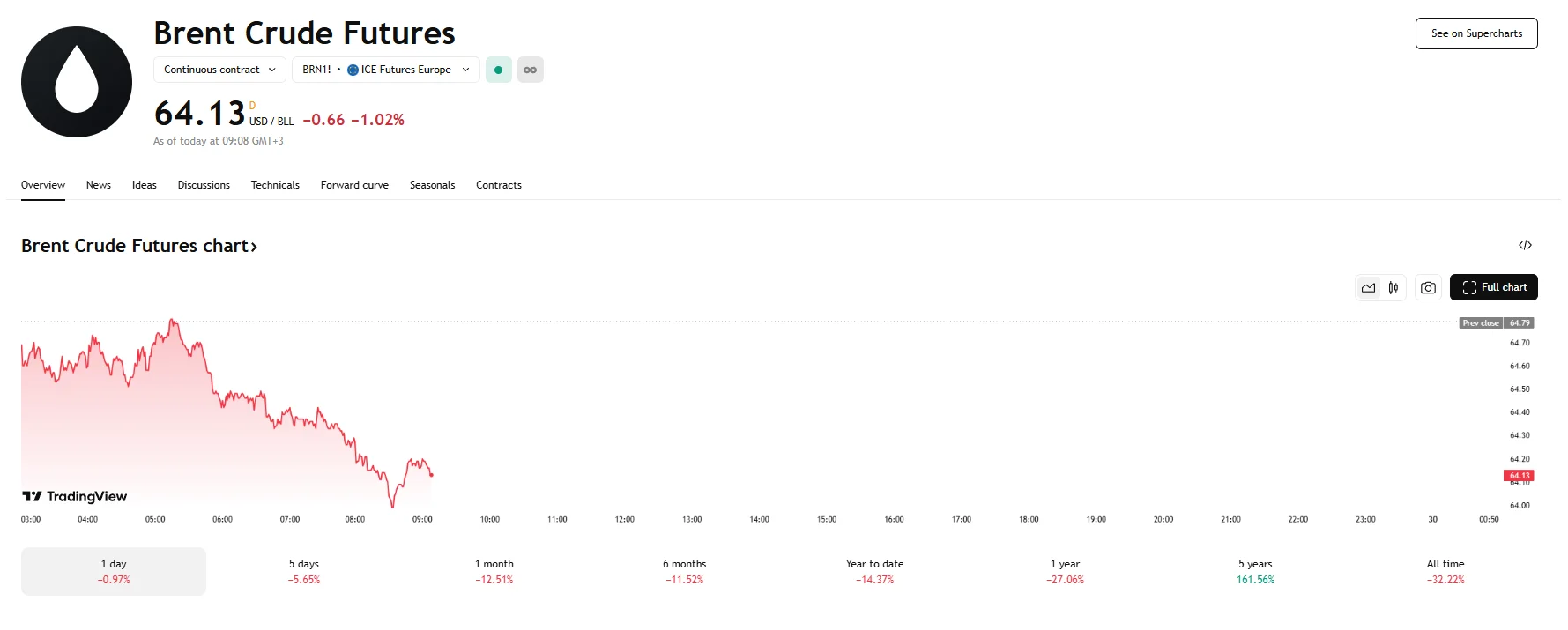

- Brent crude futures witnessed a roughly 1% decrease on Tuesday.

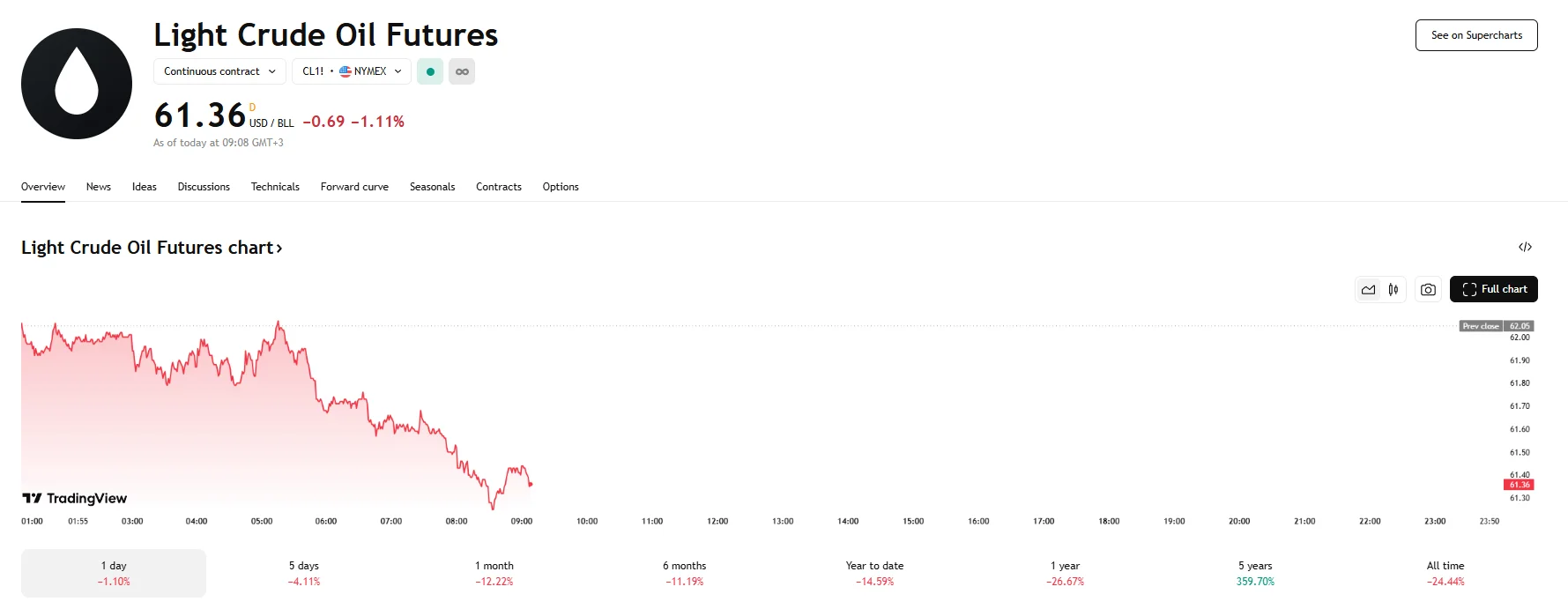

- WTI futures also slid downwards, falling 1.11% to $61.36.

- Recession fears and a potential acceleration of supply output by OPEC+ fueled bearish sentiment.

Demand Concerns Linked to US-China Trade Dispute Weigh on Oil Prices

Tuesday witnessed a downturn in the value of both prominent crude oil benchmarks as anxieties surrounding the global economic landscape took hold. Specifically, the price of Brent crude futures experienced a decline of 1%, reaching $64.13 per barrel. Simultaneously, West Texas Intermediate (WTI) futures in the United States saw a more pronounced dip of 1.11%, falling below the $62 threshold.

Economists Fear US Trade Policies Could Trigger Global Recession, Hurting Oil Demand

Growing apprehension among investors regarding the future trajectory of global demand has served to dampen enthusiasm surrounding crude oil futures. A key factor fueling this unease is the protracted trade dispute between the United States and China. The ongoing imposition of tariffs and retaliatory measures between these nations has stoked fears of a broader economic slowdown, potentially leading to a reduced appetite for energy resources.

Market analysts have pointed out that the lack of tangible progress in resolving the trade impasse, coupled with an absence of clear indicators suggesting a resurgence in demand from mainland China, continues to cast a shadow over the oil market.

OPEC+ Output Hike Plans Add to Trader Apprehension

Adding to the downward pressure on prices is the anticipated strategy of the Organization of the Petroleum Exporting Countries and its allies (OPEC+). Reports indicate that several members within this influential group are likely to propose a further acceleration of their oil output increases for the month of June. This potential surge in supply, occurring at a time when demand forecasts are already uncertain, has raised concerns about a possible oversupply in the market.

Weak Dollar Fails to Lift WTI

Interestingly, the decline in WTI prices, in particular, has occurred despite the backdrop of a weaker US dollar. Typically, a depreciating dollar can provide a degree of support to commodity prices, as it makes dollar-denominated assets more affordable for buyers using other currencies, potentially bolstering demand. However, in the current climate, the overriding concerns regarding the impact of the trade war on global economic activity and the potential for increased oil supply appear to outweigh the traditional supportive influence of a weaker dollar on WTI.