Key moments

- The DAX 40 index increased by 1.26% on Monday, reaching €23,140.

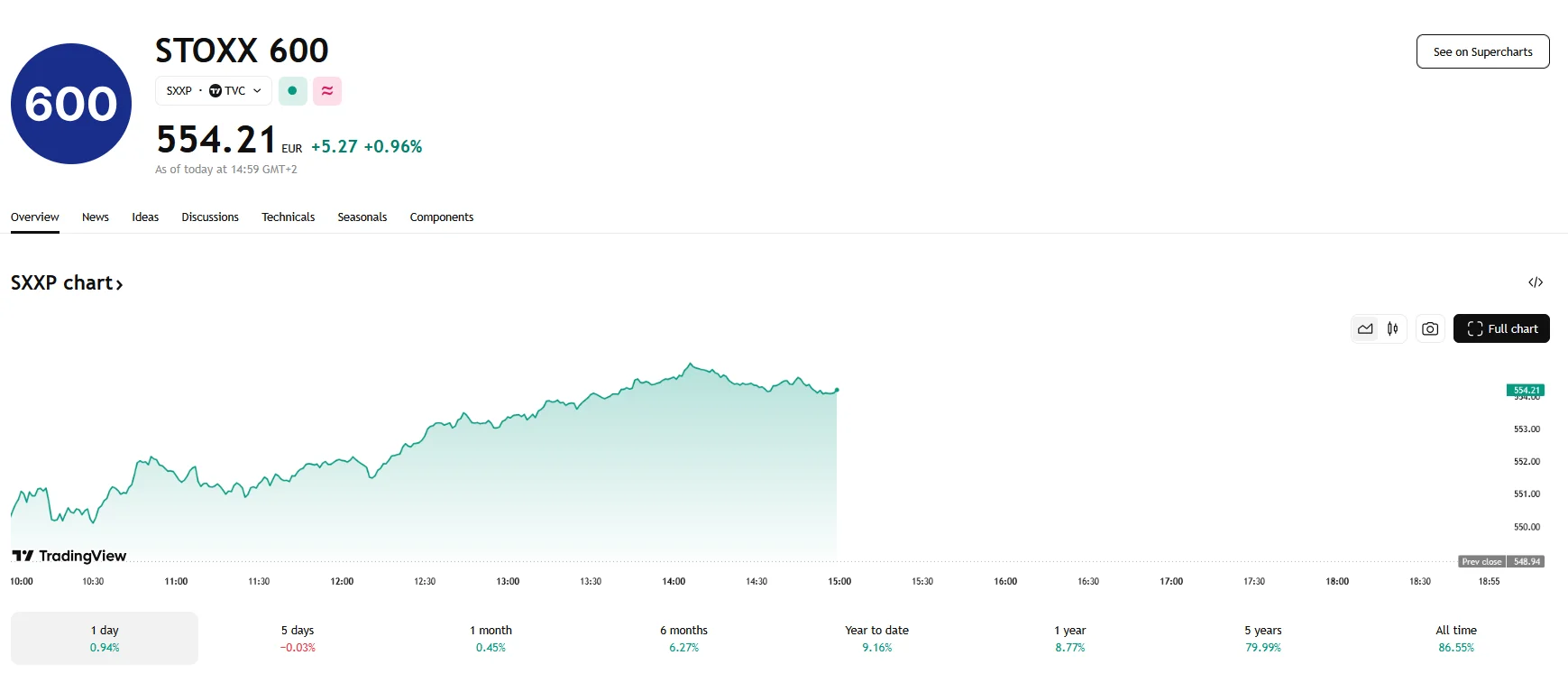

- STOXX Europe 600 also gained, rising by almost 1% to around €554.

- Promising figures tied to the German IFO Business Climate Index contributed to the positive market momentum.

European Stocks See Strong Gains

European equity markets experienced a significant upswing on Tuesday, with the DAX 40 index demonstrating a robust 1.26% increase, while the broader STOXX Europe 600 index climbed by 0.96%. This positive market movement was influenced by a combination of economic data releases and evolving geopolitical factors, particularly concerning U.S. trade policies.

Despite a slight deceleration in momentum, prevailing market sentiments surrounding the DAX index remain bullish in the medium term. Contributing to the positive momentum was the release of the German IFO Business Climate Index, which rose to 86.7 in March, surpassing February’s 85.3. This marked the highest figure reported in eight months and indicated a potential recovery in the region’s largest economy.

The German government’s plans to invest heavily in defense and infrastructure have bolstered investor confidence, contributing to the outperformance of European equities compared to their U.S. counterparts. However, market participants remain vigilant regarding U.S. trade policies, particularly the tariffs announced by former U.S. President Donald Trump. His recent statements, indicating potential exemptions for certain countries and a more sector-focused approach to tariffs, have introduced an element of uncertainty into the market.

Analysts have noted that the market’s response to Trump’s tariff announcements has been characterized by short-term trading strategies, reflecting the prevailing uncertainty. The lack of clarity surrounding the implementation of tariffs has led to heightened caution among investors, contributing to increased market volatility.

Despite the concerns surrounding U.S. trade policies, the improved German business sentiment and the prospect of fiscal stimulus have provided a positive impetus for European equities. The combination of these factors has contributed to the DAX 40 and STOXX Europe 600 indices’ upward movement, signaling a renewed sense of optimism in the European market.