Key moments

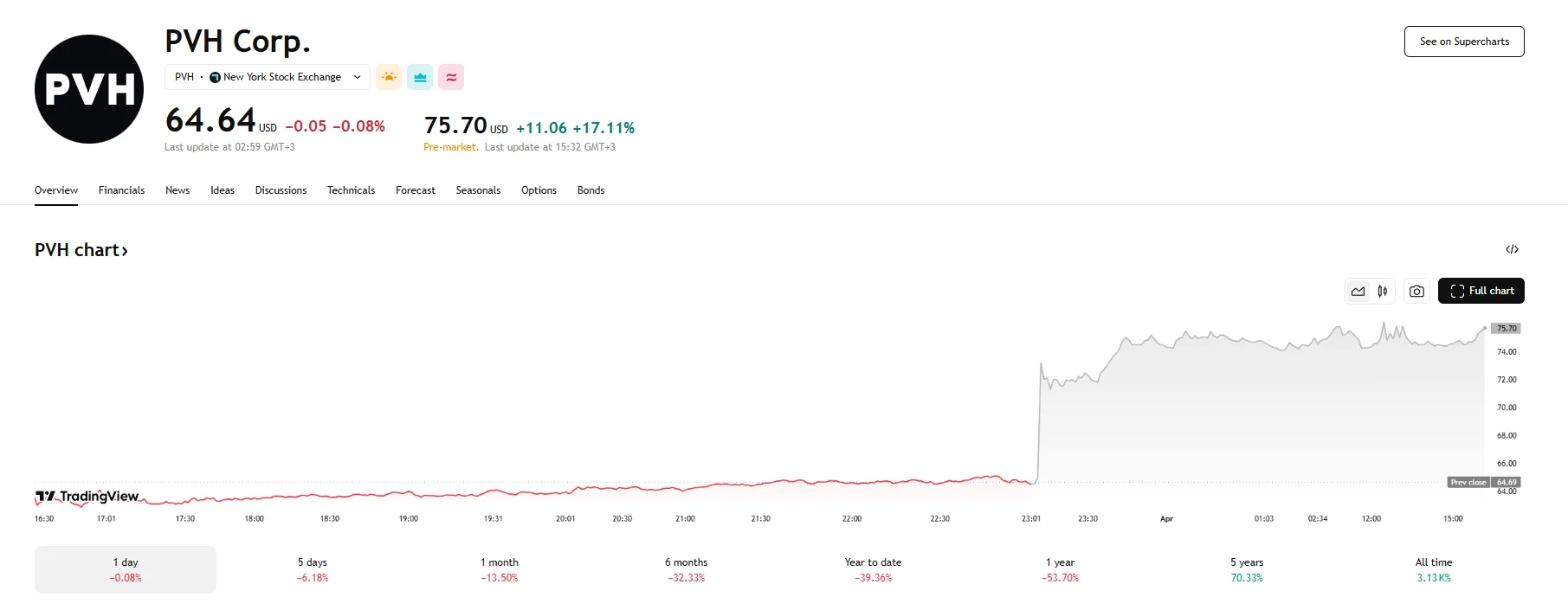

- PVH’s pre-market share price hit $75.70.

- The rally was triggered by a recent earnings report, according to which revenue reached $2.37 billion in 2024’s fourth quarter, higher than the projected $2.33 billion.

- The company also reported an EPS of $3.27.

PVH Q4 Earnings Outperform, Results Trigger 17.11% Pre-Market Stock Surge

Calvin Klein and Tommy Hilfiger owner PVH Corp’s (NYSE: PVH) shares experienced a dramatic 17.11% surge during Tuesday’s pre-market hours, allowing the stock price to reach $75.70. This significant uptick served as a notable recovery from the stock’s recent 52-week low below $63. The surge followed PVH’s latest financial report, according to which its Q4 earnings per share (EPS) amounted to $3.27, surpassing analyst expectations of $3.21.

Despite a 5% year-over-year decline in revenue, the $2.37 billion figure was still welcome by market participants as it exceeded the more conservative analyst forecast of $2.33 billion. PVH has consistently outperformed forecasts, beating EPS estimates in each of the last four quarters. For the upcoming fiscal year 2025, PVH has provided an optimistic outlook, suggesting a potential EPS of up to $12.75, which significantly exceeds the previously predicted $11.88. Additionally, a $500 million share buyback has been planned for 2025 by PVH, showcasing the company’s commitment to shareholder value.

The company’s strong earnings report, coupled with an upbeat outlook and shareholder-friendly buyback plans, has resonated well with investors. CEO Stefan Larsson highlighted the company’s strong finish to the year and its solid positioning for 2025, emphasizing the achievement of record gross margins and double-digit non-GAAP EBIT margins.

Despite the positive earnings report and optimistic forecast, Tuesday saw Evercore ISI revise its price target for PVH stock downward, from $139 to $105. The firm maintained an “Outperform” rating, however, indicating continued confidence in the stock’s potential, albeit at a reduced target price.

The company’s forward-looking earnings guidance and aggressive buyback strategy are seen as not only boosting immediate shareholder value but also demonstrating a long-term commitment to sustainable growth. This approach aligns with a broader trend, where companies leverage market challenges to enhance investor trust and strengthen their market positioning.