Key moments

- Ten Cheddar’s Scratch Kitchen restaurants are now part of an on-demand delivery pilot, initiated by Darden Restaurants and facilitated by Uber Technologies.

- Darden reports a 6.2% increase in total sales for the fiscal third quarter, amounting to $3.2 billion, driven by same-restaurant sales growth and strategic acquisitions.

- Darden revises its fiscal 2025 financial outlook, projecting significant sales growth and new restaurant openings.

Darden Restaurants Expands Delivery Services and Reports Strong Financial Performance

Darden Restaurants, in partnership with Uber Technologies, has launched an on-demand delivery pilot program at ten Cheddar’s Scratch Kitchen locations. This initiative leverages Uber Direct’s delivery logistics network, allowing customers to place orders directly through Cheddar’s website and app. The company intends to expand this service across its entire Cheddar’s brand network, building on the success of a previous pilot program at Olive Garden. Darden’s chief information officer, Chris Chang, highlighted the strong partnership with Uber Direct and the positive results from the Olive Garden rollout as key factors driving Cheddar’s expansion.

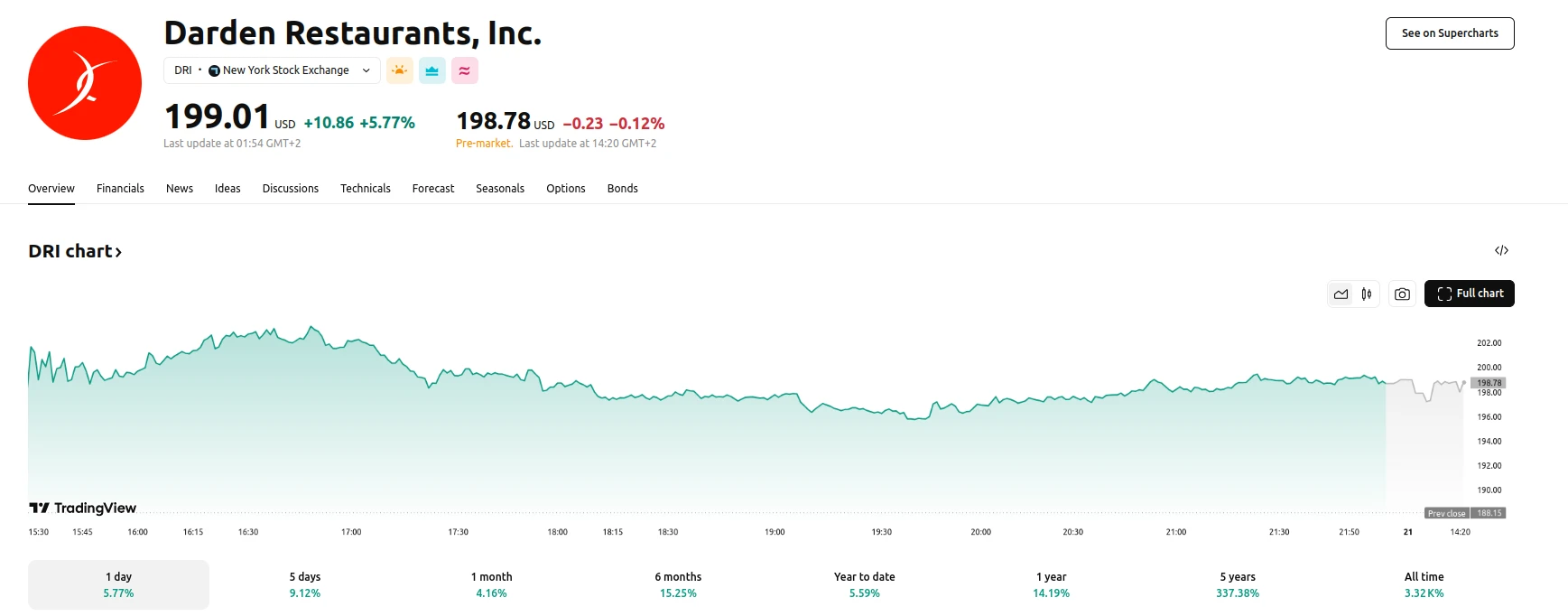

In its fiscal third quarter, Darden Restaurants reported a 6.2% increase in total sales, reaching $3.2 billion. This growth was attributed to a 0.7% rise in same-restaurant sales and contributions from the acquisition of Chuy’s locations and the opening of new restaurants. The company’s net income also saw an increase, rising to $323.4 million. Darden’s board of directors declared a quarterly cash dividend of $1.40 per share, reflecting the company’s strong financial performance.

Darden has also updated its fiscal 2025 financial outlook, incorporating the operating results of its recent Chuy’s acquisition. The company projects total sales of $12.1 billion and same-restaurant sales growth of 1.5%. Darden also plans to open between 50 and 55 new restaurants and anticipates capital expenditures of $650 million. The company expects overall inflation to be around 2.5%. These projections exclude pre-tax transaction and integration costs associated with the Chuy’s acquisition. The company’s strategic expansion of delivery services and strong financial performance underscore its commitment to growth and innovation.