Key moments

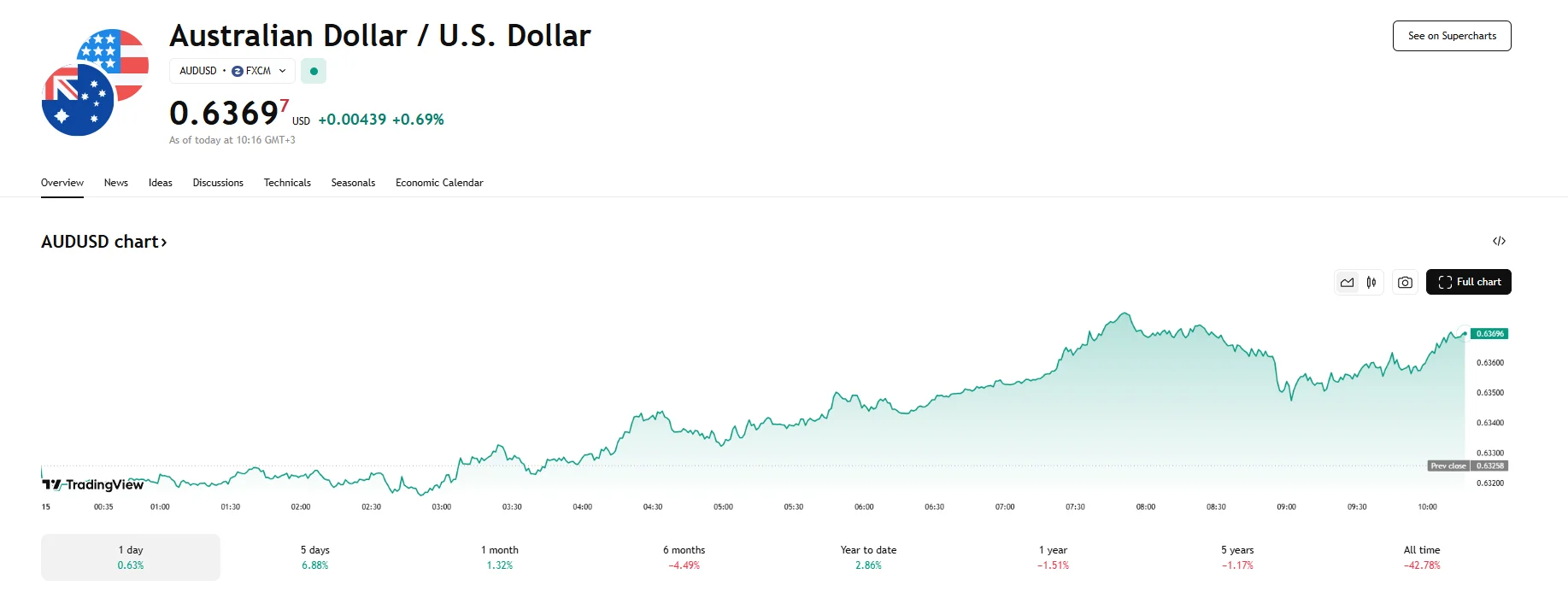

- AUD/USD experienced a notable increase on Tuesday, rising by 0.69%.

- A Washington decision to pause tariffs on Chinese electronics played a key role in the Australian dollar’s ascent.

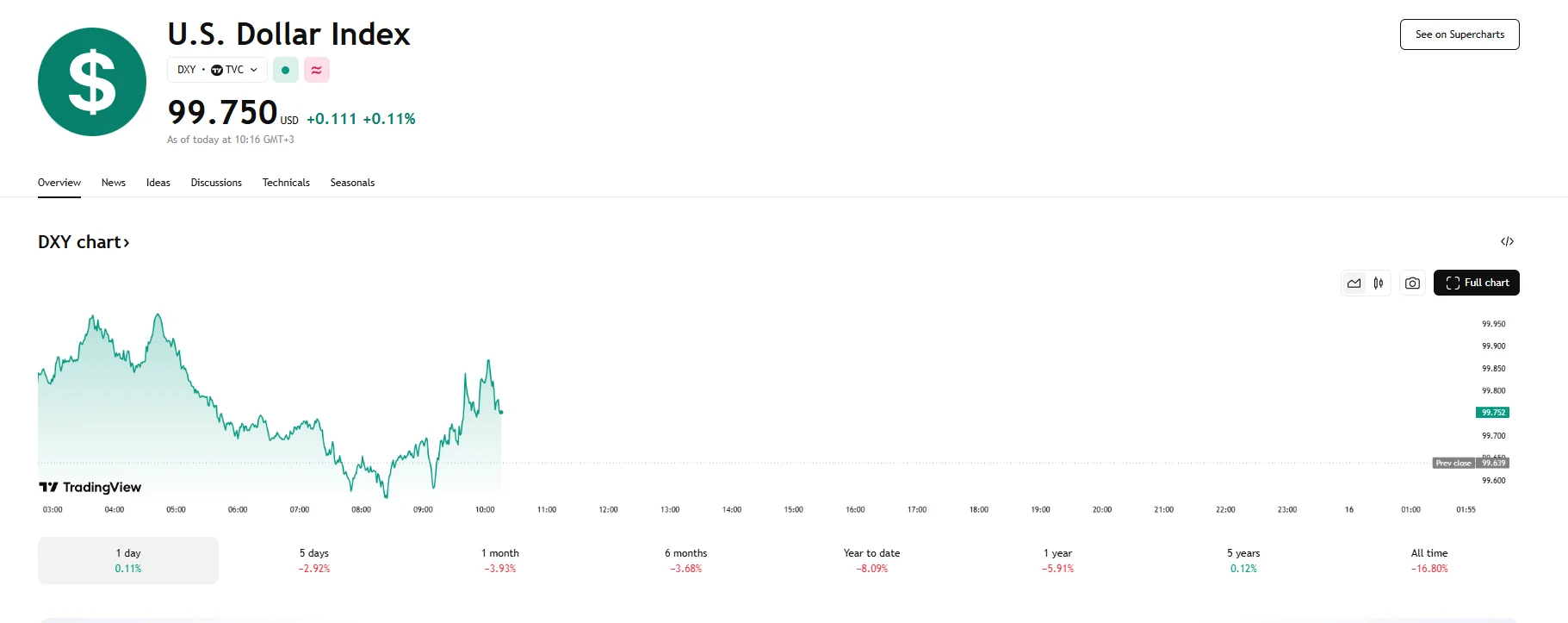

- The US Dollar Index has thus far failed to climb above 100, which can be attributed to the back-and-forth nature of the US administration’s tariff policies along with economy-related concerns.

Tariff Shift Fuels Australian Dollar Gains

Tuesday saw the Australian dollar appreciate by 0.69% to reach a level of 0.6369 against its US counterpart. This upward trajectory for the AUD/USD pair appears to be underpinned by a confluence of factors, including shifts in the Trump administration’s trade policies and the US dollar’s ongoing struggle below the 100 mark.

One significant element contributing to the Aussie’s climb is the recent adjustment in US tariffs on certain Chinese electronic goods. The decision by Washington to exempt items like smartphones and computers from previously imposed duties on China has seemingly injected a degree of optimism into global markets.

The White House’s move is particularly relevant for the Australian dollar due to the robust economic relationship between Australia and China. As China serves as a major consumer of Australian commodities and a key trading partner, any easing of trade tensions between the world’s two largest economies tends to have a positive spillover effect on the Australian currency. The perception of reduced friction in global trade flows can bolster risk sentiment, often benefiting currencies like the Australian dollar, which is typically viewed as a risk-sensitive asset.

Furthermore, the recent performance of the US dollar has also played a role in the AUD/USD pair’s upward movement. The US Dollar Index (DXY), which measures the greenback’s strength against around half a dozen major currencies, has struggled to gain enough momentum to breach the 100 threshold. Concerns surrounding the potential impact of fluctuating trade policies on the US economy itself have also exerted pressure on the US dollar. The imposition and subsequent easing of tariffs have sowed confusion, potentially disrupting supply chains and creating uncertainty for businesses. Moreover, recent economic data from the US, including indicators of inflation and consumer sentiment, have presented a mixed picture,

In contrast, the Australian dollar has found support not only from external trade developments but also from domestic factors. While the Reserve Bank of Australia’s (RBA) recent meeting minutes indicated a degree of uncertainty regarding the timing of future interest rate adjustments, the Australian economy has shown relative resilience. The prospect of a more stable economic outlook in Australia compared to the uncertainty surrounding US trade and its potential domestic impact can make the Aussie a more attractive proposition for investors.