Key moments

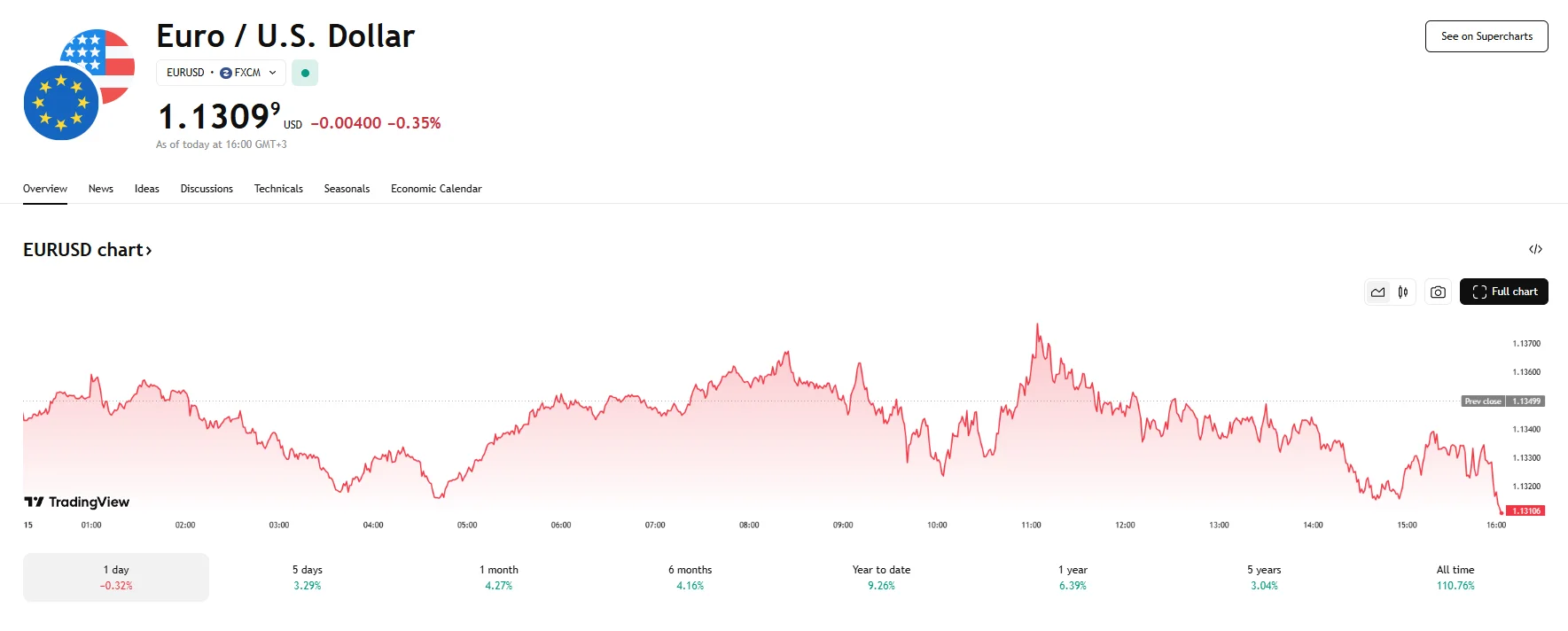

- The EUR/USD slid 0.35% on Tuesday, reaching 1.1309.

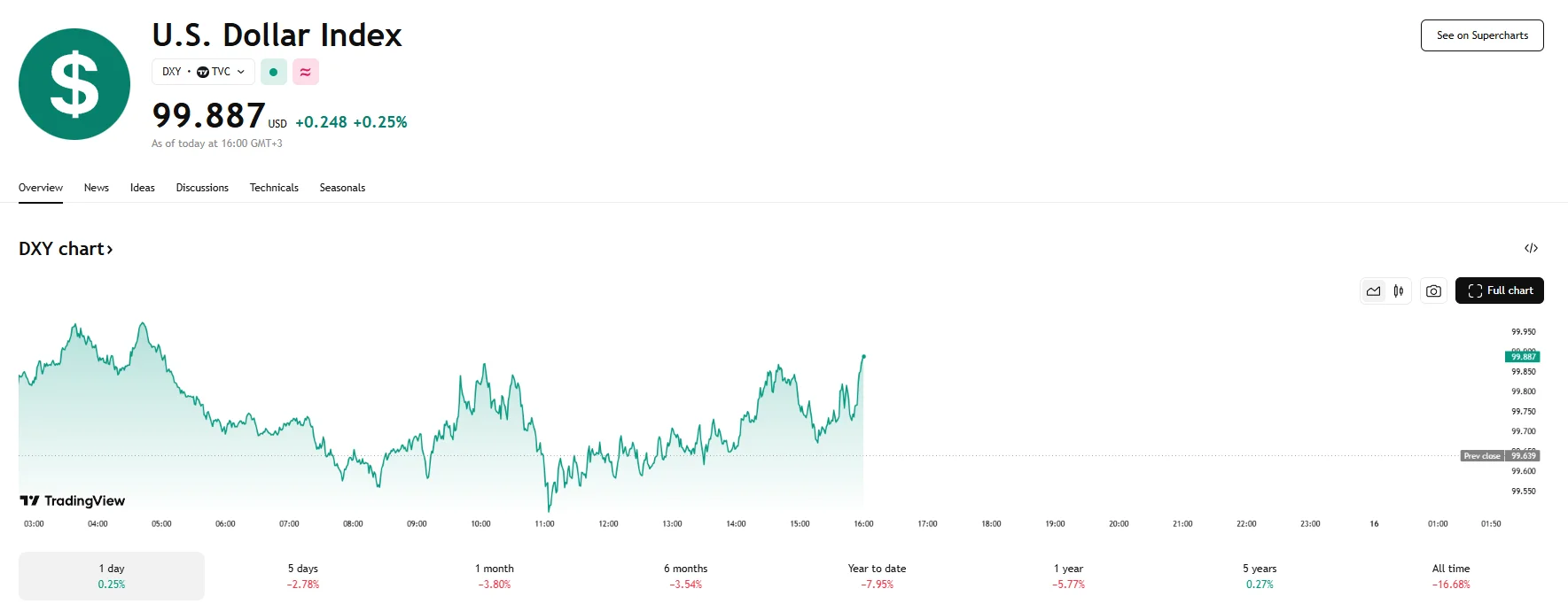

- In addition, the US Dollar Index increased by 0.25%.

- The German ZEW Economic Sentiment Index fell in April, weighing on the euro.

Euro Under Pressure Against Dollar as Tariff Uncertainty Persists

On Tuesday, the exchange rate between the euro and the US dollar suffered a slight decline, with the EUR/USD pair falling by 0.35% to reach 1.1309. This downward movement occurred within a broader context of ongoing market apprehension surrounding the White House’s trade policies and a notable dip in economic sentiment within Germany, a key driver of the Eurozone economy.

The euro’s headwinds were partly tied to the release of the German ZEW Economic Sentiment Index for April. This closely watched indicator, which gauges the expectations of financial market experts regarding Germany’s economic development, registered a significant decline, falling to -14. This figure was considerably lower than the market consensus of a positive 9.3, signaling a marked deterioration in economic expectations for Europe’s largest economy.

Analysts attributed this sharp downturn in sentiment to the prevailing uncertainties surrounding US trade policies and their potential ramifications on the Eurozone and global commerce as a whole. The tariff changes were highlighted as significantly weighing on economic expectations within Germany.

However, the said tariffs have continued to cast a shadow over trader confidence in the dollar as well, which seems to be preventing the EUR/USD from experiencing a more substantial decline. Despite a period of relative calm in the currency markets on Tuesday, following a volatile week that saw significant fluctuations in the dollar’s value and a surge in US Treasury yields, market participants remained cautious.

The erratic nature of President Trump’s pronouncements and actions regarding levies, including the imposition and subsequent temporary postponement of duties on various imported goods, has created a climate of confusion for investors and policymakers globally. This lack of clarity has made it challenging to assess the long-term implications for international trade and economic growth, thereby contributing to a fragile sentiment towards dollar-denominated assets. The US Dollar Index (DXY) managed to edge slightly higher on Tuesday, gaining 0.25% to trade near the 99.880 level. Nonetheless, the 100 mark remains elusive.