Key moments

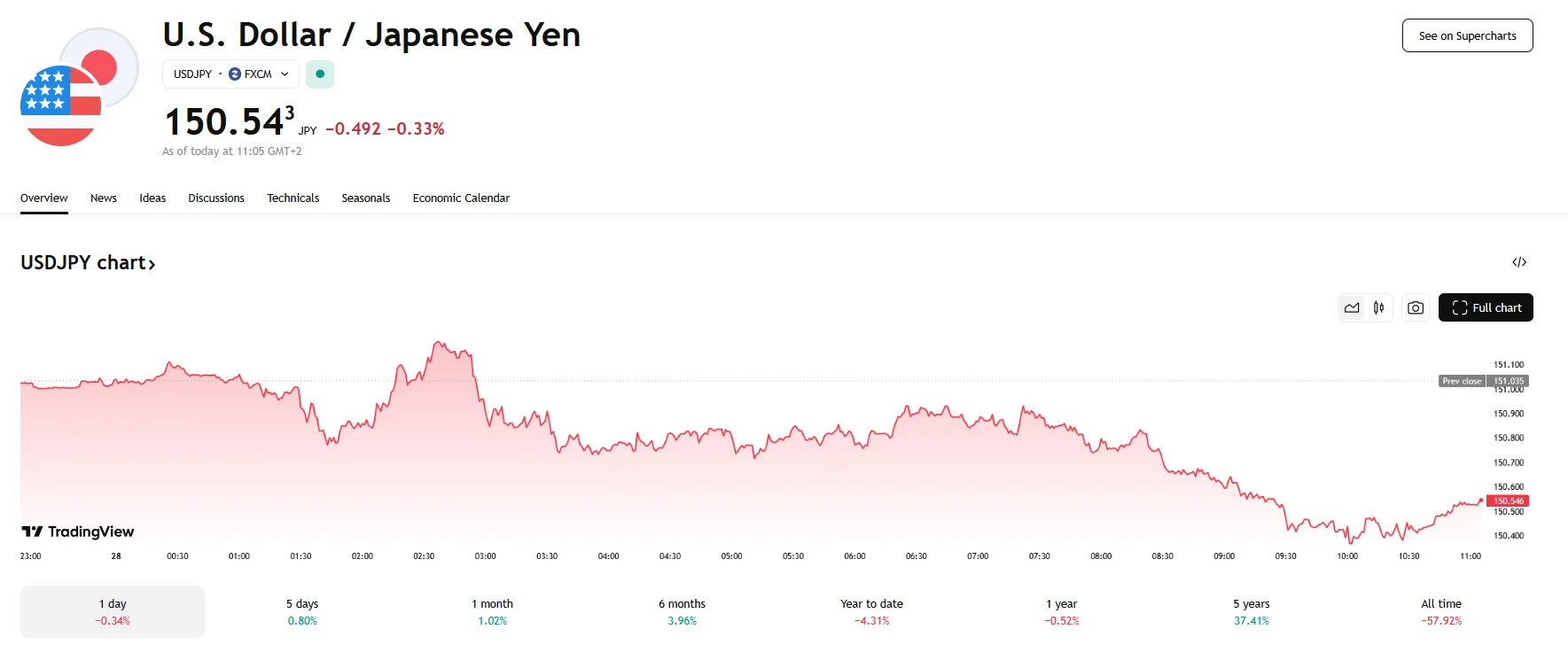

- The USD/JPY pair is trading at around 150.50.

- Tokyo’s CPI registered a 2.9% year-over-year increase in March, while Core CPI rose by 2.4%.

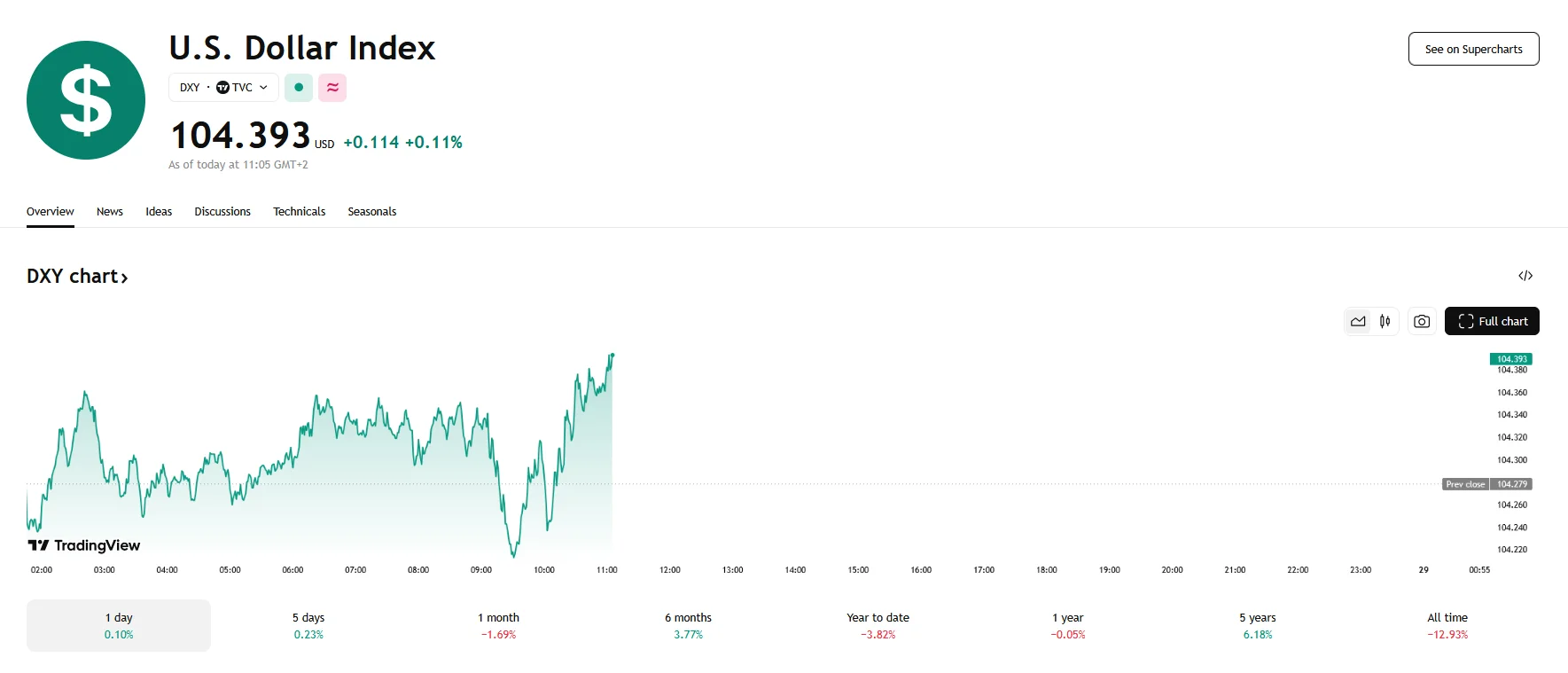

- The U.S. Dollar Index remains stable near 104.340.

Yen Strengthens on Promising Inflation Data

The Japanese yen experienced a surge in value on Friday, resulting in the USD/JPY exchange rate falling beneath the ¥151 threshold. The drop followed the release of the latest Tokyo inflation data. March figures indicated a 2.4% rise in the city’s core consumer price index (not including erratic fresh food costs), surpassing February’s 2.2%.

The broader Tokyo CPI for March showed a 2.9% year-over-year increase, up from 2.8% in February, further signaling inflationary pressures within the Japanese economy. Notably, the core CPI that omits fresh food and energy prices prone to fluctuations climbed to 2.2%, exceeding the previous month’s 1.9%. This increase also surpassed the Bank of Japan’s (BoJ) annual 2% target. The figures also bolstered confidence in the yen, leading to the USD/JPY dropping 0.33% to 150.54.

Policymakers are prepared to increase rates if economic and price forecasts are met, according to the BoJ’s Summary of Opinions that was released after the March meeting. However, the summary also highlighted growing concerns regarding potential downside risks stemming from the Trump administration’s tariff policies. These trade tensions have introduced a layer of uncertainty, prompting the BoJ to adopt a cautious approach in its near-term policy decisions.

Although the U.S. Dollar Index has demonstrated resilience, maintaining a position near 104.340, this has yet to steer the USD/JPY pair toward recovery. Moreover, the dollar’s performance is being closely monitored in light of potential impacts from Trump’s tariffs, which have introduced volatility into global markets and could exert further pressure on the dollar. The upcoming release of the U.S. Core Personal Consumption Expenditures (PCE) Price Index is anticipated to provide further insights into the Federal Reserve’s rate-cut strategy.