Key moments

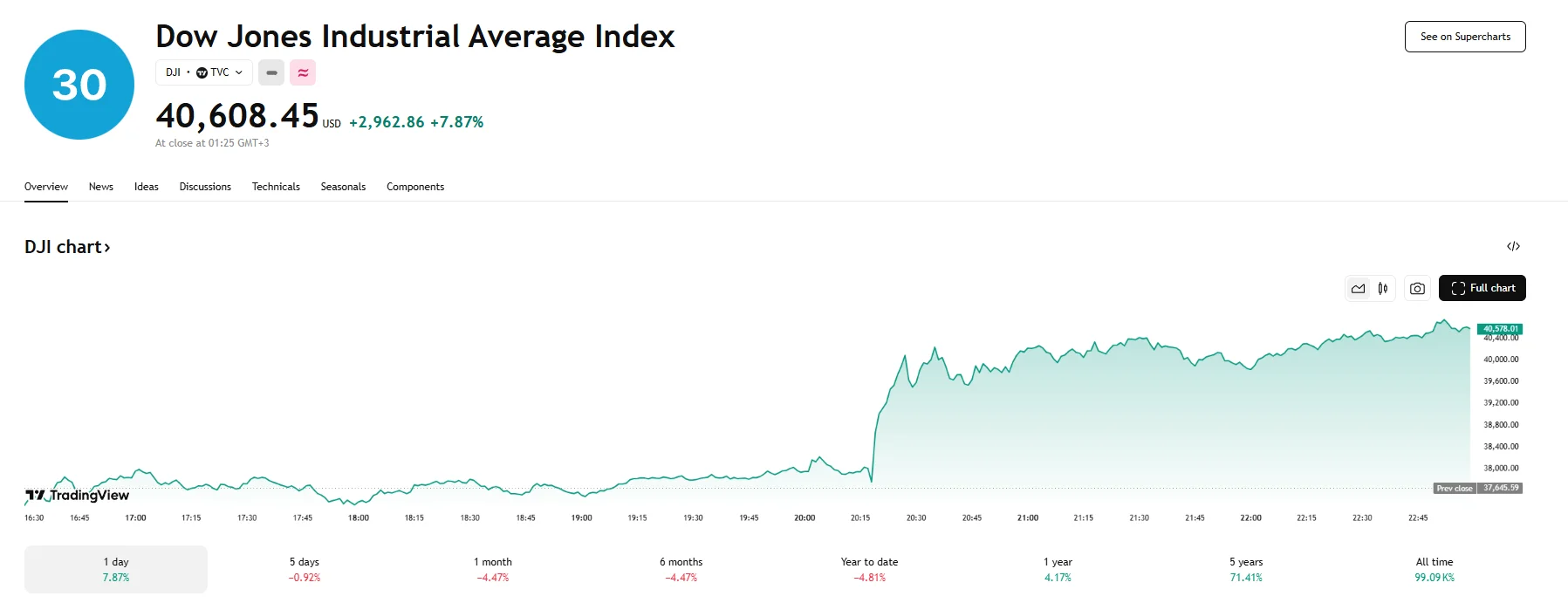

- The Dow Jones Industrial Average experienced a major rally, soaring by 2,963.86 basis points on Wednesday.

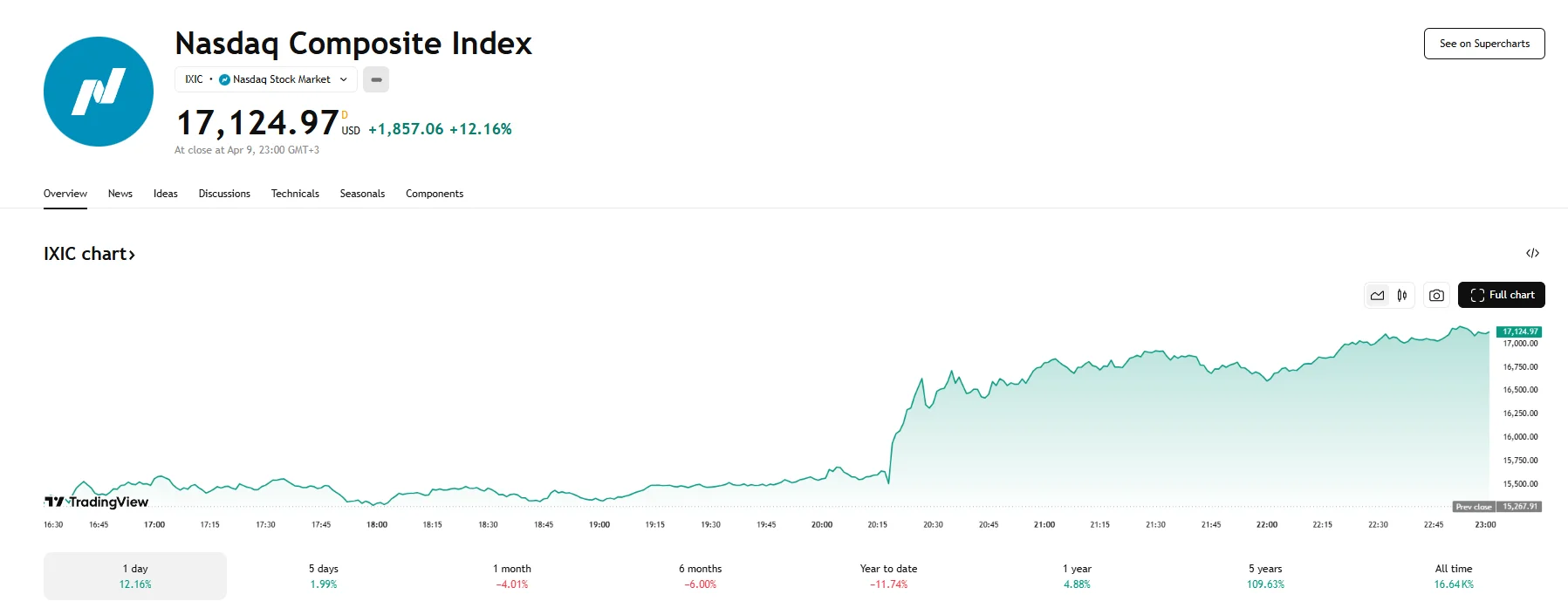

- The Nasdaq Composite and the S&P 500 also closed with gains. The former reached 17,124.97, while the latter achieved a 9.51% increase.

- Stocks rebound after it was announced that most US tariffs higher than the 10% baseline would be halted for 90 days.

90-Day Tariff Pause Sends Wall Street Stocks Soaring

US stocks surged dramatically following President Trump’s surprising announcement of a 90-day pause on the newly implemented reciprocal tariffs for most nations, with the one exception being China. This sudden policy reversal triggered a historic rally, with the Dow Jones Industrial Average skyrocketing by an unprecedented 2,963.86 points, representing a 7.87% increase.

Moreover, the S&P 500 witnessed its most significant single-day gain since the 2008 financial crisis, climbing 9.51% to close at 5,456.89. The Nasdaq Composite, particularly sensitive to trade-related uncertainties, soared by a remarkable 12.16%, adding 1,857 basis points and settling at 17,124.97, marking its largest single-day jump since early 2001.

Trump’s social media announcement, stating, “I have authorized a 90-day PAUSE, and a substantially lowered Reciprocal Tariff during this period, of 10%, also effective immediately,” served as the catalyst for this market frenzy. However, he simultaneously revealed an escalation of tariffs on Chinese goods, raising them to 125%. Treasury Secretary Scott Bessent subsequently clarified that the 90-day pause would apply to most countries, and this statement provided further impetus for the market rally as investors welcomed the temporary reprieve from the previously imposed higher tariffs.

Approximately 30 billion shares were traded in total, marking the most active trading session in Wall Street’s recent history. The rally was broad-based, with nearly every stock in the S&P 500 experiencing gains.

Tech giants, which had been particularly vulnerable to the trade war’s impact, led the charge. Tesla (TSLA) surged by an impressive 22.69%, while Apple (AAPL) and Nvidia (NVDA) also experienced significant gains, rising by 15.33% and 18.72%, respectively. Retailers like Walmart (WMT) rose as well, rising 9.6%. Another company that saw its stock go up was Amazon, with shares climbing 11.98%.

Despite the market’s jubilant reaction, uncertainties remain. Trump’s decision to maintain and even escalate tariffs on China signals that trade tensions are far from resolved. Additionally, the 10% baseline tariff on all goods imported to the US continues to create a complex and potentially volatile trade landscape.