Key moments

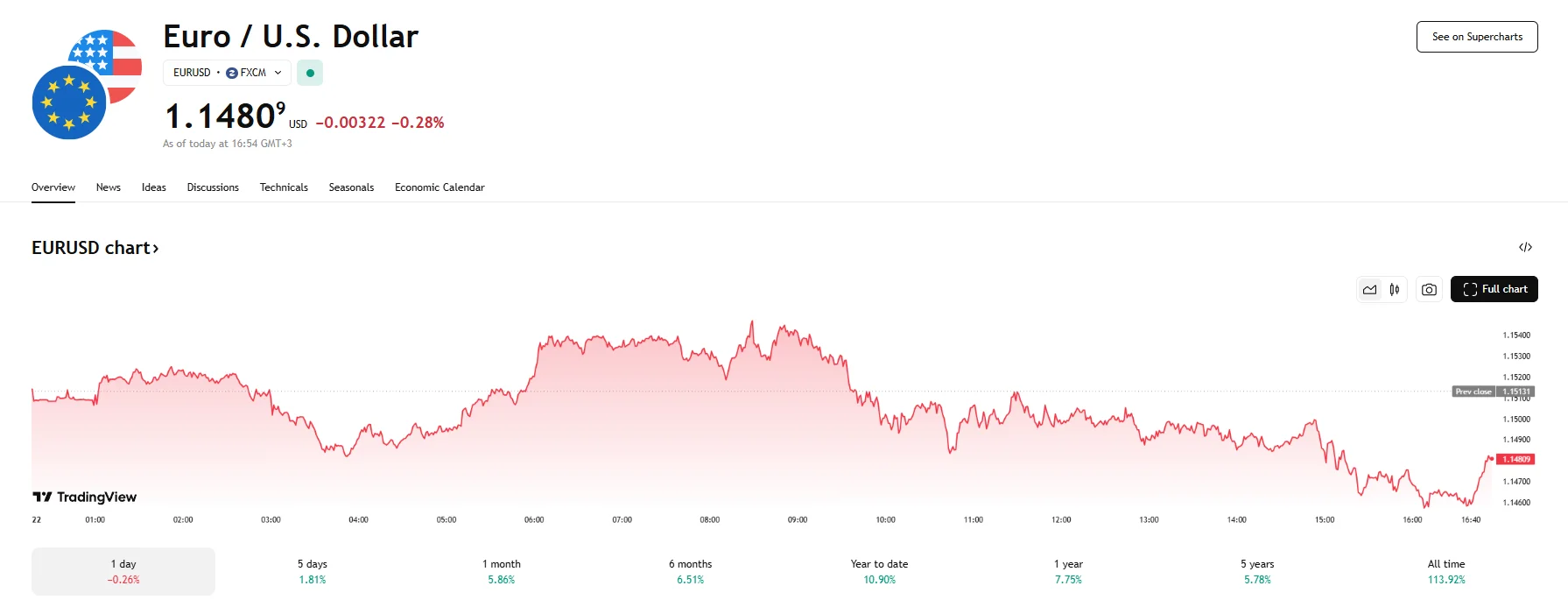

- The EUR/USD pair fell 0.28% on Tuesday, reaching 1.1480.

- The US Dollar Index (DXY) continues trading below 99.000 as trade disagreements and the public dispute between President Trump and Fed Chair Powell exerted pressure on markets.

- The IMF has decided to cut its economic growth forecast for the Eurozone, lowering it to 0.8%.

EUR/USD Dips Amid Bleak IMF Growth Forecast

On Tuesday, the EUR/USD pair experienced notable fluctuations around the 1.1500 mark, which saw the pair decline slightly to 1.1480. This movement occurred after the pair had previously climbed to a three-year high of 1.1575. The resilience of the EUR/USD near 1.1500 can be attributed to the persistent weakness of the US dollar, which has been under pressure due to escalating tensions between the Federal Reserve and the US President.

The US Dollar Index (DXY), reflecting the dollar’s value against major currencies, struggled to maintain its footing, hovering close to a three-year low. This vulnerability stems from ongoing trade conflicts as well as President Trump’s vocal criticism of Federal Reserve Chairman Jerome Powell’s monetary policy. Trump has publicly accused Powell of hindering economic growth by not implementing interest rate reductions.

Conversely, Powell has advocated for maintaining the current interest rate range, citing the need to assess the long-term inflationary impact of the Trump administration’s newest policies on international trade, immigration, and more. The ongoing dispute has raised concerns among investors regarding the dollar’s credibility and the stability of US assets, particularly as the president has threatened to remove Powell from his position.

Simultaneously, the euro faced its own challenges, which impeded its rise. At present, market participants expected the European Central Bank (ECB) to implement interest rate cuts in June. Moreover, concerns over the Eurozone’s economy continue to mount, which prompted the International Monetary Fund (IMF) to revise its Eurozone growth forecast.

According to the IMF, the Eurozone’s economy will grow a mere 0.8% in 2025, down from the previous 1%. The IMF also revised its global economic forecast, with the United States’ outlook now standing at 1.8%, a significant downgrade from January’s prediction of 2.7%. The United Kingdom’s forecast was also adjusted downwards to 1.1%, while China’s expected economic growth prospect for 2025 was lowered to 4%. The IMF’s decision to revise these forecasts across major economies is largely attributed to the anticipated repercussions of US trade policies, including substantial tariffs on goods from numerous trading partners.