Key moments

- Natural gas futures faced a downturn on Friday, falling 1.25, and are expected to register a weekly loss.

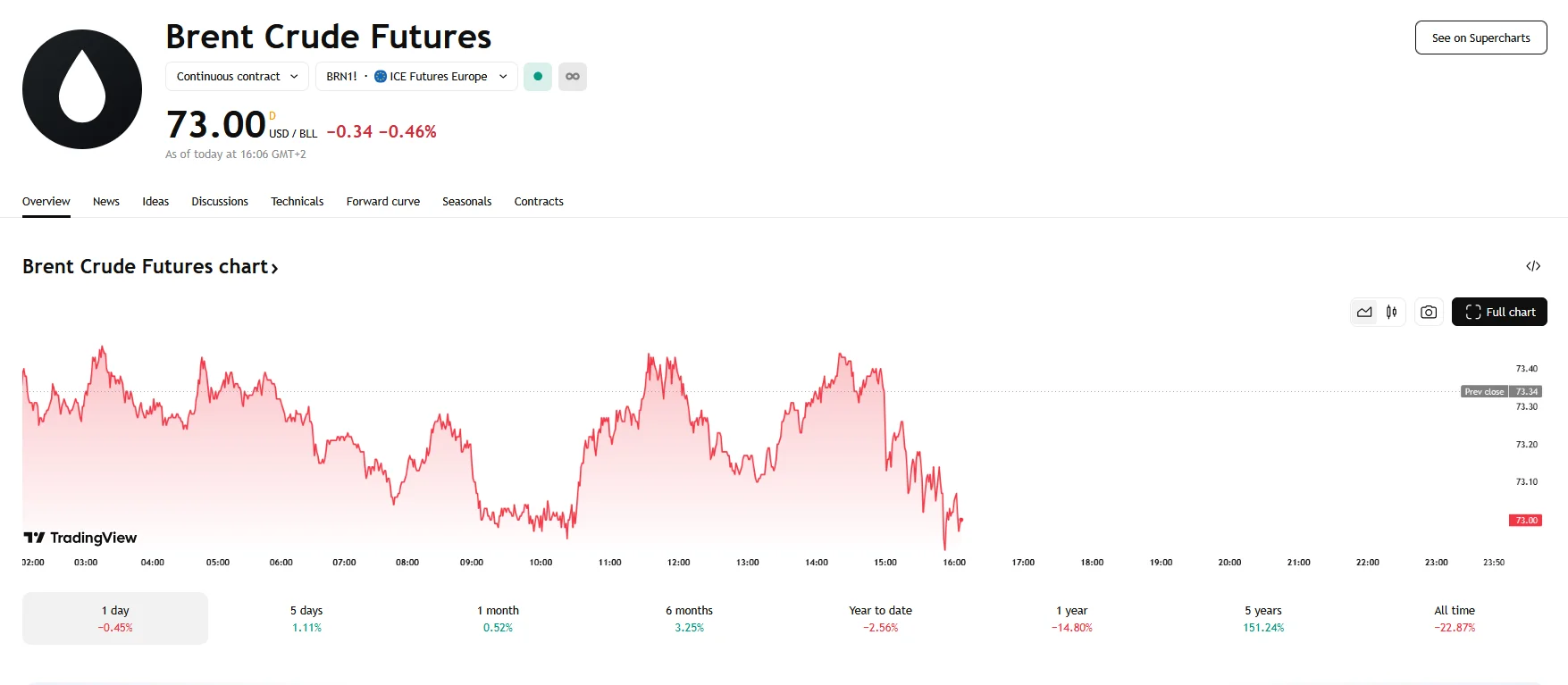

- Friday’s trading saw Brent crude oil futures decline by 0.46%, while West Texas Intermediate (WTI) futures dropped 0.36%.

- Crude oil is poised to conclude the week with price increases.

U.S. Energy Market: Natgas Faces Downward Pressure, Crude Oil Climbs

The U.S. energy sector witnessed a notable divergence in performance on Friday, with natural gas futures experiencing a decline, while weekly crude oil futures, despite a slight price dip on Friday, are expected to rise.

Natural gas futures faced downward pressure due to higher-than-anticipated storage injections. As reported by the Energy Information Administration (EIA), inventory deficits are rapidly diminishing because of the said storage injections.

According to Eli Rubin of EBW Analytics, recent EIA reports have been predominantly bearish, indicating a market struggling to establish a stable balance between supply and demand. This situation is compounded by mild weather in March, which has diminished demand and further contributed to the inventory build-up. Although liquefied natural gas (LNG) export facilities have enjoyed major flows, this has been insufficient to counterbalance the impact of record domestic output. The combined effect of these factors has resulted in a decline in natural gas prices, with the market anticipating potentially lower spring prices.

Conversely, crude oil markets, despite a minor setback on Friday, have positioned themselves for a third consecutive week of gains. West Texas Intermediate (WTI) and Brent crude futures experienced slight declines on Friday, with WTI falling below $70 and Brent touching $73. However, both benchmarks have registered approximately 2.5% gains over the week. This upward momentum is primarily attributed to geopolitical tensions, particularly the U.S. administration’s imposition of tariffs on Venezuelan oil and sanctions on Iranian exports.

However, the oil market’s trajectory is not without its challenges. BOK Financial’s Dennis Kissler has argued that “crude futures are still struggling to turn bullish,” indicating persistent uncertainties. The ongoing trade disputes, particularly the U.S. tariff policies, have raised concerns about potential demand reduction.