Key moments

- Major US indices experienced major volatility on Monday, with notable lows being followed by a recovery as news of a potential 90-day pause of the recently announced tariffs on US imports made headlines.

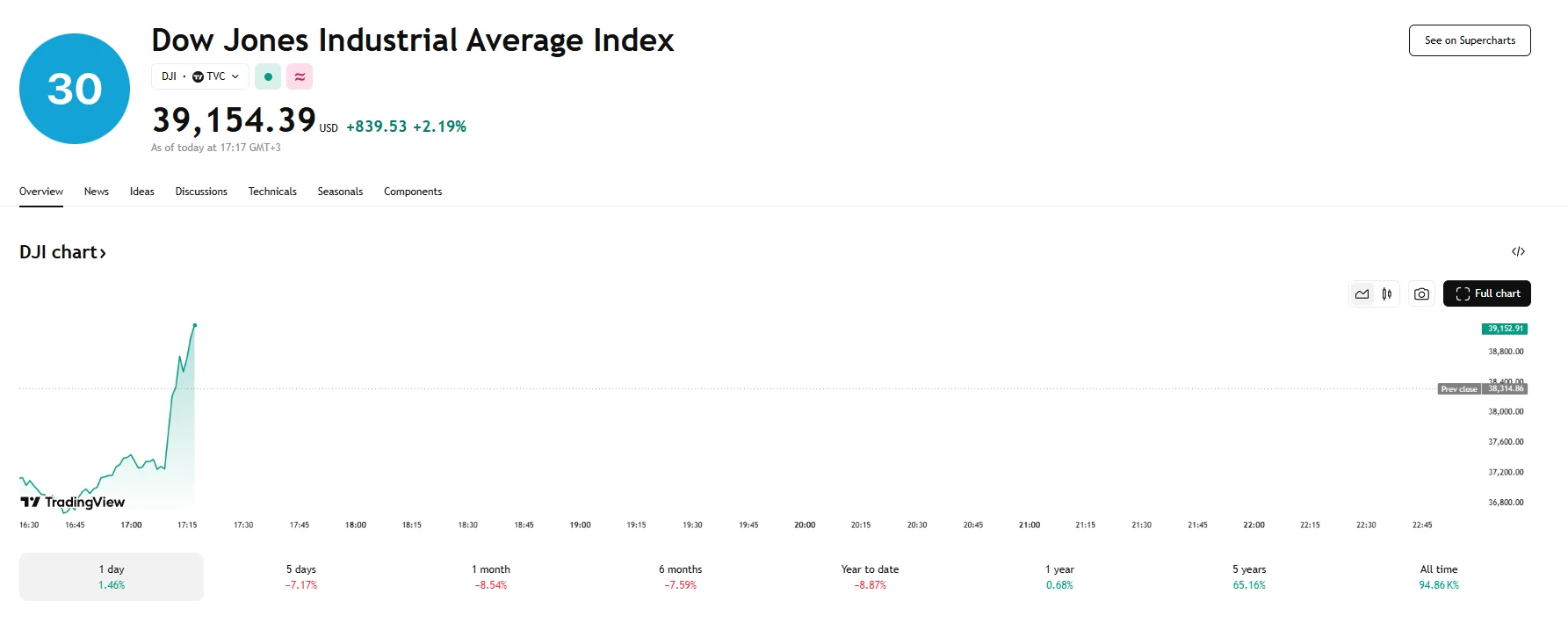

- Dow soared 2.19% to reach $39,154.

- The Nasdaq Composite and S&P 500 indices also saw gains, climbing around 1% and 3.27%, respectively.

Wall Street Indices Experience Significant Uptick on Potential Tariff Pause

Monday witnessed a dramatic roller coaster ride on Wall Street, with major indices initially plummeting to alarming lows before recovering after it was revealed that US President Donald Trump is considering pausing the implementation of his latest tariff policies for 90 days. The Dow Jones Industrial Average experienced a staggering decline, shedding over 1,000 basis points and reaching $37,268, representing a 2.73% drop. However, the Dow achieved a significant turnaround and rebounded by 2.19% to surpass $39,100.

The Nasdaq Composite also mirrored this volatile pattern, initially falling by 2.82% to $15,148. The tech-heavy index then rallied, climbing almost 1% to reach $15,733, demonstrating a substantial intraday recovery. Similarly, the S&P 500, a broad measure of the US stock market, dropped over 2% to just below the $5,000 mark, only to achieve a 3.27% increase to $5.240, effectively erasing earlier losses.

The initial market turmoil was primarily attributed to investor sentiments surrounding the potential economic repercussions of newly implemented US tariffs. These tariffs, imposed on a wide range of trading partners, triggered fears of a global trade war, which could significantly disrupt international commerce and dampen economic growth.

Concerns that these tariffs would lead to increased inflation and a slowdown in US economic activity further weighed on confidence in the markets. The abrupt shift that led to the substantial recovery occurred after reports emerged indicating that multiple countries were engaging with the US to negotiate “great deals,” and that a potential 90-day pause on tariffs was being considered by President Donald Trump. However, for now, it appears the pause would not apply to the duties imposed on Chinese imports. It should be noted that the 90-day proposal was initially made by billionaire Bill Ackman, who criticised the tariffs.

The dramatic swings on Monday underscored the profound impact of trade policy on investor confidence. The initial sharp decline demonstrated the market’s vulnerability to geopolitical tensions and policy changes, while the subsequent recovery illustrated its capacity for rapid reassessment based on emerging information.