Key moments

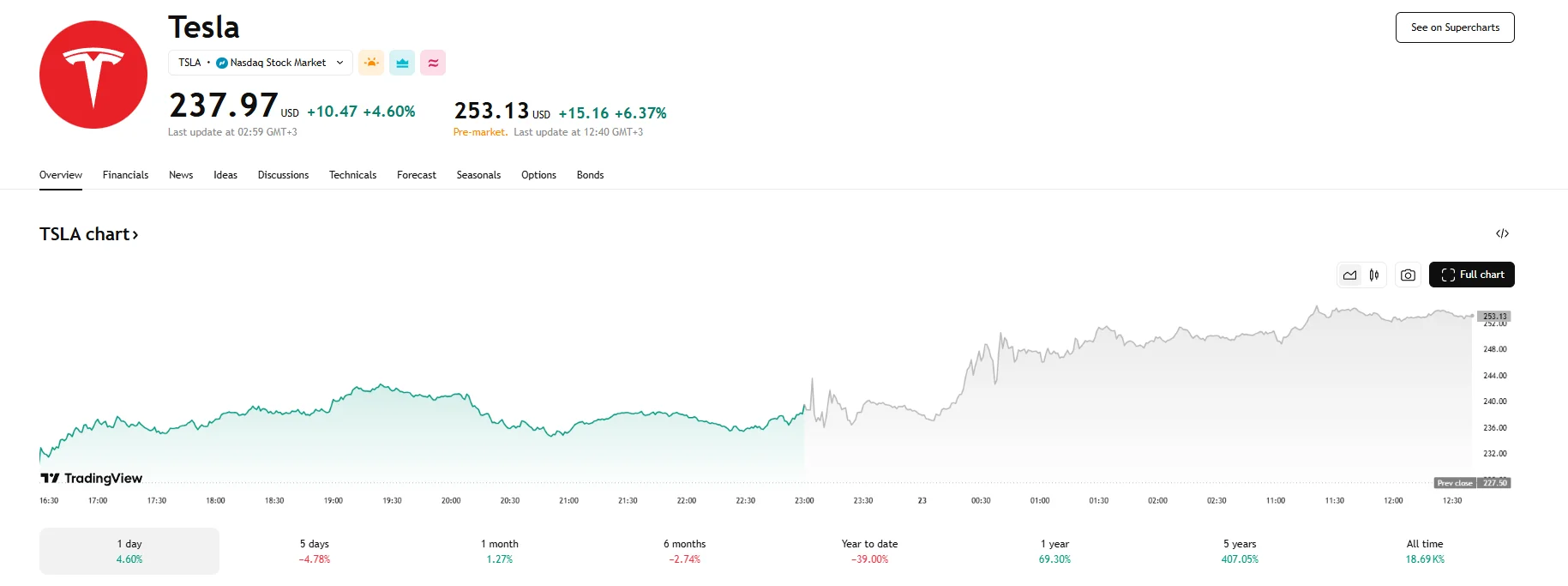

- Tesla’s after-hours share price soared on Wednesday, climbing 6.37% to reach $253.13.

- The company’s net revenue, earnings, and other key metrics fell sharply during 2025’s first quarter. The earnings drop was particularly staggering at 71%.

- Musk declared he would allocate more of his attention to Tesla’s activities, which resonated strongly with investors.

Tesla Jumps 6% on Musk’s Commitment Amid Profit Slump

Tesla’s stock experienced a notable surge of over 6% to 253.13 during Wednesday’s pre-market trading session, even though the company’s Q1 earnings were disappointing. This unexpected upward movement followed CEO Elon Musk’s commitment to focus on the electric vehicle manufacturer.

The share price had already demonstrated positive momentum on Tuesday, climbing by 4.60% to close at $237.97. This earlier gain mirrored a broader rally as growing optimism surrounding a potential easing of international trade tariffs propelled markets. This positive trajectory presented a stark contrast to the company’s Q1 financial performance, as the results fell short of the anticipated figures of Wall Street analysts.

A significant area of concern was the company’s automotive revenue, which witnessed a substantial 20% decrease to $14 billion, an over $3 billion drop from last year’s metric. Furthermore, the company’s overall profitability took a major hit, with earnings plummeting by a staggering 71% to $409 million, translating to a mere 12 cents a share. Examining the broader financial landscape, Tesla’s total revenue also experienced a contraction, declining by 9% to reach $21.3 billion.

The company maintained its plan to launch a robotaxi pilot program in Austin this June and begin limited production of its Optimus humanoid robots in Fremont later this year. However, Tesla withdrew previous growth forecasts, stating it would revisit 2025 guidance during its second-quarter update.

While the financial report painted a picture of declining financial metrics for Tesla, investors found reassurance in the statements made by CEO Elon Musk during the electric car giant’s earnings call. Musk reportedly addressed investor concerns about his divided attention between Tesla and his role in the Trump administration’s government efficiency initiative. He vowed to shift his focus and allocate more of his time to overseeing Tesla’s operations starting next month, suggesting a renewed dedication to navigating the company through its current challenges. As a result, Tesla’s stock enjoyed substantial gains during Wednesday’s after-hours trading.