Key moments

- Asian stock markets experienced a widespread upswing on Friday, echoing the positive trends from the previous day’s trading on Wall Street. Japan’s Nikkei index saw a significant 1.9% boost, while the South Korean KOSPI rose 0.95%.

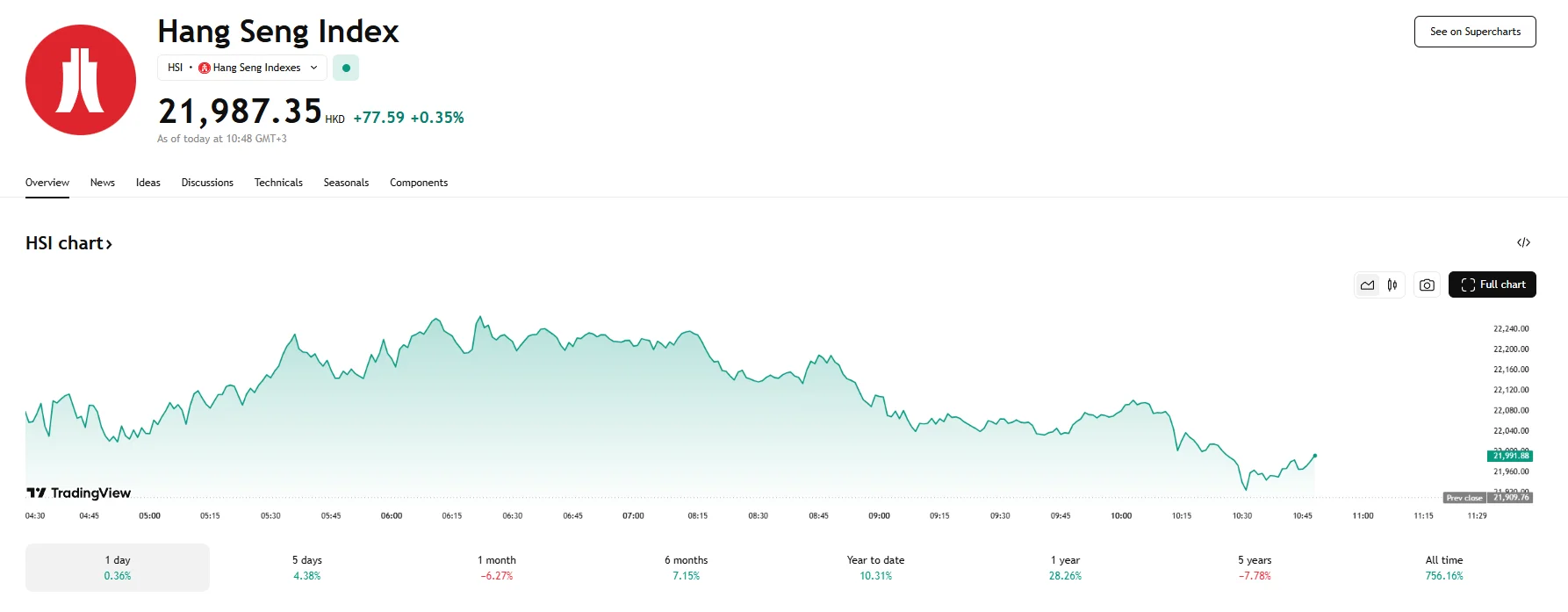

- Hong Kong’s Hang Seng Index also participated in the regional rally, edging up by 0.35%.

- As reported by CNN, it appears China has opted to aid local importers by doing away with 125% duties on some integrated circuits sourced from the US.

Asian Stocks Rally Amid Renewed Hopes of Tariff Tension Ease

Friday witnessed a surge in Asian stock markets, mirroring the positive momentum observed on Wall Street. Japan’s benchmark Nikkei index experienced a substantial rally, closing 1.9% higher, a significant jump of over 660 points to reach 35,705.67. This impressive climb reflected the improved sentiment across the region and potentially a weakening of the Japanese Yen, which can benefit export-oriented companies. Similarly, South Korea’s KOSPI index also registered notable gains, rising by nearly 1% to settle at 2,546.31.

In Hong Kong, the Hang Seng Index joined the upward trend, gaining over 0.3% to almost reach the 22,000 mark. The positive movement in Hong Kong was particularly noteworthy in light of reports detailing China’s potential half of retaliatory tariffs when it comes to semiconductors.

Microchip exports to China had previously faced levies as high as 125% in response to levies imposed by the Trump administration. According to several Chinese import agencies that got in touch with CNN, however, apparent exemptions on US-made integrated circuits were discovered during routine customs clearances.

While Chinese authorities have not officially confirmed these tariff exemptions, the reports from CNN’s sources provided a strong indication of a shift in trade policy and appeared to resonate positively with investors in the Hong Kong market. Among the top performers on the Hang Seng, Lenovo saw its shares climb by 3.39%, while internet giant Baidu also experienced a significant jump of 3.38%.

The broader context for this Asian market rally included the tailwind from a strong performance on Wall Street in the preceding session. Optimism surrounding potential future interest rate cuts by the US Federal Reserve and hopes for a less confrontational stance on trade from the US administration had already set a positive tone across the US and global markets. China’s apparent willingness to selectively ease tariffs on crucial US semiconductors further amplified this positive sentiment.