Key moments

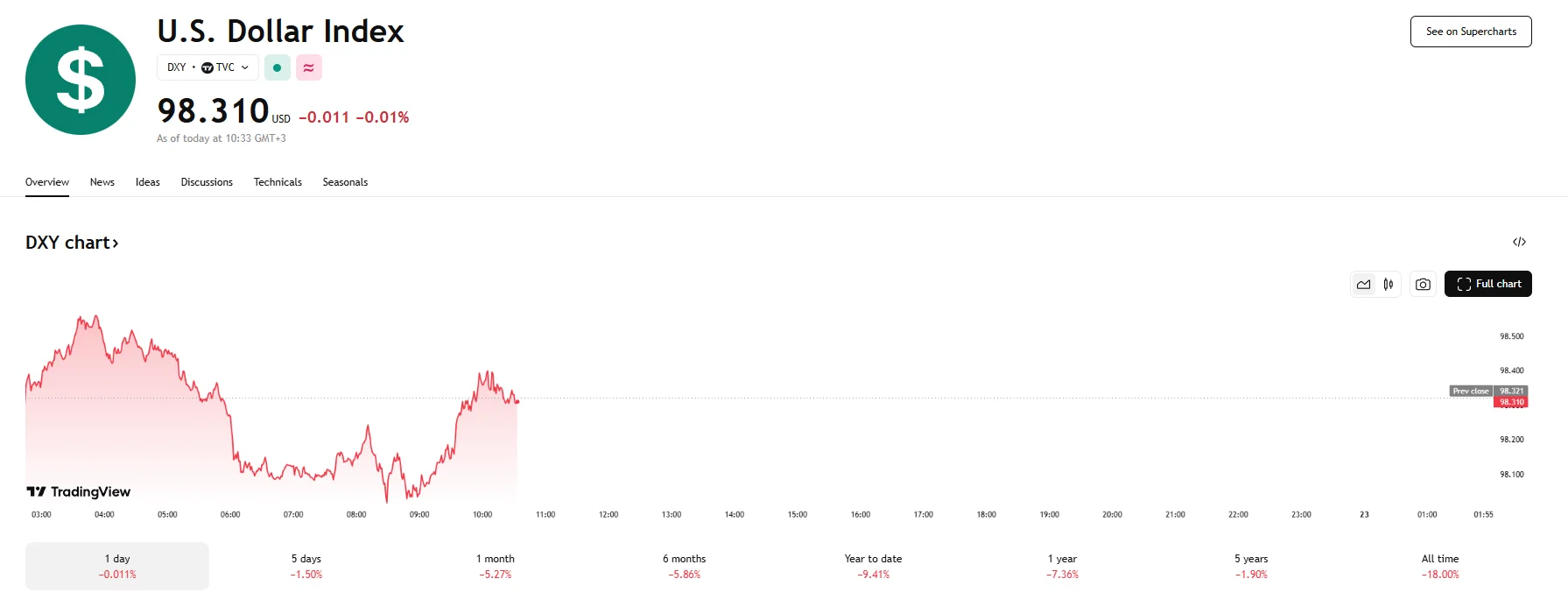

- The US Dollar Index fell to 98.310 on Tuesday.

- Treasury yields rose, with the 10-year yield surpassing 4.4% and the 30-year yield exceeding 4.9%.

- The AUD/USD pair climbed 0.14% to 0.6425.

Greenback’s Decline Continues, Australian Dollar Soars

The US dollar extended its downward spiral on Tuesday, hitting fresh multi-year lows as political uncertainty and global trade tensions diminished its appeal as a safe-haven asset. Meanwhile, the Australian dollar has capitalized on the greenback’s weakness, climbing to its highest level in four months.

The US Dollar Index (DXY), which measures the currency against a basket of major peers, fell below 98.32 to 98.10, marking its weakest level since early 2022. The decline comes amid growing concerns over the Federal Reserve’s independence after President Trump renewed his criticism of Chair Jerome Powell and pushed for immediate interest rate cuts.

Trump’s latest accusations of Powell being “too late” on monetary policy have rattled markets, and investors lost confidence in the US dollar on fears that political meddling could compromise the Fed’s authority. Furthermore, treasury yields have edged higher, reflecting market anxiety over inflation and growth prospects. The 10-year yield is now higher than 4.4%, while the 30-year yield climbed past the 4.9% mark. These moves suggest investors are demanding higher returns amid concerns that Trump’s trade policies could slow economic expansion.

The Australian dollar has been a key beneficiary of the dollar’s decline, with the AUD/USD pair jumping 0.14% to 0.6425. Today’s price movements marked the Aussie’s highest level in four months, and the rally came as traders shifted away from US assets.

Market participants have also been pricing in potential rate cuts from the Reserve Bank of Australia (RBA), with some anticipating a reduction of 50 basis points next month if global economic conditions worsen. Upcoming Australian PMI data will be closely watched for further clues on domestic economic health.

Beyond the Fed feud, confidence in the greenback eroded due to the lack of progress in the tariff talks between the US and China. With the dollar index down nearly 6% this month and 9% year-to-date, analysts have warned that further declines are possible if Trump’s rhetoric escalates or if global trade conditions deteriorate.