Key moments

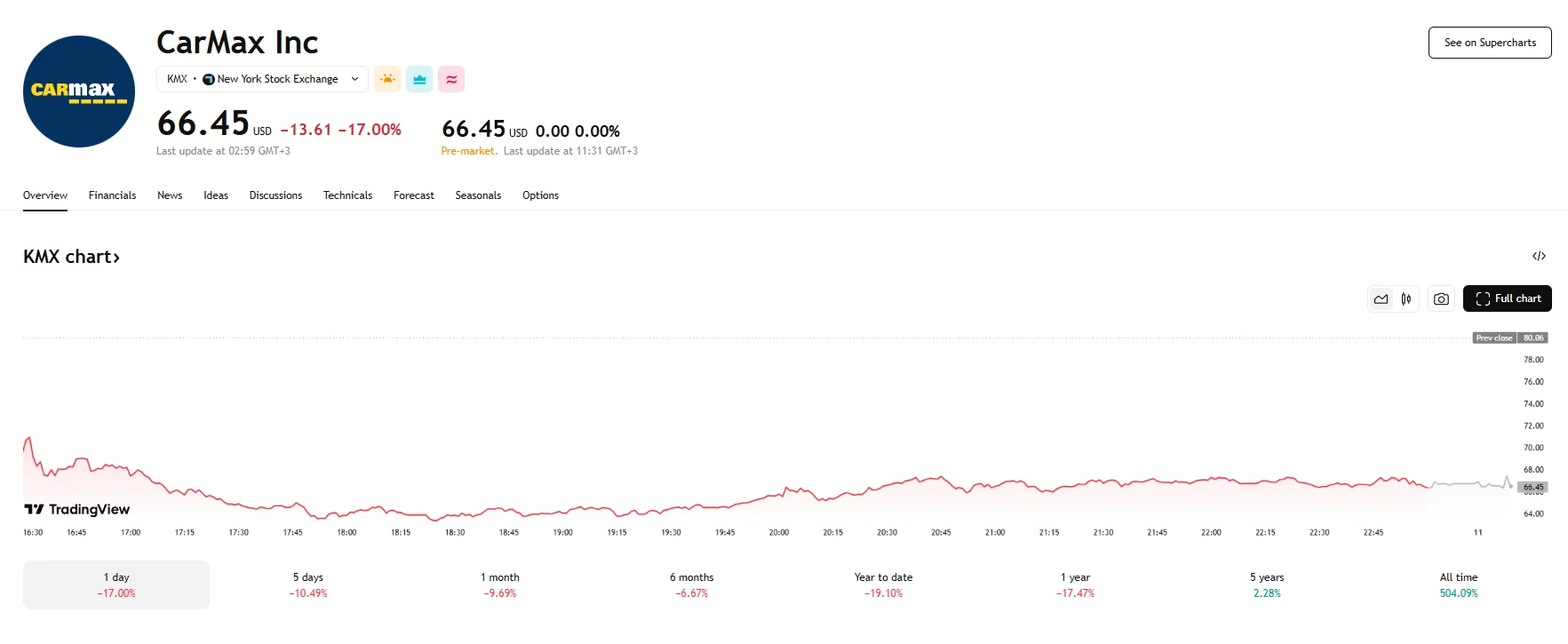

- CarMax’s stock value declined on Thursday, falling 17% to close at $66.45.

- The company’s Q4 earnings report revealed figures that were not quite as high as what Wall Street was expecting. Notably, analysts had forecasted an EPS of $0.66, but the final figure stood at $0.58.

- CarMax CEO William Nash expressed optimism regarding the tariff headwinds that have been affecting the automotive sector, as he expects used car sales could rise amid a struggling new-car market.

EPS Shortfall Affects CarMax Stock

Thursday witnessed a significant downturn for CarMax Inc., with its stock experiencing a sharp 17% decline, which culminated in a closing price of $66.45. This substantial drop followed the release of the company’s fourth-quarter earnings report that, despite showcasing growth in several key areas, failed to meet the expectations of financial analysts.

The earnings statement revealed that CarMax achieved a 6.7% increase in its net revenue, reaching $6.0 billion. Furthermore, the company reported a healthy rise in its unit sales, with retail used car sales climbing by 6.2% and wholesale units sold increasing by 3.1%. CarMax also saw a significant improvement in its profitability per retail unit, with gross profit per retail used vehicle surging by 13.9% to $2,322. Additionally, the company’s earnings per share demonstrated robust growth, rising by 81.3% to $0.58 compared to the same period last year.

However, the overall financial results fell short of the optimistic projections held by market analysts. Specifically, CarMax’s reported earnings per share of $0.58 lagged behind the consensus estimate of $0.66. This discrepancy appears to have been a primary driver of investor disappointment. Further analysis revealed that while used vehicle sales witnessed a 7.5% increase to $4.84 billion during the quarter, this figure also slightly missed the anticipated $4.87 billion.

Looking ahead, potential macroeconomic factors, particularly those related to international trade policies, are casting a shadow over the automotive industry. According to projections from Goldman Sachs, the current administration’s tariff policies could lead to a significant increase in car prices, potentially ranging from $2,000 to $4,000. The financial institution suggests that these tariffs could simultaneously dampen consumer demand, affect supply chains, and increase cost burdens.

CarMax’s Chief Executive Officer, William Nash, suggested that these policies could prove advantageous for used car dealerships like CarMax. The rationale behind this view is that the imposition of 25% levies on imported cars and parts could constrain the supply of new vehicles as manufacturers and importers grapple with increased costs. This potential reduction in new car supply could subsequently drive greater demand for used vehicles, leading to an increase in used car prices.