Key moments

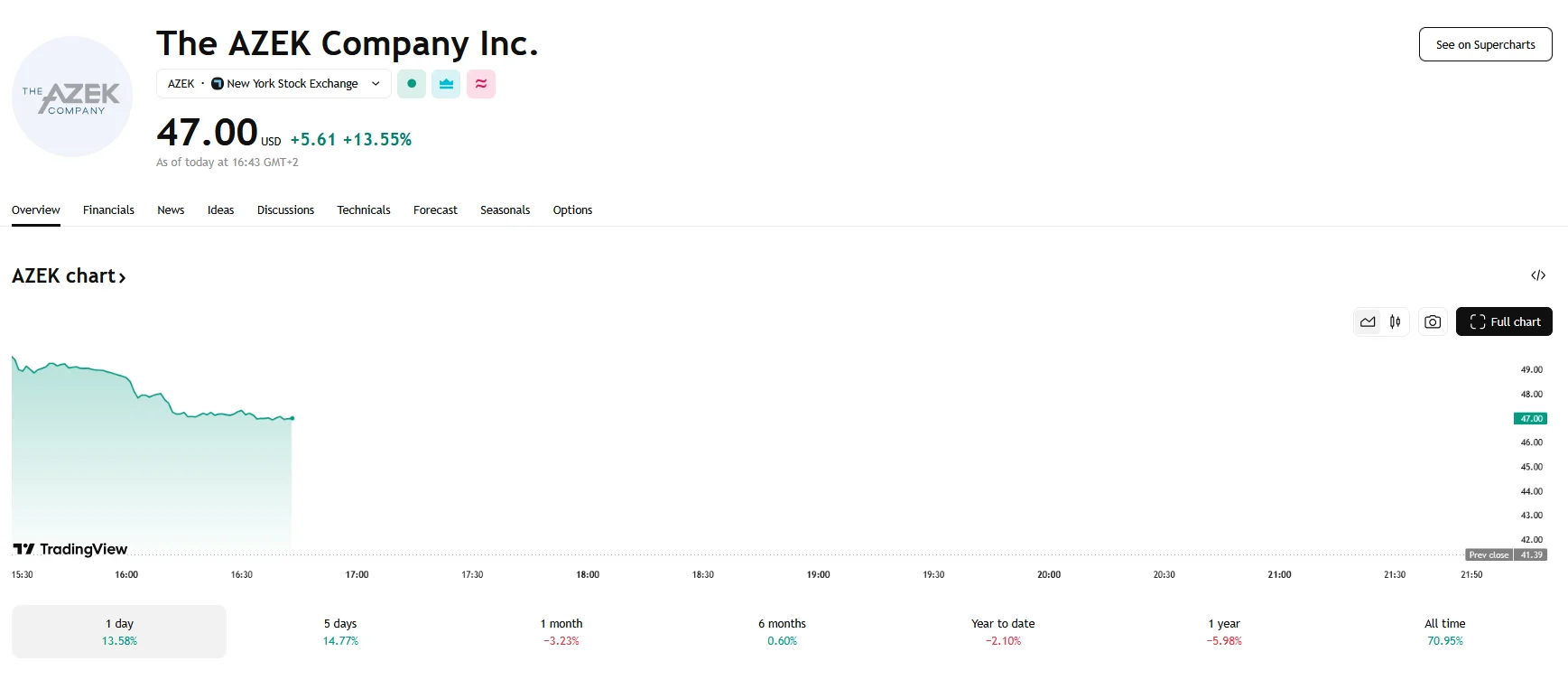

- AZEK’s stock surged 13.55% to $47.

- The price jump occurred after it was announced that the company would be acquired by James Hardie for $8.75 billion.

- The takeover’s cost failed to impress James Hardie’s investors, resulting in a stock price decline exceeding 14%.

James Hardie’s $8.75B AZEK Deal Sparks Investor Skepticism

The financial markets reacted sharply to the announcement of James Hardie’s acquisition of AZEK, a manufacturer of outdoor living products, for $8.75 billion. AZEK’s stock experienced a significant surge after the deal was announced, climbing 13.55% to reach $47 per share. Conversely, James Hardie’s stock plummeted, falling more than 14% as investors expressed skepticism about the acquisition’s value.

By combining cash and James Hardie equity, the acquisition seeks to form a dominant building products enterprise, utilizing the synergistic strengths of both firms. The $8.75 billion agreement also addresses AZEK’s net debt, which stood at approximately $386 million at the end of 2024.

The agreement stipulates that AZEK shareholders will receive $26.45 in cash in addition to 1.0340 James Hardie shares for each AZEK share they own. Post-acquisition, James Hardie shareholders are expected to hold roughly 74% of the combined company. AZEK shareholders will own around 28%. James Hardie will also list its shares on the NYSE, potentially leading to broader index inclusion in the U.S.

James Hardie’s CEO, Aaron Erter, presented the acquisition as a strategic move to accelerate growth and enhance customer solutions. He emphasized the complementary nature of the two companies’ product lines, spanning siding, decking, and railing, and highlighted the potential for significant synergies and improved profitability. Erter also noted the shared company cultures focused on customer satisfaction and innovation.

AZEK’s CEO, Jesse Singh, echoed this sentiment, stating that the merger marks an exciting phase in AZEK’s growth trajectory. He emphasized the value delivered to AZEK shareholders and the long-term growth opportunities presented by the combined entity. Singh also pointed to the shared commitment to innovation and sustainability as a foundation for future success.

Analysts like Ketan Mamtora of BMO Capital Markets viewed the deal as highly favorable for AZEK shareholders. However, investor views regarding James Hardie’s side of the deal were negative. The substantial drop in James Hardie’s stock price indicates concerns that the acquisition may be overvalued. The initial valuation of the deal was $56.88 per AZEK share, but after James Hardie’s stock decline, the valuation dropped to $52.48.