Key moments

- The Trump administration’s 20% tariff on goods from the European Union, along with most other duties higher than 10%, have been paused for 90 days.

- The anticipation of significant trade barriers being averted fueled substantial buying activity in Frankfurt, as the DAX index rose 8.23% on Thursday.

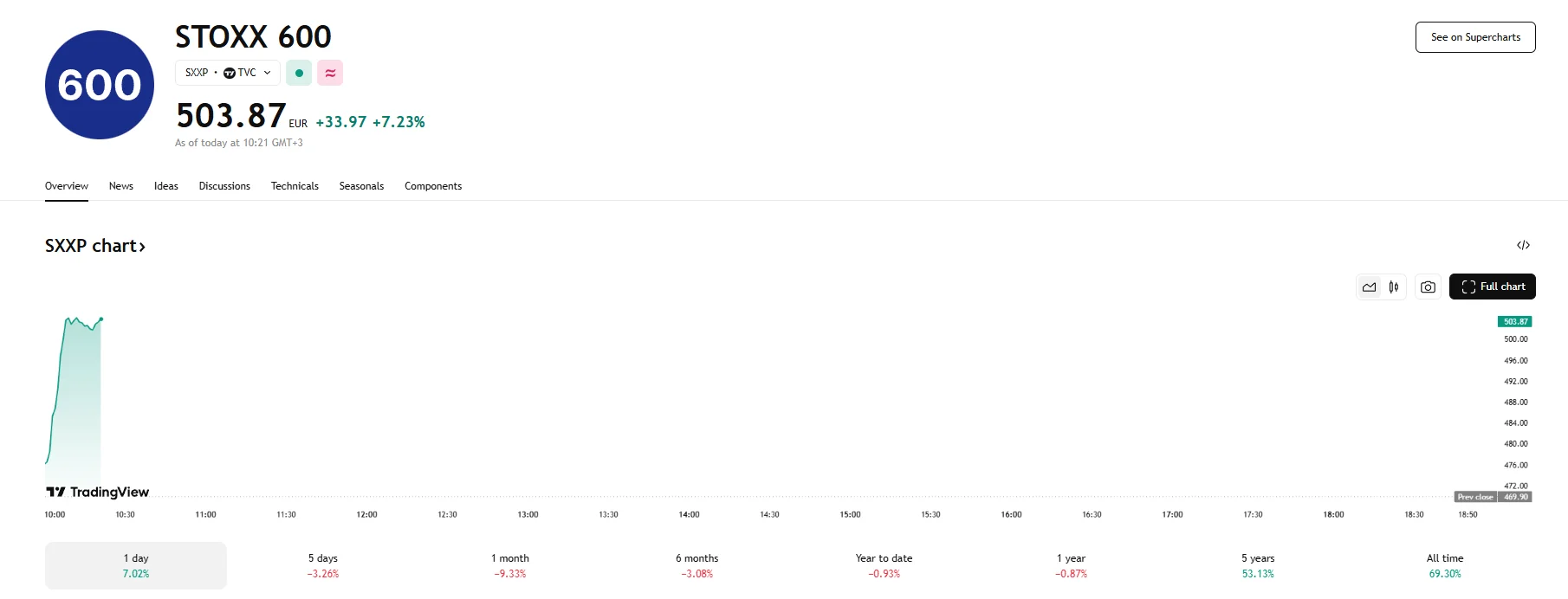

- The effects were also felt across the Eurozone, with the STOXX 600 index gaining 7.23%.

European Investors Cheer Tariff Pause

European markets erupted in a wave of optimism on Thursday, propelled by President Trump’s unexpected decision to implement a 90-day pause on his newly enacted tariffs. This policy reversal, which included a reprieve from the previously threatened 20% tariff on European Union exports to the United States, resulted in the STOXX 600 index experiencing a substantial uplift of 7.23%.

Germany’s DAX demonstrated investors’ remarkable enthusiasm as well, with the early trading session on Thursday witnessing an 8.23% surge. This translated to an impressive gain of 1,629.21 basis points, highlighting the relief felt by German exporters who were particularly vulnerable to the US tariffs.

The positive sentiment extended beyond the Eurozone. The FTSE 100 index in London registered a robust climb of 5.37% on Thursday, mirroring the European market’s positive response to the shift in US trade policy.

This dramatic market upswing followed President Trump’s Wednesday announcement, which indicated that for a 90-day period, most tariffs on goods designated for the US would not exceed the baseline duty of 10%. Crucially, this included a delay in the implementation of a 20% tariff that targeted the European Union. The news of this reprieve came shortly after the European Commission had unveiled its own set of retaliatory tariffs, threatening duties of up to 25% on approximately €21 billion worth of imports from the United States, ranging from orange juice to motorcycles.

Prior to Trump’s unexpected pause, the EU had finalized its countermeasures in response to what European officials deemed “unjustified and damaging” US tariffs. While expressing a preference for negotiated solutions, the EU had prepared a phased implementation of tariffs, with the first levies targeting €3.9 billion worth of US goods set to take effect the following week. Subsequent rounds were planned for mid-May and December. The initial set of EU tariffs was slated to include duties of up to 25% on agricultural products, steel, and aluminum, strategically targeting sectors with political significance in the United States.