Key moments

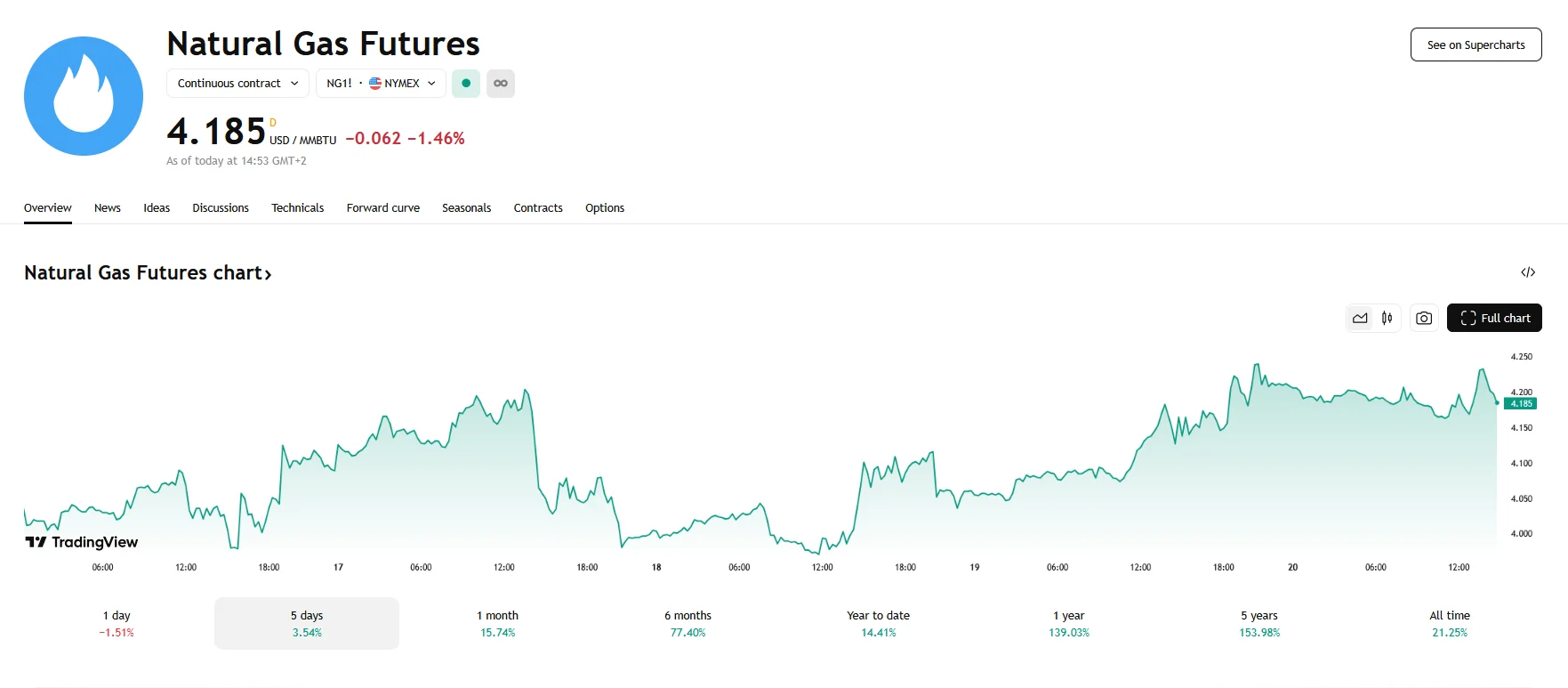

- U.S. natural gas futures remain above $4.10 per mmBtu.

- Increased demand from global markets, facing supply issues and geopolitical tensions, supports upward pressure on U.S. gas futures.

- Below-average storage levels raise supply concerns, but reduced demand forecasts may ease pressure.

Nat Gas Futures Show Resilience Post-Rally

Thursday saw U.S. natural gas futures maintaining a position above the $4.10 per million British thermal units (mmBtu) threshold. This stabilization comes after Wednesday’s dynamic trading period, where prices experienced a significant climb, driven by a confluence of factors influencing both supply and demand.

The natural gas market witnessed a robust upswing on Wednesday, with prices escalating by approximately 4.8%. This surge culminated in front-month gas futures reaching nearly $4.25 per mmBtu, marking a one-week high. This surge can be attributed to several key elements, most notably the unprecedented volumes of natural gas channeled towards LNG export terminals, alongside a transient reduction in domestic production rates.

The U.S. has solidified its position as a leading global LNG supplier, and this status has played a pivotal role in shaping domestic natural gas prices. Record-breaking flows to LNG export plants have amplified demand, contributing to the upward pressure on futures. These elevated export levels reflect the ongoing global demand for U.S. natural gas, particularly in regions facing supply constraints or geopolitical uncertainties.

Simultaneously, a temporary reduction in daily U.S. natural gas output has further supported price stability. Although overall monthly output remains at record highs, a short-term dip, attributed to pipeline maintenance and other operational factors, has tightened supply, thereby bolstering prices.

Natural gas storage levels are a key indicator of market health. Following a period of extreme cold, storage levels remain below historical averages, raising concerns about potential supply shortages. However, forecasts of reduced demand may alleviate some pressure on storage, allowing for a gradual replenishment of reserves. The U.S. natural gas market is increasingly intertwined with international energy markets, with prices influenced by global benchmarks and geopolitical events.

The continued operation and expansion of LNG export facilities, such as Venture Global’s Plaquemines LNG plant, are instrumental in maintaining high export volumes. These facilities ensure that U.S. natural gas can meet the demands of international markets, contributing to the nation’s role as a dominant LNG supplier. As the market progresses, upcoming storage reports and weather forecasts will be key in determining the near-term direction of natural gas prices.