Key moments

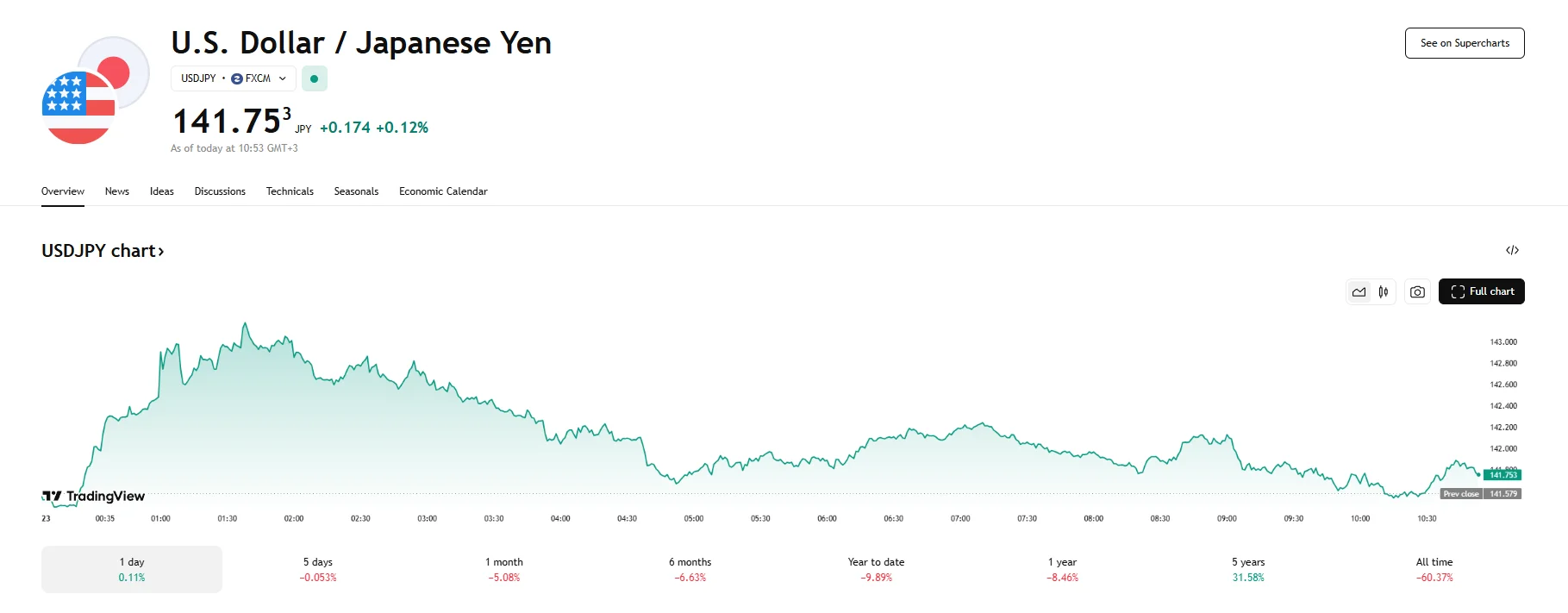

- The USD/JPY pair is now hovering close to the 142.00 mark.

- This followed an earlier surge past the 143.00 threshold, which marked the yen’s lowest valuation against the dollar in months.

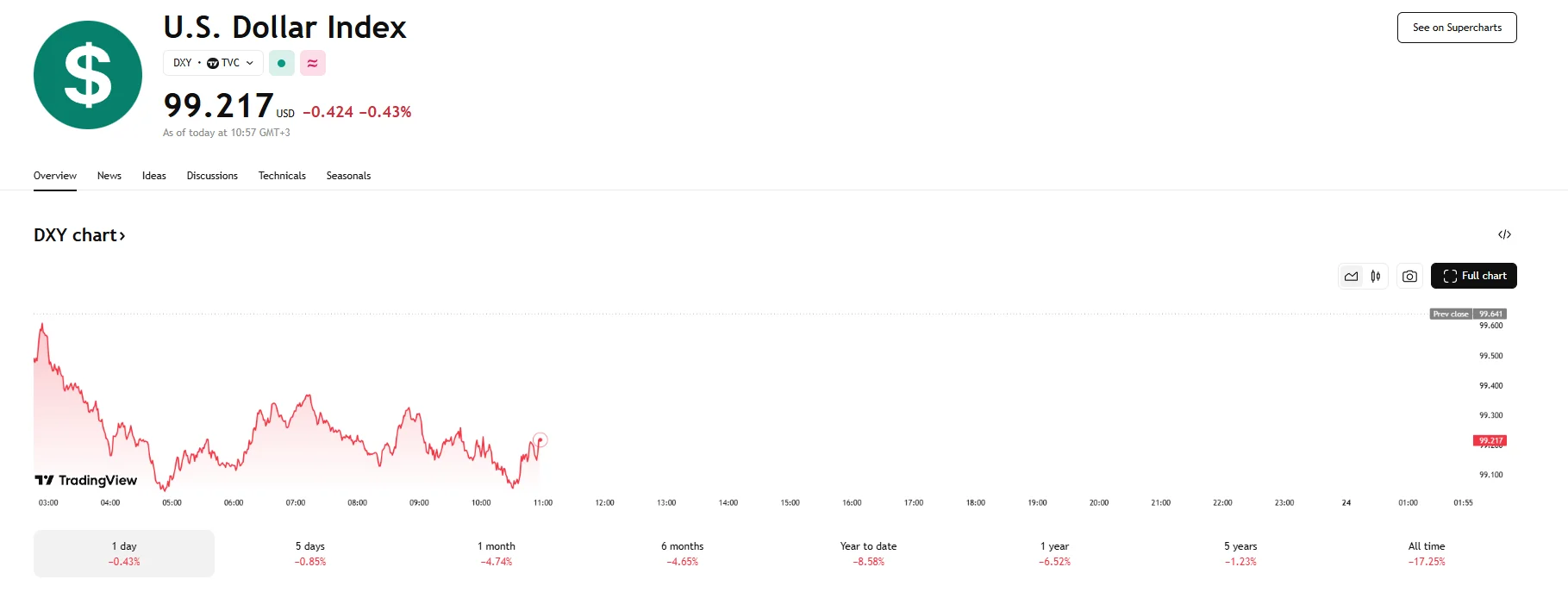

- The US Dollar Index was boosted by positive news regarding potential trade negotiations, but lingering concerns regarding the US economy’s stability exerted pressure on the greenback.

USD/JPY Loses Steam as Economic Worries Resurface

The dynamic interplay between global risk appetite and central bank policy has led to a volatile trading session for the USD/JPY currency pair. Earlier in the day, the US dollar experienced a significant surge against the Japanese yen, propelling the exchange rate above the 143 threshold. This depreciation of the yen to its weakest level in several months was initially fueled by growing optimism surrounding the potential easing of trade tensions and a subsequent recovery in the US dollar. However, this upward momentum for the USD/JPY has since waned, with the rate falling to 141.75 as traders reassessed monetary policy expectations.

The initial strengthening of the US dollar was largely triggered by signals emanating from the United States regarding its trade relations. Statements from key figures within the Trump administration hinted at a possible softening of the stance on trade, particularly concerning the ongoing tariff disputes with China.

Specifically, US Treasury Secretary Scott Bessent reportedly suggested that the existing tariff conflict between the two economic giants was “unsustainable” and the tariffs could be reduced. This prospect of reduced trade friction bolstered risk appetite, leading investors to move away from safe-haven currencies like the yen.

Adding to the dollar’s initial strength was a sense of relief washing over the markets after Trump explicitly stated that he had “no intention of firing” Fed Chair Jerome Powell. The US Dollar Index reflected positive sentiments surrounding this statement, climbing above the 99 mark as the greenback enjoyed renewed investor interest.

However, the upward trajectory of the USD/JPY pair proved to be short-lived. Several factors contributed to the yen’s partial recovery. Firstly, while the initial optimism surrounding trade proved supportive of risk assets and the dollar, the actual progress toward concrete trade agreements remained uncertain.

Underlying concerns about the future direction of the US economy and the Federal Reserve’s monetary policy continued to linger in the market. Despite the immediate relief over Powell’s job security, investors remained attuned to signals suggesting a potential shift towards a more accommodative stance by the Fed. Data from the CME Group’s FedWatch Tool indicated that market participants were increasingly pricing in the possibility of multiple interest rate cuts by the Federal Reserve within the current year.

Conversely, the Japanese yen found some underlying support from expectations regarding the Bank of Japan’s future monetary policy. While recent domestic economic data, such as the preliminary manufacturing PMI, indicated a continued contraction in factory activity, the services sector showed signs of robust expansion. This mixed economic picture, coupled with firming expectations that the Bank of Japan might consider further interest rate hikes in 2025, helped increase the yen’s appeal.